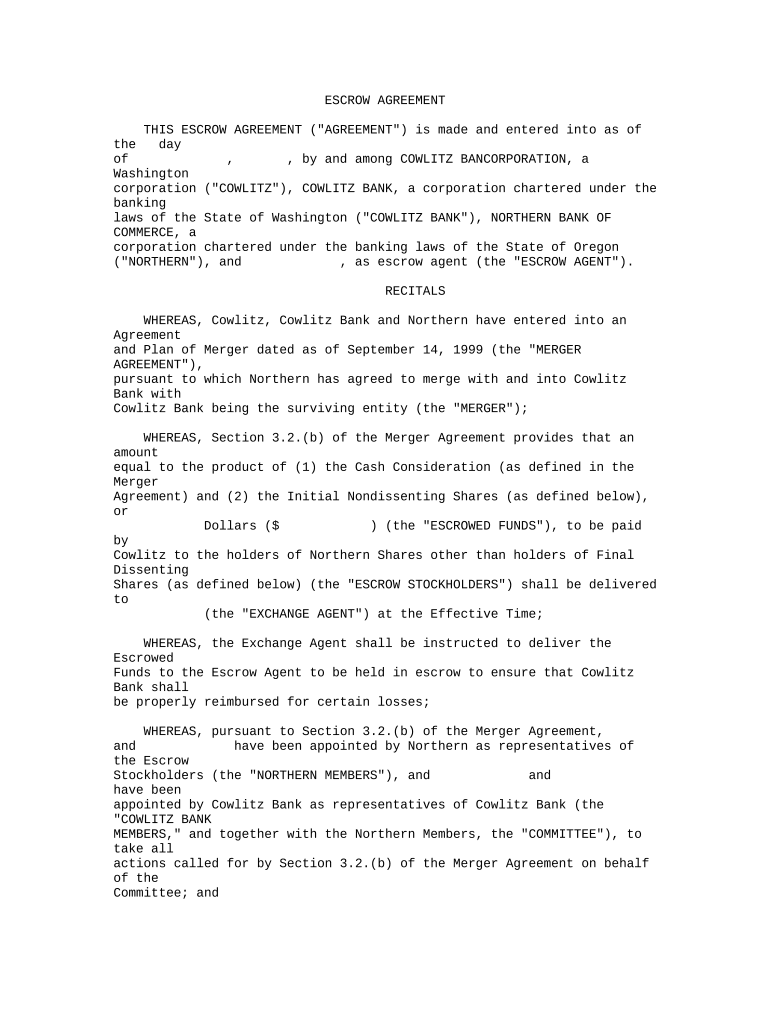

Escrow Agreement Bank Form

What is the Escrow Agreement Bank

An escrow agreement bank is a legal document that outlines the terms and conditions under which a third-party escrow agent holds funds or assets on behalf of two parties involved in a transaction. This agreement ensures that the funds are only released when specific conditions are met, providing security and trust in financial transactions. Commonly used in real estate, mergers, and acquisitions, the escrow agreement bank serves as a safeguard against fraud and non-performance by either party.

How to Use the Escrow Agreement Bank

Using an escrow agreement bank involves several steps. First, both parties must agree on the terms of the transaction and select a reputable escrow agent. Next, the parties will complete the escrow agreement bank form, detailing the transaction specifics, such as the amount of money involved, the conditions for release, and the timeline. Once signed, the escrow agent will hold the funds until the agreed conditions are satisfied, at which point the funds will be disbursed accordingly.

Steps to Complete the Escrow Agreement Bank

Completing the escrow agreement bank involves a systematic approach:

- Identify the parties involved in the transaction.

- Define the terms and conditions clearly, including payment amounts and release conditions.

- Select a qualified escrow agent to oversee the transaction.

- Fill out the escrow agreement bank form accurately, ensuring all necessary details are included.

- Review the agreement with all parties to confirm understanding and acceptance.

- Sign the document, ensuring that all signatures are properly executed.

- Submit the completed form to the escrow agent for processing.

Key Elements of the Escrow Agreement Bank

Several key elements must be included in an escrow agreement bank to ensure its effectiveness:

- Parties Involved: Clearly identify the buyer, seller, and escrow agent.

- Transaction Details: Specify the nature of the transaction, including amounts and timelines.

- Conditions for Release: Outline the specific conditions that must be met for the funds to be released.

- Fees: Detail any fees associated with the escrow service.

- Dispute Resolution: Include provisions for resolving any disputes that may arise.

Legal Use of the Escrow Agreement Bank

The legal use of an escrow agreement bank is governed by state laws and regulations. It is essential to ensure that the agreement complies with applicable legal standards to be enforceable in court. This includes adhering to the requirements for signatures, notarization, and any specific disclosures mandated by law. Consulting with a legal professional can help ensure that the escrow agreement is valid and protects the interests of all parties involved.

Examples of Using the Escrow Agreement Bank

Escrow agreements are commonly used in various scenarios, including:

- Real Estate Transactions: Buyers deposit earnest money with an escrow agent until the sale is finalized.

- Business Acquisitions: Funds are held in escrow until all conditions of the sale are met.

- Online Sales: Escrow services can protect buyers and sellers in online transactions, ensuring that goods are delivered before payment is released.

Quick guide on how to complete escrow agreement bank

Complete Escrow Agreement Bank effortlessly on any device

Online file management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the needed form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage Escrow Agreement Bank on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Escrow Agreement Bank with ease

- Find Escrow Agreement Bank and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and Carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Escrow Agreement Bank while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an escrow agreement bank?

An escrow agreement bank is a financial institution that holds funds on behalf of two parties during a transaction, ensuring security and compliance. By utilizing an escrow agreement bank, you can confidently complete transactions, knowing that the funds are safeguarded until all terms are fulfilled.

-

How does airSlate SignNow facilitate escrow agreements?

airSlate SignNow streamlines the process of creating and managing escrow agreements by allowing you to eSign documents securely. Our platform ensures that all parties can easily access and sign the necessary documentation related to the escrow agreement bank, making your transactions efficient and reliable.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. With our plans, you can efficiently manage your documents related to the escrow agreement bank without breaking the bank, providing you with a cost-effective solution that doesn’t compromise on quality.

-

What features does airSlate SignNow offer for managing escrow agreements?

Our platform provides features such as customizable templates, automated reminders, and secure document storage, all tailored for managing escrow agreements. Utilizing these features ensures that your escrow agreement bank processes are seamless and organized.

-

How can I integrate airSlate SignNow with my existing systems?

airSlate SignNow offers robust API integrations that allow you to connect with your existing applications and workflows. This means you can easily access your escrow agreement bank documents within your familiar systems, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for escrow agreements?

Using airSlate SignNow for escrow agreements provides enhanced security, faster transaction times, and improved accuracy. By adopting our solution, you can minimize the risks associated with traditional methods, ensuring that your escrow agreement bank dealings are protected and efficient.

-

Is airSlate SignNow compliant with industry regulations for escrow agreements?

Yes, airSlate SignNow is designed with compliance in mind, adhering to industry standards for electronic signatures and document handling. This compliance ensures that your transactions linked to the escrow agreement bank meet all necessary legal requirements, safeguarding your interests.

Get more for Escrow Agreement Bank

- Sample of group authority letter form

- Inland respite timesheet 2020 form

- Form pctipea409 january 2015

- Guardian lima form

- Family intake form refuge center refugecenter

- Application for residence permit for persons form

- Indoor cricket score sheet form

- 3 on 3 basketball tournament registration form template

Find out other Escrow Agreement Bank

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure