Examples of Completed Iht205 Form

Key elements of the iht205 form

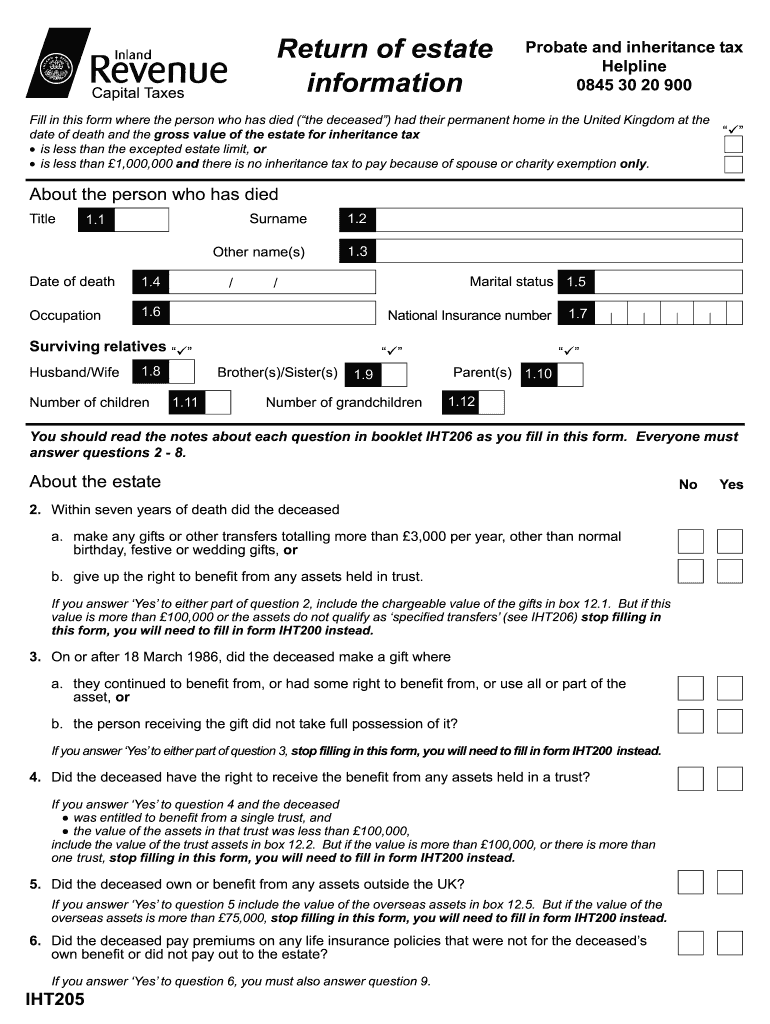

The iht205 form is a critical document used in the probate process in the United States. It serves as a declaration of the value of an estate for tax purposes. Understanding its key elements is essential for accurate completion. The form typically includes:

- Personal Information: This section requires details about the deceased, including their name, date of birth, and date of death.

- Asset Valuation: You must provide a comprehensive list of the deceased's assets, including real estate, bank accounts, and personal property, along with their estimated values.

- Liabilities: This part requires you to disclose any debts or liabilities that the deceased had at the time of death, which can affect the overall estate value.

- Signature Section: The form must be signed by the executor or administrator of the estate, confirming the accuracy of the information provided.

Steps to complete the iht205 form

Completing the iht205 form accurately is crucial for ensuring compliance with probate regulations. Here are the steps to follow:

- Gather Information: Collect all necessary documents related to the deceased's assets and liabilities.

- Fill Out Personal Information: Enter the deceased's name, date of birth, and date of death in the designated fields.

- List Assets: Provide a detailed account of all assets, ensuring to include accurate valuations.

- Disclose Liabilities: List any outstanding debts or obligations to give a complete picture of the estate's financial status.

- Review and Sign: Carefully review the completed form for accuracy before signing it as the executor or administrator.

Legal use of the iht205 form

The iht205 form is legally recognized in the probate process, serving as a formal declaration of the estate's value. It is essential for tax assessments and ensuring compliance with state laws. Filing this form accurately can prevent legal complications and penalties. It is important to note that any discrepancies or inaccuracies can lead to delays in the probate process or potential legal challenges.

Examples of using the iht205 form

The iht205 form is commonly used in various scenarios during the probate process. Here are a few examples:

- Estate Tax Calculation: Executors use the form to report the total value of the estate for tax assessment purposes.

- Asset Distribution: The form helps in determining how assets will be distributed among beneficiaries.

- Debt Settlement: It provides a clear picture of liabilities, assisting in settling debts before distributing the remaining assets.

Form Submission Methods

The iht205 form can be submitted through various methods, ensuring convenience for executors. The available submission methods include:

- Online Submission: Many jurisdictions allow for electronic filing of the iht205 form, streamlining the process.

- Mail: The form can be printed and mailed to the appropriate probate court or tax authority.

- In-Person Submission: Executors may also choose to deliver the form in person at the relevant office for immediate processing.

Required Documents

To complete the iht205 form, certain documents are typically required. These may include:

- Death Certificate: A certified copy is often needed to verify the date of death.

- Asset Documentation: Proof of ownership and valuation for all listed assets, such as property deeds and bank statements.

- Liability Records: Documentation of any debts or obligations the deceased had, including loan agreements and credit card statements.

Quick guide on how to complete iht205 return of estate information blank form to print out and fill in

Effortlessly Prepare Examples Of Completed Iht205 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly solution to traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Examples Of Completed Iht205 on any device using the airSlate SignNow Android or iOS applications and streamline any document-centered process today.

The Easiest Way to Modify and eSign Examples Of Completed Iht205 with Ease

- Locate Examples Of Completed Iht205 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Examples Of Completed Iht205 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

On any number of blank multiple choice questions, is it better to fill in each answer with the same answer (e.g., "C" over and over), or fill out each answer randomly?

Let us take the CFA L1 exam as an example:There are 240 three-choice questions (33% probability of a correct answer for each question).Assuming a passing score of 70%, we need to get at least 240 * 70% = 168 correct answers to succeed.If we pick all Cs (in the case of a 3-choice MCQ) we can expect a score of 33%*240 = 80 but we are sure to fail (assuming correct choices of As, Bs and Cs are equally distributed), while if we choose randomly, our expected score should also be 80 but our range of results will go from 0 to 240, so we should go for this option. For each chosen number of correct answers we have a binomial distribution with a mean of np = 240 * 33% = 80 and a standard deviation of [np(1-p)]^0.5 = 7.3. Therefore, the minimum threshold of 168 is about 12 σ away from the mean which means chances of succeeding by randomly picking As, Bs or Cs are infinitesimal. a) The probability of 168 correct answers in whatever order out of 240 questions is 240! * (1/168!) * [1/(240-168)!] * (33%^168) * [(1-33%)^(240-168)].We must also account for 169 correct answers, 170, 171... until 240, and sum all those amounts.b) We can also use the Excel BINOMDIST function and calculate 1 - BINOMDIST(167, 240, 1/3, TRUE) to find the cumulative probability from 168 to 240 correct answers. We find a very small figure of order E-15 (which happens to be negative, should be positive, probably Excel cannot handle such a small figure).This is the probability to succeed in passing the CFA L1 exam by randomly choosing between As, Bs or Cs.As a conclusion, we have the choice between picking all Cs (0% success rate) and picking randomly between As, Bs and Cs (infinitesimal success rate, but infinitely better than 0%).The smart choice is the second one, and the real smart choice is to study for the exam.

Create this form in 5 minutes!

How to create an eSignature for the iht205 return of estate information blank form to print out and fill in

How to create an eSignature for the Iht205 Return Of Estate Information Blank Form To Print Out And Fill In online

How to create an electronic signature for your Iht205 Return Of Estate Information Blank Form To Print Out And Fill In in Google Chrome

How to generate an eSignature for signing the Iht205 Return Of Estate Information Blank Form To Print Out And Fill In in Gmail

How to create an eSignature for the Iht205 Return Of Estate Information Blank Form To Print Out And Fill In straight from your smart phone

How to generate an eSignature for the Iht205 Return Of Estate Information Blank Form To Print Out And Fill In on iOS

How to generate an electronic signature for the Iht205 Return Of Estate Information Blank Form To Print Out And Fill In on Android devices

People also ask

-

What are some Examples Of Completed Iht205 documents?

Examples Of Completed Iht205 documents typically include completed inheritance tax forms that capture details about the deceased’s estate. These forms can be submitted to HMRC to calculate any inheritance tax due. You can find templates and samples online that demonstrate how to fill out the Iht205 correctly.

-

How can airSlate SignNow help with completing Iht205 forms?

airSlate SignNow streamlines the process of completing Iht205 forms by allowing you to easily fill out and eSign documents online. With our user-friendly interface, you can ensure that all required fields are correctly completed, reducing the risk of errors. This makes it easier to create your own Examples Of Completed Iht205 documents.

-

Is there a cost associated with using airSlate SignNow for Iht205 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage your document signing and completion process efficiently. For a detailed breakdown of our pricing, visit our pricing page and see how our services can help you with Examples Of Completed Iht205.

-

What features does airSlate SignNow offer for eSigning Iht205 documents?

airSlate SignNow provides a robust set of features for eSigning Iht205 documents, including templates, cloud storage, and mobile accessibility. Users can create, edit, and send documents for signature with just a few clicks. These features make it easier to generate Examples Of Completed Iht205 documents quickly and efficiently.

-

Can I integrate airSlate SignNow with other applications for processing Iht205 forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to manage your documents more effectively and helps in creating Examples Of Completed Iht205 forms directly from your preferred apps.

-

What benefits does airSlate SignNow provide for managing Iht205 documents?

Using airSlate SignNow for managing Iht205 documents offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By using our platform, you can ensure that your Examples Of Completed Iht205 documents are securely stored and easily accessible whenever needed.

-

Are there any templates available for Iht205 completion on airSlate SignNow?

Yes, airSlate SignNow offers templates that can be customized for completing Iht205 forms. These templates provide a structured format that ensures all necessary information is included, making it simple to generate Examples Of Completed Iht205 documents without starting from scratch.

Get more for Examples Of Completed Iht205

- Brief in support of motion for summary judgment mississippi form

- Judgment granting summary form

- Petition authority 497314557 form

- Petition joinder form

- Authority minor form

- Decree granting authority to compromise and settle claim of minor without guardianship mississippi form

- Petition for authority to compromise and settle claim of a minor without guardianship divorced parents mississippi form

- Cna authorization to release information amada senior care

Find out other Examples Of Completed Iht205

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF