Nonqualified Stock Option Form

What is the Nonqualified Stock Option

A nonqualified stock option (NSO) is a type of employee stock option that does not meet the requirements set by the Internal Revenue Code for favorable tax treatment. Unlike incentive stock options (ISOs), NSOs can be granted to employees, consultants, and directors, offering flexibility in how companies can compensate individuals. When exercised, the difference between the exercise price and the fair market value of the stock is subject to ordinary income tax, making it essential for both employees and employers to understand the implications of this option.

How to use the Nonqualified Stock Option

Using a nonqualified stock option involves several steps. First, the employee must receive the option from their employer, detailing the number of shares, exercise price, and expiration date. Once the option is granted, the employee can choose to exercise it, typically by purchasing shares at the predetermined price. After exercising, the employee may hold the shares or sell them, depending on their financial strategy. It is crucial to consult with a financial advisor to understand the tax implications and timing of exercising the option.

Steps to complete the Nonqualified Stock Option

Completing a nonqualified stock option involves the following steps:

- Review the stock option agreement to understand the terms.

- Determine the best time to exercise the option, considering market conditions and personal financial goals.

- Complete the exercise form provided by your employer, specifying the number of shares to purchase.

- Submit the form along with payment for the shares, if applicable.

- Receive the shares and decide whether to hold or sell them based on your investment strategy.

Legal use of the Nonqualified Stock Option

The legal use of nonqualified stock options is governed by federal and state laws. It is important for employers to comply with the Securities and Exchange Commission (SEC) regulations when granting these options. Additionally, companies must ensure that the options are documented properly in the stock option agreement to avoid potential legal issues. Employees should also be aware of their rights and obligations under the agreement, including any vesting schedules and tax implications.

Key elements of the Nonqualified Stock Option

Key elements of a nonqualified stock option include:

- Exercise Price: The price at which the employee can purchase the stock.

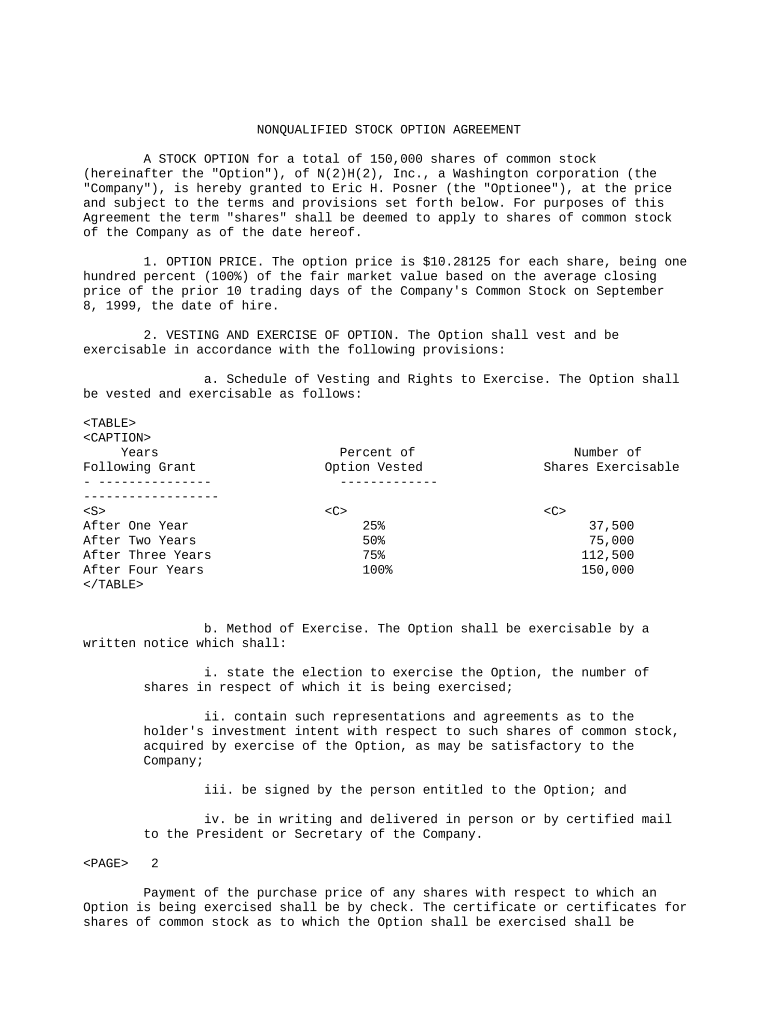

- Vesting Schedule: The timeline over which the employee earns the right to exercise the option.

- Expiration Date: The date by which the option must be exercised or it becomes void.

- Tax Implications: The tax treatment upon exercise, which is subject to ordinary income tax.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding nonqualified stock options. These guidelines outline how income is recognized upon exercising the option and the reporting requirements for both employers and employees. It is essential to adhere to these guidelines to avoid penalties and ensure compliance with tax regulations. Employees should receive a Form W-2 or Form 1099-MISC to report income from exercised options.

Quick guide on how to complete nonqualified stock option

Complete Nonqualified Stock Option seamlessly on any device

Digitized document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Nonqualified Stock Option on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Nonqualified Stock Option with ease

- Locate Nonqualified Stock Option and click Get Form to begin.

- Take advantage of the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Nonqualified Stock Option and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a nonqualified option in the context of airSlate SignNow?

A nonqualified option refers to a type of stock option that does not meet the specific requirements set by the IRS for favorable tax treatment. With airSlate SignNow, you can easily manage documents related to nonqualified options, ensuring compliance and efficient record-keeping.

-

How does airSlate SignNow facilitate the management of nonqualified options?

airSlate SignNow streamlines the process by providing a user-friendly platform to create, send, and eSign documents related to nonqualified options. This simplifies administration and allows for better tracking of acceptance and delivery.

-

What features does airSlate SignNow offer for handling nonqualified options?

Key features for managing nonqualified options include customizable templates, advanced document routing, and robust authentication methods. These tools are designed to enhance security and facilitate seamless transactions related to nonqualified options.

-

Is airSlate SignNow cost-effective for small businesses managing nonqualified options?

Yes, airSlate SignNow is a cost-effective solution for small businesses handling nonqualified options. Its pricing model is designed to accommodate various budgets, making it accessible for those who need to manage stock options without breaking the bank.

-

Can airSlate SignNow integrate with other tools for nonqualified options management?

Absolutely! airSlate SignNow offers integrations with popular software solutions and platforms that can help enhance your management of nonqualified options. This allows businesses to maintain workflow continuity and streamline document processes.

-

What benefits does airSlate SignNow provide for businesses dealing with nonqualified options?

Businesses utilizing airSlate SignNow for nonqualified options can benefit from increased efficiency, enhanced security, and improved document accuracy. These advantages help reduce errors and legal complications associated with stock options.

-

How secure is airSlate SignNow for managing sensitive nonqualified option documents?

airSlate SignNow prioritizes security by utilizing advanced encryption methods and strict compliance with data protection regulations. This ensures that all documents related to nonqualified options are kept safe and secure throughout their lifecycle.

Get more for Nonqualified Stock Option

Find out other Nonqualified Stock Option

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors