Loan Security Form

What is the Loan Security Form

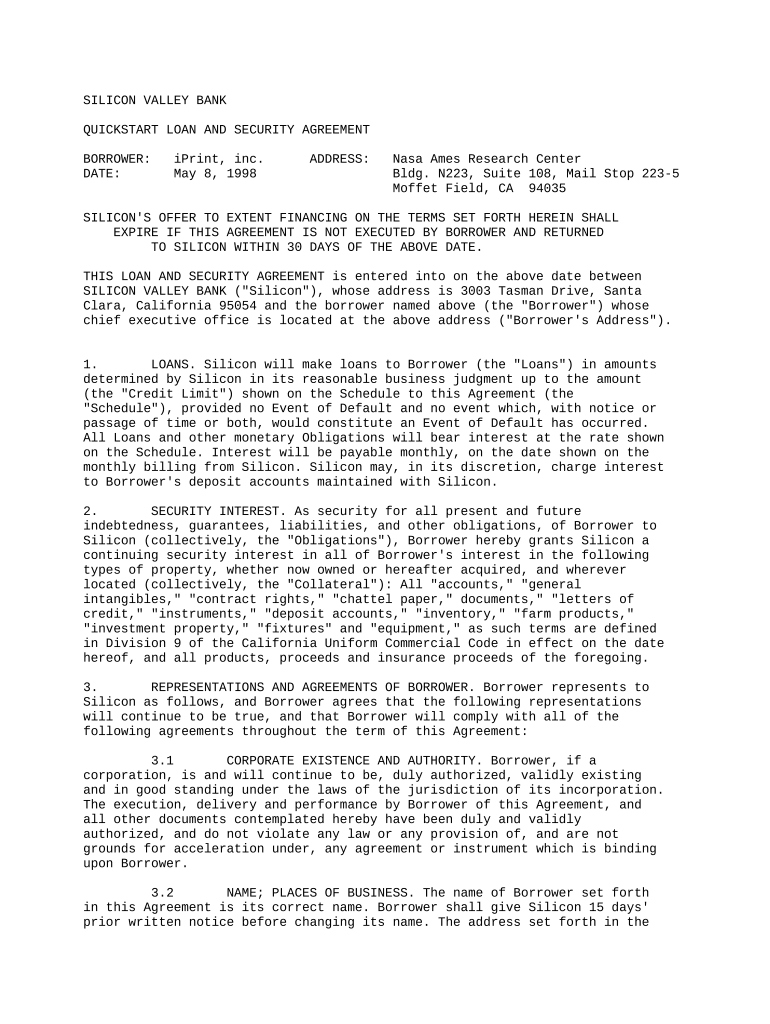

The Loan Security Form is a legal document used to establish a security interest in collateral when a borrower takes out a loan. This form outlines the terms of the loan agreement and specifies the assets that will back the loan. It is essential for lenders to secure their investment and for borrowers to understand their obligations. The form typically includes details such as the loan amount, interest rate, repayment terms, and a description of the collateral being used to secure the loan.

Steps to complete the Loan Security Form

Completing the Loan Security Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification and details about the collateral. Follow these steps:

- Fill in the borrower’s name and contact information.

- Provide the lender’s name and contact details.

- Clearly describe the collateral, including make, model, and identification numbers where applicable.

- Specify the loan amount and interest rate.

- Outline the repayment terms, including due dates and payment methods.

- Sign and date the form, ensuring all parties involved do the same.

Once completed, the form should be reviewed for accuracy before submission.

Legal use of the Loan Security Form

The Loan Security Form is legally binding when executed properly. It must comply with relevant state and federal laws governing secured transactions. This includes adherence to the Uniform Commercial Code (UCC), which provides a framework for the creation and enforcement of security interests. To ensure legal validity, the form should be signed by all parties involved, and it may need to be filed with the appropriate state authority, depending on the type of collateral. Understanding the legal implications of this form is crucial for both lenders and borrowers.

How to obtain the Loan Security Form

The Loan Security Form can typically be obtained through various sources. Many financial institutions provide their own version of the form, tailored to their specific requirements. Additionally, the form may be available online through legal document services or financial websites. It is important to ensure that the version used meets all legal standards and is appropriate for the specific loan transaction. Consulting with a legal professional can also provide guidance on obtaining and using the correct form.

Key elements of the Loan Security Form

Several key elements must be included in the Loan Security Form to ensure its effectiveness and legality. These elements typically consist of:

- The names and addresses of the borrower and lender.

- A detailed description of the collateral.

- The total loan amount and applicable interest rate.

- Repayment terms, including schedule and methods.

- Signatures of all parties involved, indicating agreement to the terms.

Including these elements helps to clarify the terms of the loan and the responsibilities of each party.

Form Submission Methods

The Loan Security Form can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online submission via the lender’s secure portal.

- Mailing a hard copy to the lender's address.

- In-person delivery at the lender's branch or office.

Each method has its own advantages, and borrowers should choose the one that best fits their situation and the lender's preferences.

Quick guide on how to complete loan security form

Effortlessly Prepare Loan Security Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily find the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files rapidly and without delays. Handle Loan Security Form on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Edit and eSign Loan Security Form Without Stress

- Find Loan Security Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Loan Security Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a security bank form?

A security bank form is a document designed for transactions or communications specifically associated with Security Bank. Using airSlate SignNow, you can securely send and eSign these forms with ease, ensuring the integrity and confidentiality of your information.

-

How can airSlate SignNow help me manage my security bank forms?

With airSlate SignNow, managing your security bank forms becomes straightforward. You can easily create, send, and track these forms digitally, streamlining your workflow and ensuring that all signatures are obtained in a secure manner.

-

Is airSlate SignNow compatible with security bank forms?

Yes, airSlate SignNow is fully compatible with security bank forms. You can upload your forms, add eSignature fields, and send them directly to recipients, making the signing process quick and efficient.

-

What are the pricing plans for airSlate SignNow related to security bank forms?

airSlate SignNow offers several pricing plans that cater to different needs, including businesses that frequently handle security bank forms. You can choose a plan that suits your budget and requirements, ensuring you get the best value for managing these important documents.

-

What features does airSlate SignNow offer for security bank forms?

airSlate SignNow provides features like customizable templates, audit trails, and secure storage for your security bank forms. These tools enhance your document management experience while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other applications for security bank forms?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage your security bank forms alongside other tools. This flexibility helps centralize your document workflows and enhances productivity.

-

What benefits does airSlate SignNow provide for handling security bank forms?

Using airSlate SignNow for security bank forms saves time and reduces operational costs. The ability to eSign documents digitally means faster turnaround times and improved efficiency, all while maintaining high-security standards.

Get more for Loan Security Form

- Office for citizens with developmental disabilities services and form

- Base datos pdf word press internet form

- Board notice louisiana board of pharmacy form

- Receipt of human remains at crematory release of cremated dhmh maryland form

- 2015 maine ems treatment protocols effective july 1 maine form

- State variations in nursing home social worker qualifications form

- Uapa keyword ideas generator form

- Maine caregiver form

Find out other Loan Security Form

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple