Insurer Claim Form

What is the insurer claim?

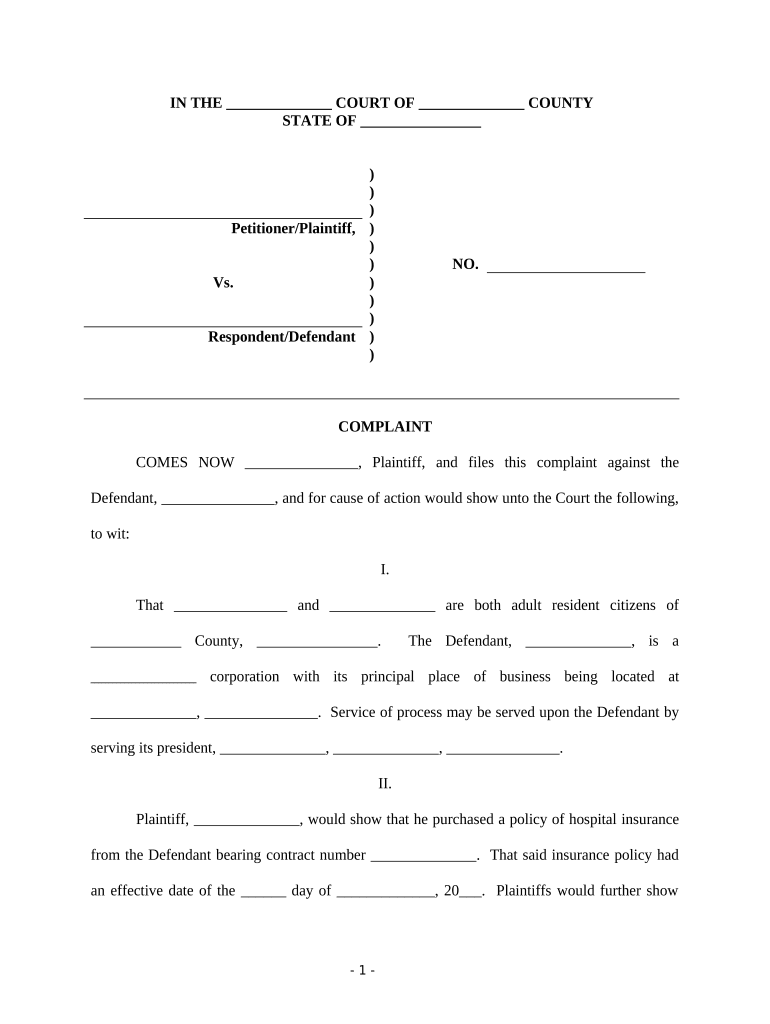

An insurer claim is a formal request made by an individual or business to an insurance company for compensation or coverage for a loss, damage, or liability as stipulated in an insurance policy. This process is essential for policyholders to receive the benefits they are entitled to under their insurance agreements. The claim must detail the circumstances of the incident, the extent of the damages, and any relevant documentation to support the request.

How to use the insurer claim

Using an insurer claim involves several steps to ensure proper submission and processing. First, gather all necessary documentation, including the insurance policy, incident reports, and any evidence of damages. Next, fill out the insurer claim form accurately, providing all required details. It is advisable to review the form for completeness and accuracy before submission. Once completed, submit the claim through the designated method, which may include online submission, mail, or in-person delivery, depending on the insurer's guidelines.

Steps to complete the insurer claim

Completing an insurer claim requires careful attention to detail. Follow these steps for a successful submission:

- Review your insurance policy to understand coverage and claim procedures.

- Document the incident thoroughly, including photographs and witness statements.

- Obtain any necessary forms from your insurer's website or customer service.

- Fill out the insurer claim form, ensuring all information is accurate and complete.

- Attach supporting documents, such as receipts or repair estimates.

- Submit the claim through the preferred method, keeping copies for your records.

Legal use of the insurer claim

The legal use of an insurer claim is governed by the terms of the insurance policy and applicable state laws. It is crucial that the claim is filed within the time limits specified in the policy to avoid denial. Additionally, the information provided must be truthful and accurate, as any misrepresentation can lead to legal consequences, including denial of the claim or cancellation of the policy.

Required documents

When filing an insurer claim, certain documents are typically required to substantiate the claim. These may include:

- A completed insurer claim form.

- Proof of loss, such as photographs or police reports.

- Receipts or invoices for repairs or replacements.

- Medical records, if applicable, for health-related claims.

- Any correspondence with the insurance company regarding the claim.

Form submission methods

Insurer claims can be submitted through various methods, depending on the insurer's policies. Common submission methods include:

- Online: Many insurers offer a secure portal for electronic submission of claims.

- Mail: Claims can often be sent via postal service to the insurer's claims department.

- In-person: Some insurers allow claims to be filed directly at their local offices.

Key elements of the insurer claim

Understanding the key elements of an insurer claim can enhance the likelihood of a successful outcome. Important components include:

- Claimant information, including contact details.

- Policy number and coverage details.

- Detailed description of the incident leading to the claim.

- Itemized list of damages or losses incurred.

- Any supporting documentation that validates the claim.

Quick guide on how to complete insurer claim

Prepare Insurer Claim effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly without any delays. Manage Insurer Claim on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Insurer Claim with ease

- Locate Insurer Claim and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and select the Done button to save your modifications.

- Decide how you wish to send your form — via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Revise and eSign Insurer Claim, ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's role in processing an insurer claim?

airSlate SignNow streamlines the process of submitting an insurer claim by allowing users to electronically sign documents quickly and securely. This reduces paperwork and minimizes delays in processing claims, ensuring that your request is handled efficiently.

-

How much does airSlate SignNow cost for managing insurer claims?

The pricing for airSlate SignNow varies based on the plan you choose, with options tailored for individuals and businesses alike. Each plan offers features that enhance the submission of insurer claims, making it a cost-effective solution for improving efficiency.

-

What features of airSlate SignNow are beneficial for insurer claims?

airSlate SignNow includes features such as customizable templates, automated notifications, and secure cloud storage, all of which are particularly useful for handling insurer claims. These features facilitate a seamless experience, from document creation to eSigning.

-

Can airSlate SignNow integrate with other platforms for insurer claims?

Yes, airSlate SignNow offers integrations with various tools and platforms that can enhance your insurer claim processes. This allows you to synchronize data and streamline your workflows, ensuring a more cohesive operation.

-

How does airSlate SignNow enhance the security of insurer claims?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive insurer claim documents. The platform employs advanced encryption, secure cloud storage, and compliance with regulations to ensure that your information remains protected.

-

Is there a free trial available for testing airSlate SignNow for insurer claims?

Yes, airSlate SignNow offers a free trial that allows potential users to explore its features for managing insurer claims without commitment. This trial helps you evaluate how the platform can streamline your claims process and improve efficiency.

-

How does airSlate SignNow improve turnaround time for insurer claims?

By utilizing airSlate SignNow, businesses can signNowly reduce the turnaround time for insurer claims. The electronic signing process and automated workflows speed up approvals, ensure swift submission, and ultimately lead to faster payouts.

Get more for Insurer Claim

- Why people need professionally sounded writers daily uganda form

- Form change marital

- Participant continuationreactivation form

- Ppe issue record sheet template form

- 2020 21 household size verification form norco college

- Csu ge breadth certification plan and csu ge for stem form

- 2019 2020 verification worksheet dependent student v5 form

- Chaffey college transcripts form

Find out other Insurer Claim

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now