Bookkeeping Agreement Form

What is the bookkeeping agreement?

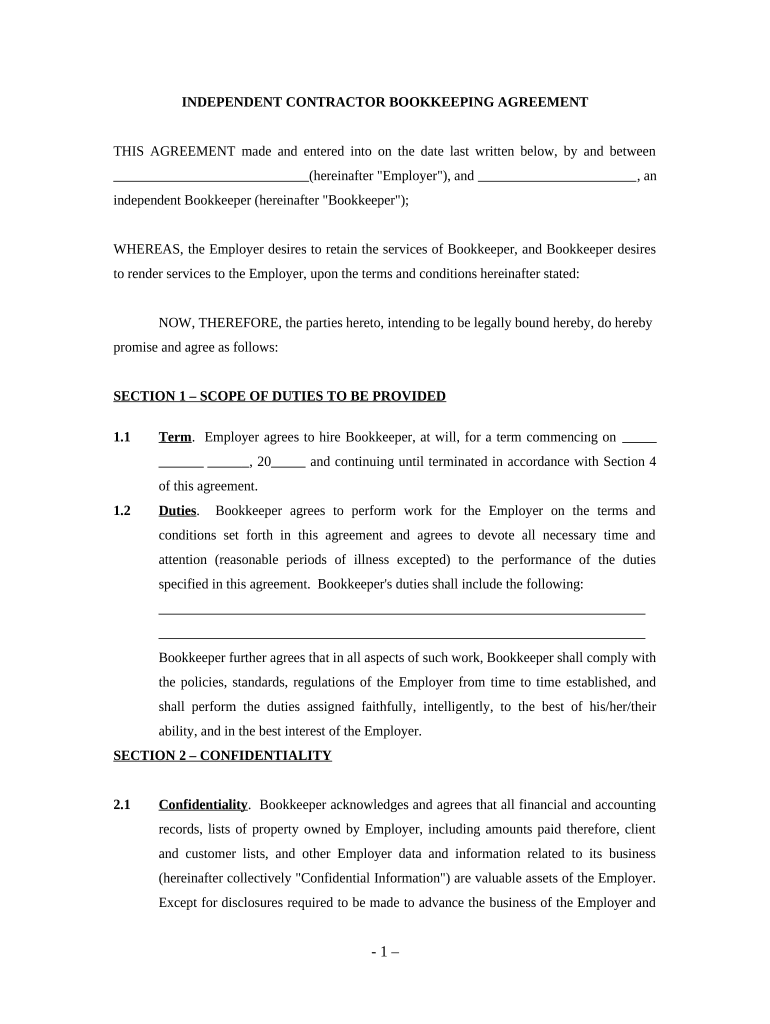

A bookkeeping agreement is a formal document that outlines the terms and conditions under which bookkeeping services will be provided. This agreement serves as a contract between a business and a bookkeeper, detailing responsibilities, payment terms, and the scope of services. It is essential for ensuring clarity and mutual understanding regarding financial management tasks, including record-keeping, financial reporting, and compliance with relevant regulations.

How to use the bookkeeping agreement

Using a bookkeeping agreement involves several steps to ensure that both parties are aligned on expectations. First, the business should identify its specific bookkeeping needs and the services required. Next, the agreement should be drafted, incorporating essential elements such as service descriptions, payment schedules, and confidentiality clauses. Once both parties review and agree to the terms, they can sign the document electronically for convenience and security. This process helps establish a professional relationship and provides a reference point for future interactions.

Key elements of the bookkeeping agreement

A comprehensive bookkeeping agreement should include several key elements to protect both parties. Important components are:

- Scope of Services: Clearly define the specific bookkeeping tasks to be performed.

- Payment Terms: Outline the fees, payment schedule, and any additional costs.

- Confidentiality Clause: Ensure that sensitive financial information remains protected.

- Duration of Agreement: Specify the length of the contract and conditions for renewal or termination.

- Liability and Indemnification: Address responsibilities and potential liabilities in case of errors or disputes.

Steps to complete the bookkeeping agreement

Completing a bookkeeping agreement involves several straightforward steps. Start by gathering all necessary information about the services required and the parties involved. Draft the agreement, ensuring all key elements are included. Both parties should review the document carefully, making any necessary adjustments. Once finalized, sign the agreement electronically using a secure platform, which ensures that the signatures are legally binding. Keep a copy for your records and provide one to the bookkeeper for their files.

Legal use of the bookkeeping agreement

The legal use of a bookkeeping agreement is crucial for ensuring that the document is enforceable in a court of law. To be legally binding, the agreement must meet specific criteria, such as having clear terms, mutual consent, and the capacity of both parties to enter into a contract. It is advisable to comply with relevant laws and regulations governing contracts in the United States, including the ESIGN Act and UETA, which validate electronic signatures. This compliance helps protect both parties in case of disputes or misunderstandings.

State-specific rules for the bookkeeping agreement

State-specific rules may apply to bookkeeping agreements, as contract law can vary across jurisdictions. It is essential to be aware of any local regulations that could affect the validity of the agreement. For instance, some states may require certain disclosures or specific language to be included in contracts. Consulting with a legal professional familiar with local laws can help ensure that the bookkeeping agreement is compliant and enforceable in the relevant state.

Quick guide on how to complete bookkeeping agreement

Complete Bookkeeping Agreement effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Bookkeeping Agreement on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to edit and electronically sign Bookkeeping Agreement with ease

- Find Bookkeeping Agreement and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that task.

- Create your electronic signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Bookkeeping Agreement and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a bookkeeping agreement?

A bookkeeping agreement is a contract that outlines the terms and conditions between a business and a bookkeeping service provider. This agreement ensures that both parties understand their responsibilities, fees, and confidentiality regarding financial data. It is essential for establishing a clear understanding of the services provided and the expectations involved.

-

What features does airSlate SignNow offer for bookkeeping agreements?

airSlate SignNow provides features such as easy document creation, eSignature capabilities, and secure cloud storage, all tailored for bookkeeping agreements. These features enable users to streamline their financial document workflows, ensuring that bookkeeping agreements can be signed and stored without hassle. Additionally, the platform offers customizable templates to suit specific bookkeeping needs.

-

How can airSlate SignNow benefit my bookkeeping processes?

Using airSlate SignNow for bookkeeping agreements can signNowly enhance efficiency in managing financial documents. It allows for quick sending and receiving of agreements, which accelerates the bookkeeping process and reduces administrative overhead. Moreover, the ability to track document status ensures you’re always informed about your bookkeeping agreements.

-

Is there a free trial available for airSlate SignNow's bookkeeping features?

Yes, airSlate SignNow typically offers a free trial for users to explore its features before committing to a subscription. This includes testing the functionalities related to bookkeeping agreements, providing you with a firsthand experience of how the platform can help streamline your bookkeeping processes. Check the website for specific trial details and terms.

-

What are the pricing options for airSlate SignNow regarding bookkeeping agreements?

airSlate SignNow offers a variety of pricing plans suitable for different business sizes and needs, including options specifically for managing bookkeeping agreements. The pricing structure is transparent, allowing you to select a plan that best fits your budget while enjoying comprehensive features. Detailed pricing information can be found on the pricing page of the airSlate SignNow website.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow supports integrations with many popular accounting and financial software, enhancing its functionality for bookkeeping agreements. This integration allows your team to manage financial documents seamlessly within your existing systems, improving overall workflow efficiency. Be sure to check the integrations section on our website for specifics.

-

How does airSlate SignNow ensure the security of my bookkeeping agreements?

airSlate SignNow prioritizes the security of your financial documents, including bookkeeping agreements, by implementing strong encryption and compliance measures. These security features protect sensitive information from unauthorized access and ensure that all transactions are secure. You can trust airSlate SignNow to handle your crucial bookkeeping documents safely.

Get more for Bookkeeping Agreement

- Instructions for dr 15ez florida department of revenue form

- Sales and use tax returns florida department of revenue form

- Fillable online communications services tax from summary form

- Parish e file welcome louisianagov form

- For calendar year 2021 or fiscal year ending form

- Important for the inventory tax and ad valorem natural gas form

- Withholding tax frequently asked questions louisiana form

- Wwwlataxstatelausmenuformsreportsregsuploadedinventory merchandise etc 20 personal property tax form

Find out other Bookkeeping Agreement

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF