Recovery Self Employed Form

What is the Recovery Self Employed

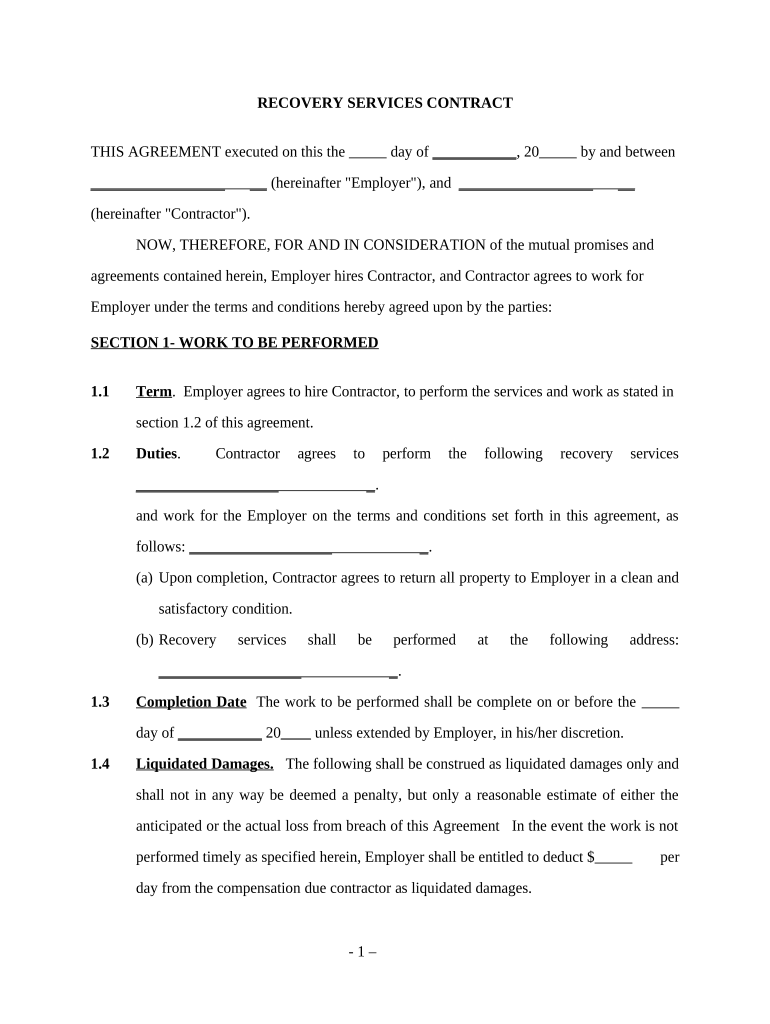

The Recovery Self Employed form is a crucial document designed for individuals who are self-employed and seeking financial assistance during challenging times. This form allows eligible self-employed individuals to apply for benefits that can help them recover from economic disruptions, such as those caused by natural disasters or public health emergencies. It is essential for self-employed individuals to understand the specifics of this form to ensure they receive the support they need.

How to use the Recovery Self Employed

Using the Recovery Self Employed form involves several steps that ensure accurate completion and submission. First, gather all necessary information, including your business details, income records, and any relevant documentation that supports your application. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors before submitting it to the appropriate agency. This process helps to streamline your application and increases the likelihood of a successful outcome.

Steps to complete the Recovery Self Employed

Completing the Recovery Self Employed form requires careful attention to detail. Here are the key steps to follow:

- Gather necessary documents, such as tax returns, profit and loss statements, and identification.

- Fill out the form, providing accurate information about your business and income.

- Review the form for completeness and accuracy.

- Submit the form electronically or by mail, following the specific instructions provided.

Legal use of the Recovery Self Employed

The legal use of the Recovery Self Employed form is governed by specific regulations that ensure its validity. It is important to comply with all legal requirements when filling out and submitting the form. This includes providing truthful information and maintaining supporting documents that can verify your claims. The form must be signed and dated appropriately to be considered legally binding. Understanding these legal aspects helps to protect your rights and ensures compliance with applicable laws.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that outline the eligibility criteria and requirements for the Recovery Self Employed form. It is essential to review these guidelines to determine if you qualify for the benefits offered. The IRS also specifies the necessary documentation and deadlines for submission, which can vary based on individual circumstances. Adhering to these guidelines will facilitate a smoother application process and help ensure that you receive the financial assistance you may be entitled to.

Eligibility Criteria

To qualify for the Recovery Self Employed benefits, applicants must meet specific eligibility criteria. Generally, this includes being self-employed, having a verifiable income, and demonstrating a loss of income due to qualifying circumstances. Additionally, applicants may need to provide evidence of their business operations and the impact of the disruption on their income. Understanding these criteria is vital for self-employed individuals seeking assistance, as it helps to ensure that they meet all necessary requirements before applying.

Required Documents

When applying for the Recovery Self Employed benefits, certain documents are required to support your application. Commonly required documents include:

- Recent tax returns, typically for the last two years.

- Profit and loss statements that reflect your business income.

- Identification documents, such as a driver's license or Social Security card.

- Any additional documentation that verifies your self-employment status and income.

Having these documents ready will help streamline the application process and increase the chances of approval.

Quick guide on how to complete recovery self employed

Complete Recovery Self Employed effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and without delays. Handle Recovery Self Employed on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Recovery Self Employed without hassle

- Locate Recovery Self Employed and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Recovery Self Employed and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is recovery self employed and how can airSlate SignNow assist with it?

Recovery self employed refers to the financial recovery processes available to self-employed individuals affected by events such as economic downturns or crises. airSlate SignNow provides tools that allow self-employed users to quickly and efficiently handle documentation related to their recovery efforts, making it easier to manage their affairs during challenging times.

-

How much does airSlate SignNow cost for self-employed users?

airSlate SignNow offers competitive pricing options tailored for self-employed individuals. Plans can fit various budgets, allowing users to choose the tier that suits their financial recovery self employed needs without breaking the bank.

-

What features does airSlate SignNow offer for self-employed professionals?

airSlate SignNow provides a variety of features specifically beneficial for self-employed users, such as document management, eSignature capabilities, and templates for common forms. These features streamline the recovery self employed process, enabling faster transactions and better organization.

-

Can airSlate SignNow help me with document compliance during recovery self employed phases?

Yes, airSlate SignNow ensures that all documents signed and managed through the platform comply with legal standards. This is crucial for recovery self employed individuals who need to present accurate and valid documentation to secure funding or support.

-

What benefits does airSlate SignNow provide for managing recovery self employed tasks?

The primary benefit of using airSlate SignNow for recovery self employed tasks is its efficiency. Users can save time with automated workflows and electronic signatures, allowing them to focus more on their recovery strategies rather than on paperwork.

-

Are there any integrations available with airSlate SignNow for self-employed users?

Absolutely! airSlate SignNow integrates seamlessly with various tools that self-employed individuals often use, such as cloud storage platforms and financial applications. This makes the recovery self employed process smoother and enhances productivity.

-

How does airSlate SignNow ensure the security of my documents during recovery self employed?

Security is a top priority for airSlate SignNow. The platform includes advanced encryption and secure access protocols to protect the sensitive information of self-employed users navigating their recovery self employed phases.

Get more for Recovery Self Employed

Find out other Recovery Self Employed

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors