Letter Collection Debt Form

What is the letter to verify debt?

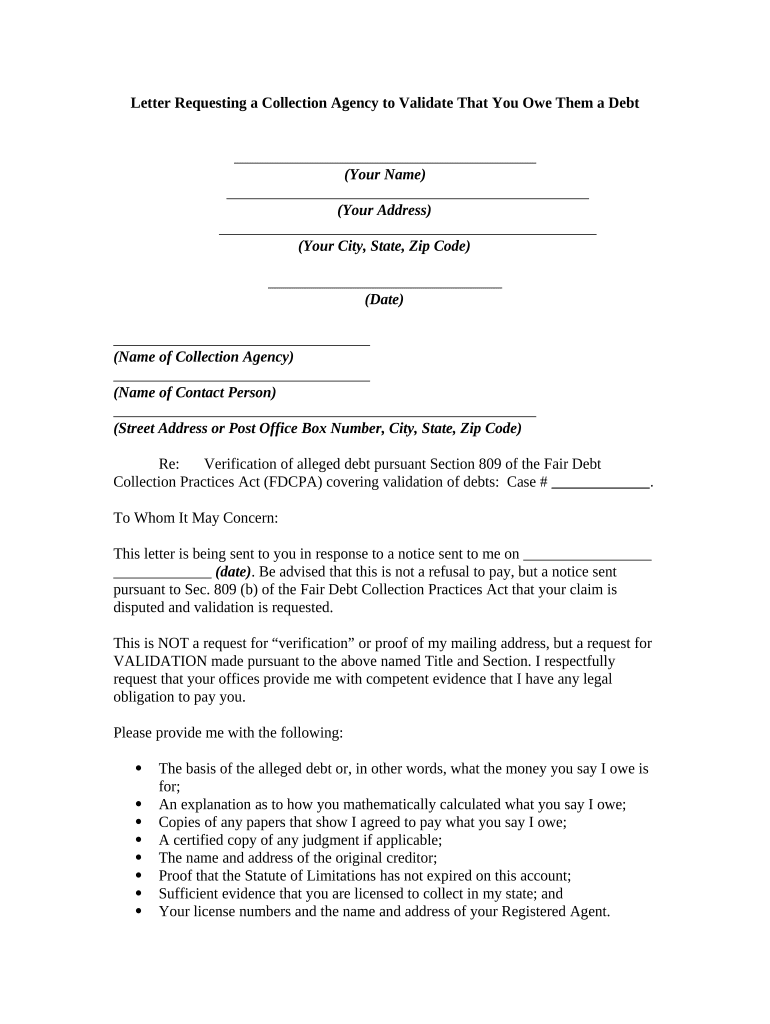

The letter to verify debt, often referred to as a debt validation letter, is a formal document that a debtor can send to a collection agency to request proof of the debt owed. This letter serves to protect consumers by ensuring that they are not held responsible for debts that may not be valid or legally enforceable. It is essential for individuals to understand their rights under the Fair Debt Collection Practices Act (FDCPA), which allows them to request verification of any debt that a collection agency claims they owe.

Key elements of the letter to verify debt

A well-structured debt validation letter should include several critical components to be effective. These elements include:

- Your contact information: Include your name, address, and phone number.

- Collection agency details: Address the letter to the specific collection agency, including their name and address.

- Debt details: Clearly state the amount of debt being disputed and any relevant account numbers.

- Request for validation: Explicitly request that the agency provide proof of the debt, including documentation that verifies its legitimacy.

- Deadline for response: Specify a reasonable timeframe for the agency to respond to your request.

Steps to complete the letter to verify debt

Completing a debt validation letter involves several straightforward steps:

- Gather information: Collect all relevant details about the debt, including any correspondence received from the collection agency.

- Draft the letter: Use a clear and professional tone to write your letter, following the key elements outlined above.

- Review for accuracy: Ensure that all information is correct and that the letter is free of errors.

- Send the letter: Choose a delivery method that provides proof of sending, such as certified mail, to ensure the agency receives your request.

- Keep records: Maintain a copy of the letter and any correspondence for your records.

Legal use of the letter to verify debt

Using a letter to verify debt is not only a consumer right but also a legal requirement for collection agencies under the FDCPA. When a debtor requests validation, the agency must cease collection activities until they provide the requested proof. This legal framework ensures that consumers are not subjected to harassment or collection of debts that may not be valid. Understanding these legal protections can empower individuals to take control of their financial situations.

Examples of using the letter to verify debt

There are various scenarios in which a debtor might use a debt validation letter:

- Disputed debts: When a debtor believes they do not owe the amount claimed by the collection agency.

- Identity theft: If a debtor suspects that a debt is a result of identity theft, they can request validation to clarify the situation.

- Unfamiliar debts: When a debtor receives a notice for a debt they do not recognize, a validation letter can help clarify the legitimacy of the claim.

How to obtain the letter to verify debt

Obtaining a letter to verify debt is straightforward. Debtors can create their own letter using templates available online or seek assistance from consumer advocacy organizations. Many legal aid services also provide resources and templates for individuals needing help with debt validation. It is important to ensure that any template used includes all necessary information and complies with legal standards to be effective.

Quick guide on how to complete letter collection debt

Complete Letter Collection Debt effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly, without delays. Manage Letter Collection Debt on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Letter Collection Debt effortlessly

- Find Letter Collection Debt and click on Get Form to begin.

- Utilize the tools we provide to submit your form.

- Highlight signNow sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Do away with misplaced or lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you choose. Modify and eSign Letter Collection Debt and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter validate debt?

A letter validate debt is a formal request sent to a creditor asking for verification of a debt. This letter is essential for consumers to ensure that they are being charged correctly and to protect their rights. airSlate SignNow makes it easy to create and send these letters securely.

-

How can airSlate SignNow assist with sending a letter validate debt?

airSlate SignNow provides a user-friendly platform to draft, send, and eSign a letter validate debt. With its intuitive interface, you can quickly customize your letter and ensure it meets legal standards for debt validation. This streamlines the process, making it hassle-free for users.

-

What are the benefits of using airSlate SignNow for debt validation letters?

Using airSlate SignNow to manage your letter validate debt offers several benefits, including enhanced security and compliance. You can track the status of your letters, ensure they are delivered on time, and maintain a digital record for your convenience. This efficiency helps protect your financial future.

-

Is airSlate SignNow cost-effective for small businesses managing debt validation?

Yes, airSlate SignNow is designed to be cost-effective for small businesses managing letter validate debt. With flexible pricing plans, you can choose an option that fits your budget while accessing all necessary features for efficient document management. This investment can save your business both time and money.

-

Can I integrate airSlate SignNow with other tools for managing debt?

Absolutely! airSlate SignNow offers integration with various platforms, allowing you to enhance your workflow when sending a letter validate debt. Whether you use accounting software or customer relationship management tools, seamless integration can streamline your processes and reduce administrative burdens.

-

What features does airSlate SignNow offer to streamline the letter validate debt process?

airSlate SignNow comes with several features designed to optimize the letter validate debt process, including customizable templates, eSigning functionality, and automated reminders. These features help ensure that your debt validation letters are completed quickly and accurately, aiding your efforts in debt management.

-

How secure is the airSlate SignNow platform for sensitive documents?

The airSlate SignNow platform prioritizes security, ensuring that all documents, including letters validate debt, are protected with advanced encryption technology. This ensures that your sensitive information remains confidential and secure throughout the entire process. You can send and receive documents with peace of mind.

Get more for Letter Collection Debt

- Budget coding manual houston independent school district form

- The village bankfull service bank located in the heart of seven form

- National press foundation awards dinnerc spanorg form

- 2019 2020 escc federal direct loan certification form

- Dear patient form

- Covetrus application form

- Written statement for ach stop payment esl federal credit form

- Forms library university of vermont

Find out other Letter Collection Debt

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online