Self Employed Independent Contractor Form

What is the Self Employed Independent Contractor Form

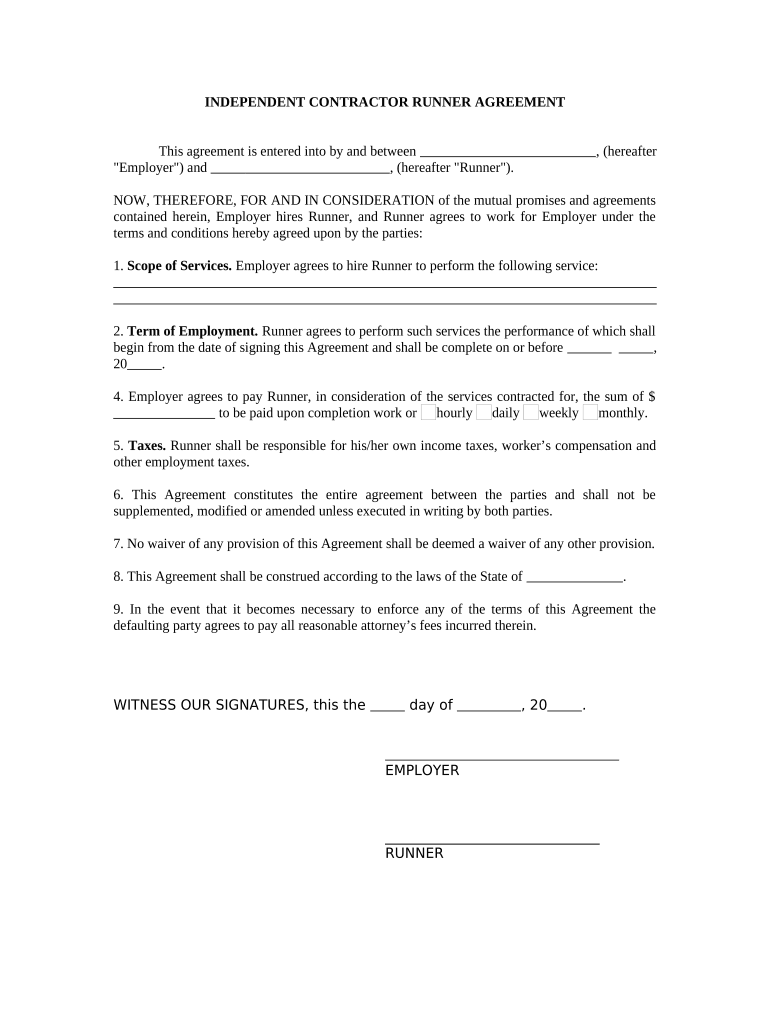

The self employed independent contractor form is a crucial document used to establish the relationship between a business and an independent contractor. This form outlines the terms of engagement, including the scope of work, payment details, and other essential conditions. It serves to clarify the responsibilities of both parties, ensuring that the contractor understands their obligations and the business is protected from potential liabilities. By formalizing this relationship, the form helps prevent misunderstandings and provides a reference point for both parties throughout the duration of the contract.

How to Use the Self Employed Independent Contractor Form

Using the self employed independent contractor form involves several key steps. First, ensure that all necessary information is gathered, including the contractor's name, contact details, and the specific services to be provided. Next, fill out the form accurately, detailing the payment terms, deadlines, and any other relevant conditions. Once completed, both parties should review the document to confirm that all information is correct and mutually agreed upon. Finally, both the business and the contractor should sign the form to make it legally binding. Utilizing electronic signature tools can streamline this process and enhance security.

Steps to Complete the Self Employed Independent Contractor Form

Completing the self employed independent contractor form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the contractor and the project.

- Fill in the contractor's details, including name, address, and contact information.

- Clearly outline the scope of work, including specific tasks and deliverables.

- Specify payment terms, including rates, payment methods, and due dates.

- Include any additional clauses relevant to the project, such as confidentiality or termination conditions.

- Review the completed form with the contractor to ensure accuracy.

- Both parties sign the form to finalize the agreement.

Legal Use of the Self Employed Independent Contractor Form

The legal use of the self employed independent contractor form is essential for protecting both parties involved. To ensure the form is legally binding, it must meet specific requirements under U.S. law. This includes obtaining signatures from both parties, which can be facilitated through electronic signature solutions that comply with regulations such as the ESIGN Act and UETA. Additionally, the form should be stored securely to provide evidence of the agreement in case of disputes. Adhering to these legal standards helps maintain the integrity of the contractor relationship and minimizes potential legal issues.

Key Elements of the Self Employed Independent Contractor Form

Several key elements should be included in the self employed independent contractor form to ensure it is comprehensive and effective. These elements include:

- Contractor Information: Full name, address, and contact details of the independent contractor.

- Scope of Work: Detailed description of the services to be provided.

- Payment Terms: Rates, payment methods, and schedule for payments.

- Duration of Contract: Start and end dates of the engagement.

- Confidentiality Clause: Provisions to protect sensitive information.

- Termination Conditions: Terms under which either party may terminate the agreement.

Examples of Using the Self Employed Independent Contractor Form

The self employed independent contractor form can be utilized in various scenarios. For instance, a graphic designer may use the form to outline their services for a marketing agency, detailing project milestones and payment schedules. Similarly, a freelance writer might employ the form to establish terms with a publishing company, specifying deadlines and compensation. Each example highlights the importance of clearly defined roles and expectations, which can help prevent disputes and ensure a smooth working relationship.

Quick guide on how to complete self employed independent contractor form

Complete Self Employed Independent Contractor Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents rapidly without disruptions. Manage Self Employed Independent Contractor Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Self Employed Independent Contractor Form with ease

- Locate Self Employed Independent Contractor Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method to deliver your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Self Employed Independent Contractor Form and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a self employed independent contractor form?

A self employed independent contractor form is a document that outlines the terms and conditions of a working relationship between a contractor and a client. It includes details such as payment terms, project scope, and responsibilities. Using airSlate SignNow, you can easily create, send, and eSign this form, ensuring both parties are on the same page.

-

How does airSlate SignNow help in managing self employed independent contractor forms?

airSlate SignNow provides a user-friendly platform to create and manage self employed independent contractor forms efficiently. With features like templates, cloud storage, and eSignature options, you can streamline the entire process. This helps you save time and maintain professionalism with your contractors.

-

What are the pricing options for using airSlate SignNow for contracts?

airSlate SignNow offers flexible pricing plans that cater to various business needs, starting from a free trial to paid subscriptions. Each plan provides tools suitable for managing self employed independent contractor forms, including eSigning features and document management. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other business tools?

Yes, airSlate SignNow integrates seamlessly with numerous business applications such as Google Drive, Dropbox, and Salesforce. This allows you to automate workflows and manage your self employed independent contractor forms alongside your other business processes. Integration enhances overall efficiency and data management.

-

What benefits does using eSignature provide for self employed independent contractor forms?

Using eSignature for self employed independent contractor forms increases security and speeds up the signing process. It eliminates the need for physical paperwork and allows for quick modifications and re-sending if necessary. With airSlate SignNow, tracking the status of your forms is easy, ensuring a smooth workflow.

-

Is it easy to customize a self employed independent contractor form using airSlate SignNow?

Absolutely! airSlate SignNow offers customizable templates for self employed independent contractor forms, allowing you to tailor them to your specific needs easily. You can modify sections, add fields, and insert your branding, ensuring that each contract reflects your business style and requirements.

-

How can I ensure compliance when using self employed independent contractor forms?

Ensuring compliance with self employed independent contractor forms is crucial. airSlate SignNow provides templates that adhere to industry standards and legal requirements. Additionally, you can access resources and support to help you stay compliant while engaging with your contractors.

Get more for Self Employed Independent Contractor Form

- This document is effective on the date filed unless a form

- Csclcd 701 rev michigan form

- Food service license application 2019 2020 state of michigan form

- How to apply for a motor vehicle repair facility registration michigan form

- Mich elf application 2011 form

- Bcs lre 052 form

- Online sunday sales application form

- Retailer application for certificate of state of michigan mi form

Find out other Self Employed Independent Contractor Form

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later