Complex Will with Credit Shelter Marital Trust for Large Estates Utah Form

What is the Complex Will With Credit Shelter Marital Trust For Large Estates Utah

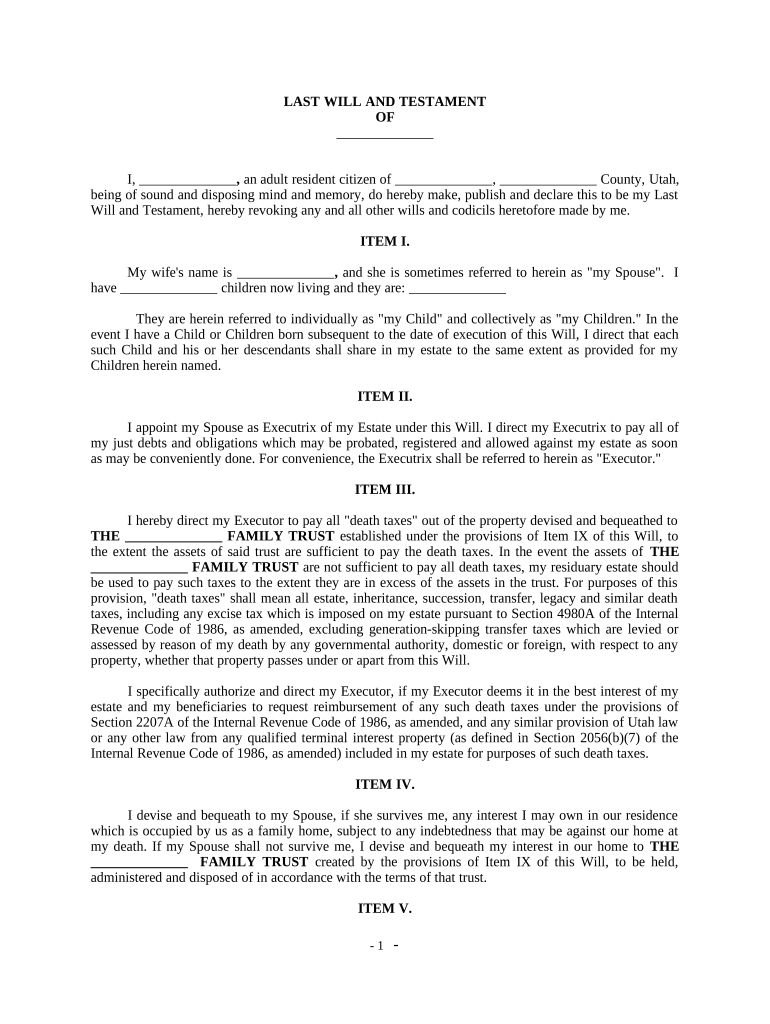

The Complex Will With Credit Shelter Marital Trust for large estates in Utah is a legal document designed to manage the distribution of a deceased person's assets while minimizing estate taxes. This type of will incorporates a marital trust and a credit shelter trust, allowing for the preservation of wealth across generations. The marital trust provides for the surviving spouse, while the credit shelter trust ensures that a portion of the estate is exempt from estate taxes, thus protecting the heirs' inheritance. This dual structure is particularly beneficial for individuals with substantial assets, as it helps maximize the estate's value for beneficiaries.

Key Elements of the Complex Will With Credit Shelter Marital Trust For Large Estates Utah

Several key elements are essential to the complex will with credit shelter marital trust. These include:

- Marital Trust: This component allows the surviving spouse to access income generated by the trust during their lifetime.

- Credit Shelter Trust: This trust holds a specific amount of the estate, which is not subject to estate taxes, thereby preserving wealth for future generations.

- Asset Allocation: Clear instructions on how assets are divided between the marital trust and the credit shelter trust are crucial for effective estate planning.

- Tax Considerations: Understanding applicable federal and state tax laws is vital to maximize benefits and minimize liabilities.

Steps to Complete the Complex Will With Credit Shelter Marital Trust For Large Estates Utah

Completing the complex will with credit shelter marital trust involves several important steps:

- Consult an Attorney: Engage with a qualified estate planning attorney familiar with Utah laws to ensure compliance and proper structuring.

- Gather Financial Information: Compile a comprehensive list of assets, liabilities, and any existing estate plans.

- Draft the Will: Work with your attorney to draft the will, ensuring all necessary components are included.

- Review and Revise: Carefully review the draft, making any necessary adjustments before finalization.

- Execute the Will: Sign the document in the presence of witnesses as required by Utah law to ensure its validity.

Legal Use of the Complex Will With Credit Shelter Marital Trust For Large Estates Utah

The legal use of the complex will with credit shelter marital trust is governed by both state and federal laws. In Utah, the will must meet specific requirements to be considered valid, including proper execution and witnessing. This type of will is particularly advantageous for those with large estates, as it allows for strategic tax planning and the efficient transfer of wealth. It is essential to ensure that the will complies with the Uniform Probate Code and any other relevant regulations to avoid potential disputes and ensure that the decedent's wishes are honored.

State-Specific Rules for the Complex Will With Credit Shelter Marital Trust For Large Estates Utah

Utah has specific rules regarding the creation and execution of wills, including those that incorporate a credit shelter marital trust. Key considerations include:

- Witness Requirements: The will must be signed by at least two witnesses who are not beneficiaries.

- Notarization: While not required, having the will notarized can add an additional layer of authenticity.

- Revocation Clauses: Clearly outline any revocation of previous wills to avoid confusion.

- Probate Process: Understanding the probate process in Utah is crucial for the timely distribution of assets.

How to Use the Complex Will With Credit Shelter Marital Trust For Large Estates Utah

Using the complex will with credit shelter marital trust effectively involves understanding its components and how they interact. The surviving spouse can benefit from the marital trust during their lifetime, receiving income and access to assets. Upon the death of the surviving spouse, the credit shelter trust becomes active, protecting the designated assets from estate taxes. It is important for individuals to regularly review and update their estate plans to reflect changes in financial status, family dynamics, or tax laws to ensure that their wishes are fulfilled and their beneficiaries are protected.

Quick guide on how to complete complex will with credit shelter marital trust for large estates utah

Handle Complex Will With Credit Shelter Marital Trust For Large Estates Utah effortlessly on any device

Digital document management has gained popularity among enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly without delays. Manage Complex Will With Credit Shelter Marital Trust For Large Estates Utah on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign Complex Will With Credit Shelter Marital Trust For Large Estates Utah with ease

- Locate Complex Will With Credit Shelter Marital Trust For Large Estates Utah and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Decide how you would like to send your form, whether by email, text (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Complex Will With Credit Shelter Marital Trust For Large Estates Utah to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Complex Will With Credit Shelter Marital Trust For Large Estates in Utah?

A Complex Will With Credit Shelter Marital Trust For Large Estates in Utah is a legal document that ensures efficient transfer of wealth while minimizing estate taxes. This trust allows for the preservation of assets for surviving spouses and can provide financial security for beneficiaries. Utilizing this strategy can be crucial for individuals with large estates.

-

How much does it cost to create a Complex Will With Credit Shelter Marital Trust For Large Estates in Utah?

The cost to create a Complex Will With Credit Shelter Marital Trust For Large Estates in Utah can vary widely based on the complexity of your estate and your attorney's fees. Typically, you can expect to pay between $1,000 to $3,000 for comprehensive legal support. Investing in this type of trust can save you signNow amounts in estate taxes down the road.

-

What are the benefits of using a Complex Will With Credit Shelter Marital Trust For Large Estates in Utah?

One of the main benefits of a Complex Will With Credit Shelter Marital Trust For Large Estates in Utah is the tax savings it provides. Additionally, it helps ensure that assets are distributed according to your wishes while providing financial security for your spouse and heirs. This trust structure can also provide protection against creditors and lawsuits.

-

Can I manage my Complex Will With Credit Shelter Marital Trust For Large Estates in Utah online?

Yes, many platforms, including airSlate SignNow, allow you to manage your Complex Will With Credit Shelter Marital Trust For Large Estates in Utah online. This includes options for document preparation, eSigning, and secure storage. The online interface makes it easy for you and your attorney to collaborate efficiently.

-

How does airSlate SignNow facilitate the signing of a Complex Will With Credit Shelter Marital Trust For Large Estates in Utah?

airSlate SignNow offers an easy-to-use platform that allows you to create and eSign your Complex Will With Credit Shelter Marital Trust For Large Estates in Utah quickly and securely. With features like document tracking and reminders, you can ensure that all parties sign at the required times without hassle. This streamlines the process, making it more convenient for everyone involved.

-

Is it necessary to hire an attorney for a Complex Will With Credit Shelter Marital Trust For Large Estates in Utah?

While it is possible to create a Complex Will With Credit Shelter Marital Trust For Large Estates in Utah without an attorney, it's highly recommended to seek legal advice. An experienced attorney can help you navigate the complexities of the laws surrounding trusts and ensure that your wishes are legally binding. This investment can ultimately save your heirs from potential legal issues in the future.

-

What should I include in my Complex Will With Credit Shelter Marital Trust For Large Estates in Utah?

When drafting a Complex Will With Credit Shelter Marital Trust For Large Estates in Utah, you should include all signNow assets, the beneficiaries of those assets, and specific instructions for distributing your estate after your passing. Additionally, consider including directives for potential future changes based on your circumstances. Consulting with an attorney will help ensure that all necessary elements are covered.

Get more for Complex Will With Credit Shelter Marital Trust For Large Estates Utah

- Sculpture vocabulary form

- Gap addendum form

- Swac football officials application form

- Personal financial statement valley national bank form

- Tractor registration victoria form

- Charitable giving request guidelines application james avery form

- Donation request form hasta la pasta

- Notice lease violation tenant form

Find out other Complex Will With Credit Shelter Marital Trust For Large Estates Utah

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document