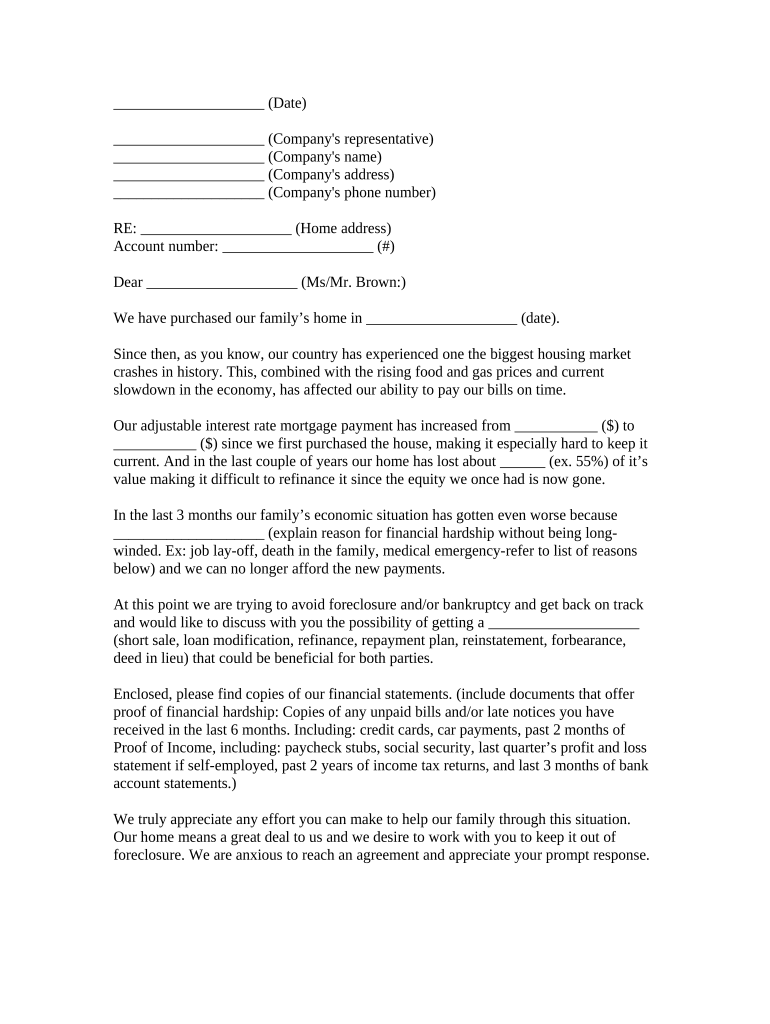

Hardship Letter Form

What is the hardship letter?

A hardship letter is a formal document that outlines an individual's or business's financial difficulties. It typically explains the circumstances that have led to the hardship, such as job loss, medical emergencies, or other unexpected expenses. This letter is often used in various contexts, including mortgage modifications, loan deferments, and financial aid applications. The purpose of the hardship letter is to provide a clear and honest account of the situation, allowing the recipient to understand the need for assistance or leniency.

Key elements of the hardship letter

To effectively communicate your situation, a hardship letter should include several key elements:

- Introduction: Begin with a brief introduction that states your purpose for writing the letter.

- Personal details: Include your name, address, and any relevant account numbers or identifiers.

- Description of hardship: Clearly explain the circumstances that have led to your financial difficulties, providing specific details.

- Impact of hardship: Describe how this situation has affected your ability to meet financial obligations.

- Request for assistance: Clearly state what you are requesting, whether it is a loan modification, deferment, or other forms of assistance.

- Closing statement: Thank the recipient for their consideration and express your hope for a positive response.

Steps to complete the hardship letter

Completing a hardship letter involves several steps to ensure clarity and effectiveness:

- Gather information: Collect all necessary documentation that supports your claims, such as pay stubs, medical bills, or termination letters.

- Draft the letter: Use a clear and concise format, ensuring that each key element is addressed.

- Review and edit: Carefully review the letter for grammar and clarity. Ensure that it accurately reflects your situation.

- Obtain signatures: If required, sign the letter and obtain any necessary signatures from co-borrowers or partners.

- Submit the letter: Send the letter through the appropriate channels, whether online or via mail, ensuring it reaches the intended recipient.

Legal use of the hardship letter

The hardship letter can serve as a legally recognized document in various situations, particularly when applying for financial relief. To ensure its legal validity:

- Adhere to any specific requirements set by the institution or organization receiving the letter.

- Include accurate and truthful information, as providing false information can lead to legal repercussions.

- Maintain copies of the letter and any supporting documentation for your records.

How to use the hardship letter

The hardship letter can be used in multiple scenarios, including:

- Applying for loan modifications or deferments with lenders.

- Requesting financial aid or assistance from educational institutions.

- Negotiating payment plans with creditors or service providers.

In each case, the letter should be tailored to address the specific requirements and expectations of the recipient, ensuring that it clearly articulates your situation and requests.

Quick guide on how to complete hardship letter

Complete Hardship Letter effortlessly on any device

Web-based document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without delays. Manage Hardship Letter on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The simplest way to modify and electronically sign Hardship Letter without hassle

- Obtain Hardship Letter and click on Get Form to begin.

- Use the tools available to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers explicitly for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Hardship Letter and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a hardship letter form?

A hardship letter form is a document used to explain your financial situation to lenders or organizations when you're seeking assistance. It details your current hardships and why you need consideration or relief, making it an essential tool for effective communication during financial struggles.

-

How do I create a hardship letter form using airSlate SignNow?

Creating a hardship letter form with airSlate SignNow is straightforward. Simply access our easy-to-use platform, select a template or start from scratch, and fill in the necessary details about your situation. You can then customize and send it for eSignature to expedite the process.

-

Is there a cost associated with using the hardship letter form feature?

airSlate SignNow offers various pricing plans, some of which include the hardship letter form feature. Depending on the plan you choose, you can access multiple templates and additional functionalities to maximize your document management experience without straining your budget.

-

What are the benefits of using the hardship letter form on airSlate SignNow?

Using the hardship letter form on airSlate SignNow allows you to streamline your request for assistance efficiently. It ensures that your communication is clear and professional, thereby increasing your chances of receiving the help you need. Additionally, our platform allows for quick signing and sending, which saves you time.

-

Can I integrate the hardship letter form with other tools?

Yes, airSlate SignNow supports integrations with various third-party applications, making it easy to incorporate your hardship letter form within your existing workflows. Whether you use CRM systems or email platforms, you can ensure seamless management of your documents across different tools.

-

How secure is the hardship letter form created with airSlate SignNow?

Security is a priority for airSlate SignNow. The hardship letter form and all documents are protected with advanced encryption and comply with industry standards, ensuring that your sensitive information remains secure throughout the signing process.

-

How long does it take to get my hardship letter form signed?

With airSlate SignNow, the time to get your hardship letter form signed can be signNowly reduced. The platform enables real-time collaboration and instant notifications, meaning you can receive completed signatures back within minutes, depending on the recipients' availability.

Get more for Hardship Letter

- National amp global form

- Educational grant heart of iowa form

- Fillable online transcript request form instructions

- Fillable online scholarship form rgg fax email print pdffiller

- Scholarship form rgg

- Fitrec lockertowel cancellation form boston university bu

- Application for employment heart of america beverage form

- Citrus cardiology consultants pa is an equal opportunity employer form

Find out other Hardship Letter

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement