MHA Request for Short Sale Form

What is the MHA Request For Short Sale

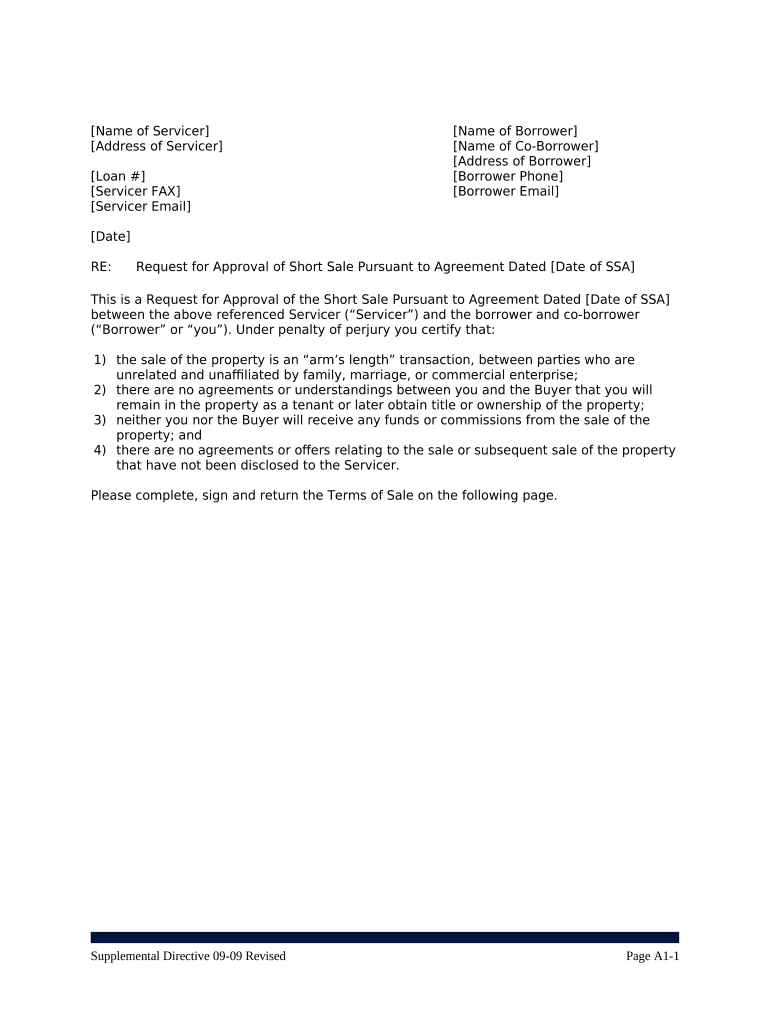

The MHA Request For Short Sale is a formal document used by homeowners seeking to sell their property for less than the amount owed on their mortgage. This request is part of the Making Home Affordable (MHA) program, designed to assist homeowners in financial distress. The short sale process allows lenders to accept a lower payoff on the mortgage, enabling the homeowner to avoid foreclosure while still fulfilling their debt obligations to the best of their ability.

How to use the MHA Request For Short Sale

To effectively use the MHA Request For Short Sale, homeowners must gather necessary financial documentation and complete the form accurately. This involves detailing their financial situation, including income, expenses, and any hardships that have led to their inability to continue mortgage payments. Once completed, the form should be submitted to the lender for review. It's important to maintain open communication with the lender throughout the process to ensure all requirements are met.

Steps to complete the MHA Request For Short Sale

Completing the MHA Request For Short Sale involves several key steps:

- Gather financial documents, including pay stubs, tax returns, and a hardship letter.

- Fill out the request form with accurate information regarding your financial situation.

- Submit the form along with supporting documents to your lender.

- Follow up with the lender to confirm receipt and address any additional requests for information.

- Await the lender's decision regarding the short sale request.

Key elements of the MHA Request For Short Sale

The MHA Request For Short Sale includes several key elements that must be addressed for the request to be considered valid:

- A detailed account of the homeowner's financial situation, including income and expenses.

- A clear explanation of the hardship that necessitates the short sale.

- Information about the property, including its current market value and any outstanding liens.

- Signatures from all parties involved, confirming the accuracy of the information provided.

Eligibility Criteria

To be eligible for the MHA Request For Short Sale, homeowners must meet specific criteria. This typically includes being in a financial hardship situation, such as job loss or medical emergencies. Additionally, the mortgage must be owned or guaranteed by a participating lender in the MHA program. Homeowners should also ensure that they are not currently in bankruptcy proceedings, as this may affect their eligibility.

Form Submission Methods

The MHA Request For Short Sale can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online submission through the lender's secure portal.

- Mailing the completed form and documents to the lender's designated address.

- In-person submission at a local branch of the lender.

Legal use of the MHA Request For Short Sale

The MHA Request For Short Sale is legally binding once it is signed and submitted to the lender. It is crucial for homeowners to ensure that all information provided is accurate and truthful, as any discrepancies could lead to delays or denial of the request. Compliance with federal and state regulations regarding short sales is essential to protect the homeowner's rights throughout the process.

Quick guide on how to complete mha request for short sale

Easily Prepare MHA Request For Short Sale on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without any delays. Manage MHA Request For Short Sale on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The Simplest Way to Alter and eSign MHA Request For Short Sale Effortlessly

- Locate MHA Request For Short Sale and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Leave behind the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign MHA Request For Short Sale, ensuring excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MHA Request For Short Sale?

An MHA Request For Short Sale is a formal application that homeowners submit to their mortgage lenders to initiate the short sale process. This request, part of the Making Home Affordable program, helps homeowners sell their property for less than what is owed on the mortgage, enabling them to avoid foreclosure.

-

How can airSlate SignNow help with MHA Request For Short Sale?

airSlate SignNow streamlines the MHA Request For Short Sale process by allowing users to send, eSign, and manage documents efficiently. With our user-friendly interface and secure platform, you can easily prepare and submit short sale requests to lenders, speeding up the approval process.

-

What features does airSlate SignNow offer for MHA Request For Short Sale documents?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure cloud storage specifically tailored for MHA Request For Short Sale documents. These features ensure that your documents are completed accurately and efficiently while maintaining compliance with legal standards.

-

Is airSlate SignNow cost-effective for managing MHA Request For Short Sale?

Yes, airSlate SignNow offers a cost-effective solution for managing MHA Request For Short Sale documents. Our competitive pricing plans allow businesses to access essential features without breaking the bank, making it an ideal choice for both small and large organizations.

-

Can airSlate SignNow integrate with other tools for MHA Request For Short Sale?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Salesforce, and more. This integration capability allows users to manage their MHA Request For Short Sale documents alongside other workflows, enhancing productivity and efficiency.

-

Are there any benefits of using airSlate SignNow for MHA Request For Short Sale beyond eSigning?

In addition to eSigning, airSlate SignNow offers benefits like automated workflows, document tracking, and real-time notifications for MHA Request For Short Sale processes. These features help users stay organized and informed, ensuring that no detail is overlooked during the submission process.

-

How secure is airSlate SignNow for handling MHA Request For Short Sale information?

Security is a top priority at airSlate SignNow. Our platform ensures that all MHA Request For Short Sale information is protected with industry-leading encryption and secure access controls, assuring users that their sensitive data remains confidential and safe from unauthorized access.

Get more for MHA Request For Short Sale

Find out other MHA Request For Short Sale

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word