F8822b Form

What is the F8822b?

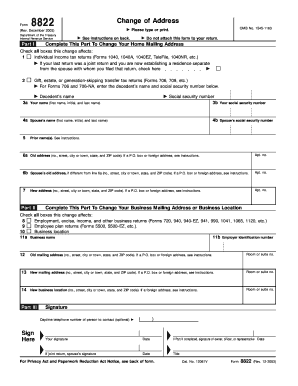

The F8822b form, also known as the IRS Form F8822b, is a document used by taxpayers to update their address with the Internal Revenue Service (IRS). This form is crucial for ensuring that all tax-related correspondence, including refunds and notices, is sent to the correct address. It is particularly important for individuals who have recently moved or changed their mailing address, as the IRS relies on accurate address information to maintain effective communication with taxpayers.

Steps to complete the F8822b

Completing the F8822b form involves several straightforward steps. First, ensure you have the correct form, which can be obtained from the IRS website. Next, fill in your personal information, including your name, old address, and new address. It is essential to provide accurate details to avoid any issues with processing your request. After completing the form, review it for any errors. Finally, submit the form to the IRS by mailing it to the address specified in the instructions. Keeping a copy for your records is also advisable.

Legal use of the F8822b

The F8822b form is legally recognized as a valid method for notifying the IRS of a change of address. To ensure its legal standing, it must be completed accurately and submitted according to IRS guidelines. This form is essential for maintaining compliance with tax laws, as it helps prevent any potential issues related to misdirected tax documents or missed communications from the IRS. Utilizing the F8822b form properly safeguards your tax information and ensures that you remain informed about your tax obligations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the F8822b form. Taxpayers should ensure that they are using the most current version of the form, which can be found on the IRS website. It is important to follow the instructions carefully, as any inaccuracies or omissions may delay the processing of your address change. The IRS recommends submitting the form as soon as possible after moving to ensure that your address is updated in their records. Additionally, it is advisable to check your IRS account online to confirm that the address change has been processed correctly.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the F8822b form, it is recommended to do so as soon as you change your address. Timely submission helps ensure that you receive important tax documents and communications from the IRS without delay. If you are filing your tax return for a given year, it is best to submit the F8822b form before the filing deadline to guarantee that your new address is on file. This proactive approach can help avoid complications during tax season.

Required Documents

When completing the F8822b form, no additional documents are required to be submitted with the form itself. However, it is essential to have personal identification information on hand, such as your Social Security number, to accurately fill out the form. If you are submitting the form for a business entity, you may need to provide the Employer Identification Number (EIN) associated with your business. Keeping a record of your submission is also advisable for future reference.

Quick guide on how to complete f8822b

Complete F8822b effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage F8822b on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign F8822b without any hassle

- Locate F8822b and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choice. Modify and eSign F8822b and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8822b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is f8822b and how does it relate to airSlate SignNow?

The f8822b form is designed for the IRS to update the address of a taxpayer. With airSlate SignNow, users can easily eSign and send the f8822b form securely and efficiently, ensuring that your tax documents are handled with care.

-

What features does airSlate SignNow provide for completing the f8822b form?

AirSlate SignNow offers intuitive features like templates and document workflows, specifically for the f8822b form. Users can add signatures, custom fields, and notations to ensure their f8822b submissions are complete and compliant with IRS requirements.

-

Is airSlate SignNow a cost-effective solution for handling f8822b documents?

Yes, airSlate SignNow offers competitive pricing plans that make it an affordable solution for handling f8822b documents. With flexible pricing options, businesses can choose a plan that fits their budget while still benefiting from robust eSigning features.

-

What are the benefits of using airSlate SignNow for eSigning f8822b forms?

Using airSlate SignNow for the f8822b form streamlines the signing process, making it faster and more reliable. Users can track the status of their f8822b submissions in real-time and receive notifications when documents are signed, ensuring a smooth workflow.

-

Can I integrate airSlate SignNow with other applications to manage f8822b forms?

Absolutely! AirSlate SignNow provides seamless integrations with popular business applications, enabling users to manage the f8822b forms within their existing workflows. This integration capability enhances productivity and creates a more cohesive approach to document management.

-

How secure is airSlate SignNow for signing f8822b documents?

AirSlate SignNow prioritizes security with its industry-standard encryption protocols and compliance with regulations, ensuring that your f8822b documents remain safe. With secure storage and access controls, your sensitive information is well protected.

-

What support resources does airSlate SignNow offer for users dealing with f8822b forms?

AirSlate SignNow provides extensive support resources, including tutorials and customer support, to assist users with the f8822b forms. Whether you need help understanding the form or navigating the eSigning process, assistance is readily available to enhance your experience.

Get more for F8822b

Find out other F8822b

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document