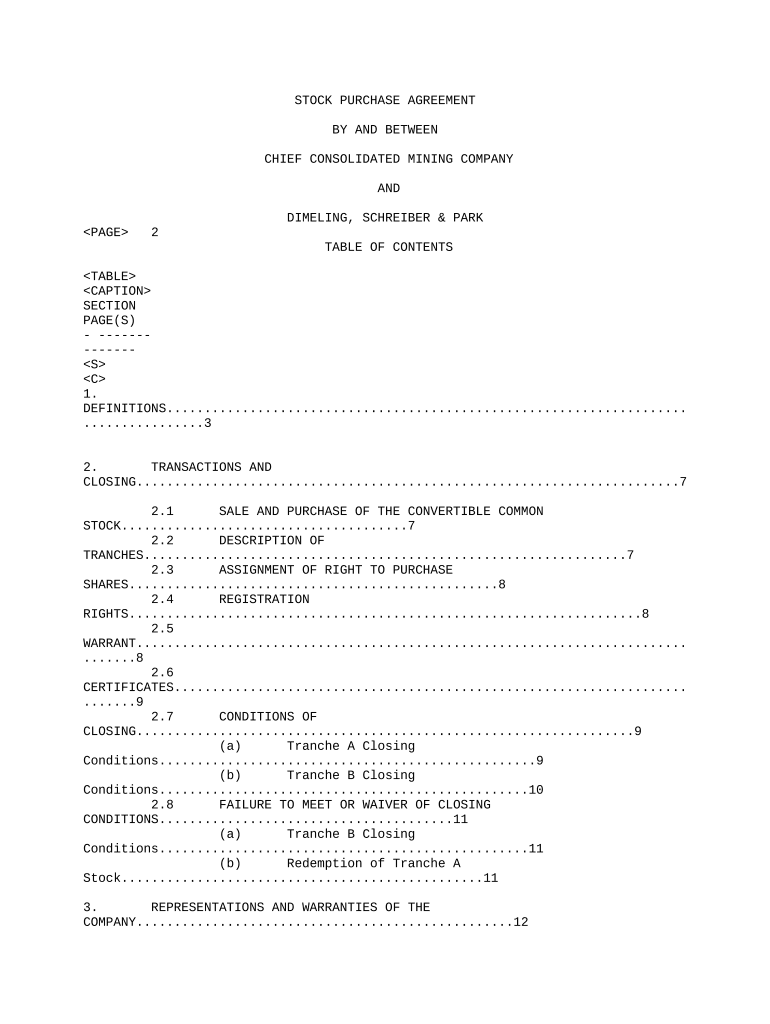

Stock Purchase between Agreement Form

What is the Stock Purchase Between Agreement

The Stock Purchase Between Agreement is a legal document that outlines the terms and conditions under which one party agrees to buy shares of stock from another party. This agreement serves to protect both the buyer and seller by clearly defining the rights and obligations of each party involved in the transaction. It typically includes details such as the number of shares being sold, the purchase price, and any warranties or representations made by the seller regarding the stock. Understanding this agreement is crucial for parties engaging in stock transactions, ensuring that both legal and financial interests are safeguarded.

Key Elements of the Stock Purchase Between Agreement

Several key elements are essential for a Stock Purchase Between Agreement to be effective and legally binding. These elements typically include:

- Parties Involved: Identification of the buyer and seller, including their legal names and addresses.

- Stock Details: Description of the stock being sold, including the number of shares and any specific rights associated with them.

- Purchase Price: The agreed-upon price per share and the total purchase price for the transaction.

- Payment Terms: Details on how and when payment will be made, including any deposits or financing arrangements.

- Representations and Warranties: Statements made by the seller about the stock, including its ownership and any encumbrances.

- Closing Conditions: Conditions that must be met before the sale can be finalized, such as regulatory approvals.

Steps to Complete the Stock Purchase Between Agreement

Completing a Stock Purchase Between Agreement involves several important steps to ensure that the transaction is executed properly. These steps typically include:

- Drafting the Agreement: Create a clear and comprehensive agreement that includes all necessary terms and conditions.

- Reviewing the Agreement: Both parties should review the document carefully to ensure mutual understanding and agreement on all terms.

- Negotiating Terms: If necessary, negotiate any terms that require adjustment before finalizing the agreement.

- Signing the Agreement: Both parties should sign the document, ideally in the presence of witnesses or a notary public to enhance its legal standing.

- Executing the Transaction: Complete the stock transfer process, including payment and delivery of stock certificates, if applicable.

Legal Use of the Stock Purchase Between Agreement

The Stock Purchase Between Agreement is legally binding when it meets certain criteria established by law. For the agreement to be enforceable, it must be clear, concise, and contain all necessary elements. Additionally, both parties must have the legal capacity to enter into the agreement and must do so voluntarily. Compliance with applicable state and federal laws is also essential, as these laws govern securities transactions. Ensuring that the agreement adheres to legal standards protects the interests of both parties and minimizes the risk of disputes.

Examples of Using the Stock Purchase Between Agreement

There are various scenarios in which a Stock Purchase Between Agreement may be utilized. Common examples include:

- Private Company Sales: When a shareholder sells their shares in a privately held company to another individual or entity.

- Investment Transactions: Investors purchasing shares from a company as part of a funding round or capital raise.

- Mergers and Acquisitions: In the context of larger transactions, where one company acquires another by purchasing its stock.

How to Obtain the Stock Purchase Between Agreement

Obtaining a Stock Purchase Between Agreement can be done through several methods. Many legal templates are available online that can be customized to fit specific needs. Additionally, consulting with a legal professional can provide tailored advice and ensure that the agreement meets all legal requirements. It is important to choose a reputable source for templates to ensure the document's validity and compliance with relevant laws. Custom agreements can also be drafted to address unique circumstances or specific terms desired by the parties involved.

Quick guide on how to complete stock purchase between agreement

Effortlessly prepare Stock Purchase Between Agreement on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage Stock Purchase Between Agreement on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Stock Purchase Between Agreement without hassle

- Locate Stock Purchase Between Agreement and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Stock Purchase Between Agreement while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the agreement chief feature in airSlate SignNow?

The agreement chief feature in airSlate SignNow allows users to manage and customize agreements efficiently. It streamlines the eSigning process by providing templates and automated workflows, ensuring that contracts are executed swiftly and securely. This feature is designed to enhance productivity and reduce errors in agreement management.

-

How much does it cost to use airSlate SignNow's agreement chief?

The pricing for airSlate SignNow's agreement chief starts at a competitive rate designed to fit various budgets. We offer different plans to accommodate businesses of all sizes, including options for small teams and large enterprises. You can choose a plan that best meets your organization's needs and take advantage of our cost-effective solutions.

-

What are the key benefits of using the agreement chief of airSlate SignNow?

Using the agreement chief in airSlate SignNow provides numerous benefits, including increased efficiency, enhanced security, and improved compliance. Users can quickly create and send documents for eSignature, saving valuable time on agreement processing. Additionally, our platform ensures that all transactions are secure, giving you peace of mind.

-

Can I integrate airSlate SignNow's agreement chief with other software?

Yes, airSlate SignNow's agreement chief offers seamless integrations with various popular software applications. This includes CRM systems, project management tools, and file storage services, allowing you to streamline your workflow. These integrations help ensure that all your agreement processes are efficient and centralized.

-

Is airSlate SignNow's agreement chief suitable for legal contracts?

Absolutely, airSlate SignNow's agreement chief is well-suited for a wide range of legal contracts. The platform provides the necessary features to create, manage, and store agreements securely, meeting legal standards. Users can also track changes and maintain records, making it ideal for compliance and audit purposes.

-

How does airSlate SignNow ensure the security of documents signed through the agreement chief?

Security is a top priority for airSlate SignNow. Our agreement chief employs encryption and robust security measures to safeguard your documents during transmission and storage. We also offer features like password protection and audit trails to enhance the integrity of your agreements.

-

What types of documents can I manage with the agreement chief in airSlate SignNow?

With the agreement chief in airSlate SignNow, you can manage various document types, including contracts, NDAs, and service agreements. The platform supports document customization, making it easy to create tailored agreements that meet specific business needs. This versatility helps streamline all your document management tasks.

Get more for Stock Purchase Between Agreement

- 2021 lara form

- Application for certificate of authority to transact business in form

- Affairs form

- Po box 30670 lansing mi 48909 michigan 384430412 form

- Certification education form

- Certification of medical education for graduates of state of michigan form

- Form csclcd 520 download fillable pdf or fill online

- Certificate of bchangeb of registered office state of michigan form

Find out other Stock Purchase Between Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now