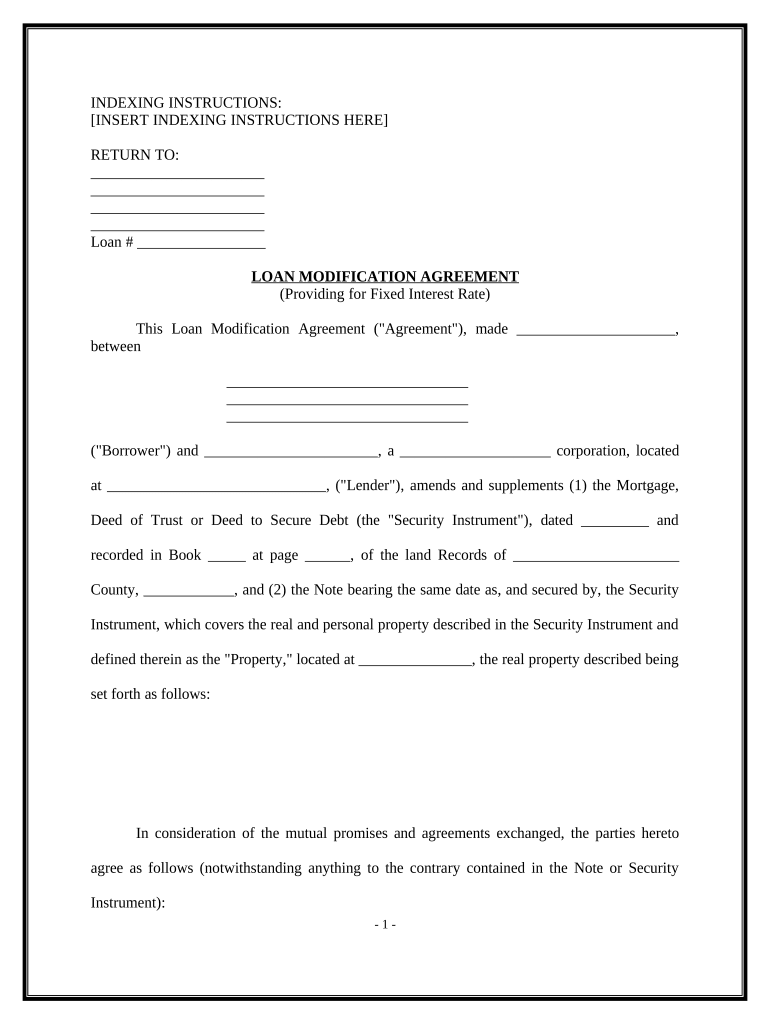

Loan Modification Agreement Form

What is the loan modification agreement?

A loan modification agreement is a legal document that alters the terms of an existing loan. This agreement is typically initiated by a borrower who is experiencing financial difficulties and seeks to adjust their loan terms to make payments more manageable. Modifications can include changes to the interest rate, loan duration, or monthly payment amounts. The goal is to prevent foreclosure and allow the borrower to maintain homeownership while fulfilling their financial obligations.

Steps to complete the loan modification agreement

Completing a loan modification agreement involves several key steps:

- Review your current loan terms: Understand the existing conditions of your loan, including interest rates and payment schedules.

- Gather necessary documentation: Collect financial statements, proof of income, and any relevant correspondence with your lender.

- Contact your lender: Reach out to your lender to discuss your situation and express your desire for a modification.

- Complete the application: Fill out the loan modification application form provided by your lender, ensuring all information is accurate.

- Submit the agreement: Send the completed loan modification agreement along with any required documentation to your lender for review.

- Follow up: Maintain communication with your lender to check the status of your application and address any additional requests.

Key elements of the loan modification agreement

Understanding the key elements of a loan modification agreement is crucial for both borrowers and lenders. Essential components typically include:

- Loan details: Information about the original loan, including the loan number and property address.

- Modification terms: Specific changes to the loan, such as new interest rates, payment amounts, and the duration of the loan.

- Borrower information: Personal details of the borrower, including names and contact information.

- Lender information: Details about the lending institution, including contact information and representatives involved.

- Signatures: Signatures of both the borrower and lender, indicating agreement to the modified terms.

Legal use of the loan modification agreement

The loan modification agreement is legally binding once signed by both parties. To ensure its validity, the document must comply with relevant laws and regulations, including the Truth in Lending Act and state-specific lending laws. It is essential for borrowers to understand their rights and obligations under the modified agreement. Additionally, lenders must adhere to fair lending practices when processing modification requests to avoid potential legal repercussions.

How to obtain the loan modification agreement

Borrowers can obtain a loan modification agreement through their lender. Most financial institutions provide specific forms or applications that need to be completed to initiate the modification process. It is advisable to visit the lender's website or contact their customer service for guidance on the required documentation and procedures. Additionally, some third-party organizations may offer assistance in navigating the modification process.

Eligibility criteria

Eligibility for a loan modification agreement typically depends on several factors, including:

- Financial hardship: Borrowers must demonstrate a legitimate financial challenge, such as job loss or medical expenses.

- Current loan status: The loan must be in good standing, or the borrower must be able to show a willingness to bring it current.

- Property type: Certain modifications may only apply to primary residences, while investment properties may have different criteria.

- Income verification: Borrowers must provide proof of income to assess their ability to make modified payments.

Quick guide on how to complete loan modification agreement

Accomplish Loan Modification Agreement seamlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Loan Modification Agreement on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Loan Modification Agreement effortlessly

- Locate Loan Modification Agreement and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that objective.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Loan Modification Agreement to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan modification agreement?

A loan modification agreement is a legal document that outlines changes to the terms of an existing loan, typically to help borrowers manage their payments more effectively. This agreement can involve reducing the interest rate, extending the loan term, or changing the repayment structure. Understanding the components of a loan modification agreement is essential for both borrowers and lenders.

-

How can airSlate SignNow help with loan modification agreements?

airSlate SignNow simplifies the process of creating, sending, and eSigning loan modification agreements. With its intuitive interface, users can quickly draft customized agreements and ensure they are legally binding. This streamlined workflow enhances efficiency and helps businesses close deals faster.

-

What are the benefits of using airSlate SignNow for loan modification agreements?

Using airSlate SignNow for loan modification agreements offers numerous benefits, including increased speed and convenience. The platform allows for secure electronic signatures, reducing delays commonly associated with traditional paper methods. Additionally, it provides tracking features that keep users informed about the status of their agreements.

-

Is there a cost associated with using airSlate SignNow for loan modification agreements?

Yes, airSlate SignNow has a variety of pricing plans tailored to meet diverse business needs. These plans provide access to features necessary for managing loan modification agreements efficiently. Investing in airSlate SignNow can ultimately save businesses time and resources in the long run.

-

Are there any integrations available for managing loan modification agreements?

airSlate SignNow offers various integrations with popular tools and platforms, making it easier to manage loan modification agreements alongside other business processes. Whether you're using CRM systems or document management solutions, these integrations enhance productivity and collaboration. This connectivity allows for a seamless experience across your workflows.

-

What security measures does airSlate SignNow have for loan modification agreements?

airSlate SignNow prioritizes the security of all documents, including loan modification agreements. The platform uses military-grade encryption and secure data storage to protect sensitive information. This ensures that both lenders and borrowers can feel confident when eSigning their agreements.

-

Can I customize a loan modification agreement using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize loan modification agreements to meet specific needs or preferences. Users can edit templates, add clauses, and modify terms to ensure the agreement aligns well with their business objectives. This level of customization helps create a more tailored experience for all parties involved.

Get more for Loan Modification Agreement

- Psychiatry certificate course form

- Credit card autopay authorization formdoc

- Medical provider claim form allianz care

- Medical provider claim form canadian medical

- Fillable online public health reports sign in fax email form

- Garda vetting student life trinity college dublin form

- Trinity college dublin tcd v1 student vetting declaration form

- Pesky gnats cbt workbook form

Find out other Loan Modification Agreement

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application