Masonry Services Contract Self Employed Form

What is the Masonry Services Contract Self Employed

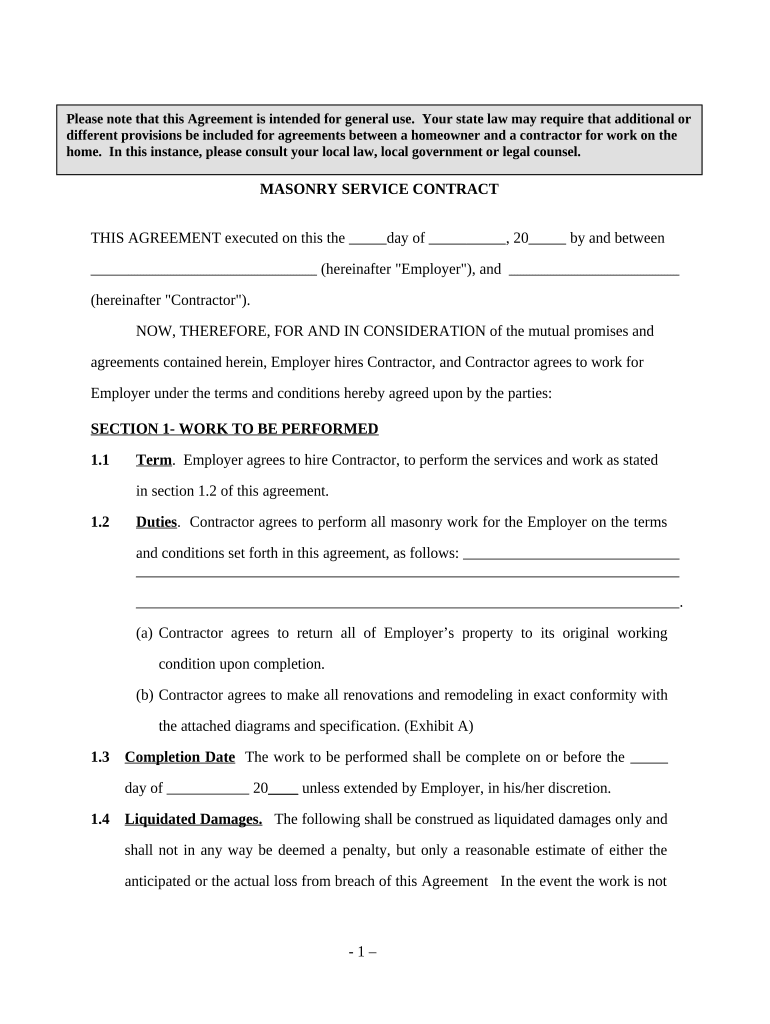

The Masonry Services Contract for self-employed individuals is a legal document that outlines the terms and conditions under which masonry services will be provided. This contract serves as a binding agreement between the contractor and the client, detailing the scope of work, payment terms, timelines, and responsibilities of both parties. It is essential for protecting the interests of both the contractor and the client, ensuring clarity and reducing the risk of disputes.

Key Elements of the Masonry Services Contract Self Employed

A well-structured Masonry Services Contract should include several critical elements:

- Scope of Work: A detailed description of the masonry services to be performed.

- Payment Terms: Clear information about the payment amount, schedule, and methods accepted.

- Timeline: Specific dates for project commencement and completion.

- Responsibilities: Outline of the obligations of both the contractor and the client.

- Termination Clause: Conditions under which either party may terminate the contract.

- Signatures: Spaces for both parties to sign, indicating their agreement to the terms.

How to Use the Masonry Services Contract Self Employed

To effectively use the Masonry Services Contract, follow these steps:

- Draft the Contract: Use a template or create a custom contract that includes all necessary elements.

- Review with the Client: Discuss the terms with the client to ensure mutual understanding and agreement.

- Make Necessary Adjustments: Modify any terms based on client feedback before finalizing.

- Sign the Contract: Both parties should sign the document, either in person or electronically.

- Distribute Copies: Provide copies to both parties for their records.

Steps to Complete the Masonry Services Contract Self Employed

Completing the Masonry Services Contract involves several straightforward steps:

- Gather Information: Collect all relevant details about the project, including materials, labor, and timelines.

- Fill Out the Contract: Enter all required information into the contract template.

- Review for Accuracy: Double-check all entries for correctness and completeness.

- Obtain Signatures: Ensure both parties sign the contract, confirming their agreement.

- Store Safely: Keep the signed contract in a secure location for future reference.

Legal Use of the Masonry Services Contract Self Employed

For the Masonry Services Contract to be legally binding, it must comply with relevant laws and regulations. This includes ensuring that:

- The contract is clear and unambiguous.

- Both parties have the legal capacity to enter into a contract.

- The contract is signed voluntarily without coercion.

- All terms are lawful and not in violation of public policy.

State-Specific Rules for the Masonry Services Contract Self Employed

Each state may have specific regulations governing masonry contracts. It is important for self-employed contractors to:

- Research state laws regarding contract requirements and enforceability.

- Understand licensing requirements for masonry work in their state.

- Be aware of any additional disclosures or clauses that may be required by state law.

Quick guide on how to complete masonry services contract self employed

Complete Masonry Services Contract Self Employed seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Manage Masonry Services Contract Self Employed on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Masonry Services Contract Self Employed effortlessly

- Find Masonry Services Contract Self Employed and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal legitimacy as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Revise and electronically sign Masonry Services Contract Self Employed to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Masonry Services Contract for Self Employed individuals?

A Masonry Services Contract for Self Employed individuals is a legal agreement outlining the terms, conditions, and responsibilities between the contractor and the client for masonry work. This contract ensures clarity on project scope, payment schedules, and timelines, protecting both parties. Utilizing such a contract is essential for self-employed masons to safeguard their rights and ensure smooth operations.

-

How much does a Masonry Services Contract for Self Employed cost?

The cost of drafting a Masonry Services Contract for Self Employed varies depending on complexity and location. Typically, DIY templates can be obtained at little to no cost, while custom contracts drafted by attorneys may range from $100 to $500. Investing in a well-drafted contract can prevent potential disputes and ensure clear communication with clients.

-

What are the key features of a Masonry Services Contract for Self Employed?

Key features of a Masonry Services Contract for Self Employed include detailed descriptions of the services provided, project timelines, payment terms, and warranties. Additionally, clauses on dispute resolution and liability protection are crucial for mitigating risks. A comprehensive contract helps set clear expectations and fosters professional relationships.

-

What benefits does a Masonry Services Contract offer to self-employed masons?

A Masonry Services Contract offers numerous benefits to self-employed masons, including legal protection, clarity on project details, and defined payment terms. This type of contract helps prevent misunderstandings and ensures that both parties are on the same page regarding responsibilities. Ultimately, it promotes professionalism in the masonry business.

-

Can I customize a Masonry Services Contract for Self Employed?

Yes, you can customize a Masonry Services Contract for Self Employed to fit your unique business needs. Various templates are available online that allow for modifications in terms of scope, pricing, and timelines. Tailoring the contract ensures that it aligns with specific project requirements and client expectations.

-

What happens if a client bsignNowes a Masonry Services Contract for Self Employed?

If a client bsignNowes a Masonry Services Contract for Self Employed, several steps can be taken, including negotiation for resolution or mediation. The contract should outline the consequences of bsignNow, which may include withholding payment or legal action. It's essential to document any bsignNowes and attempt to resolve issues amicably before pursuing formal measures.

-

Are there any integrations available for managing Masonry Services Contracts for Self Employed?

Yes, there are various software integrations available that can help manage Masonry Services Contracts for Self Employed. Tools like airSlate SignNow allow for easy creation, signing, and tracking of contracts electronically, enhancing efficiency. Integrating such solutions simplifies document management and ensures contractual obligations are met timely.

Get more for Masonry Services Contract Self Employed

- Oregon dmv accident report form amgazpl

- State of alaska division of motor vehicles application for school form

- Bdvr 153 record request for account holders bdvr 153 record request for account holders form

- Make a high quality logo for you by workkruchok7 fiverr form

- Update my address welcome to the state of new york form

- Aish open government form

- Form k 89 vehicle storage rates requirements application

- 83039 adoc form

Find out other Masonry Services Contract Self Employed

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast