Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Utah Form

Understanding the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Utah

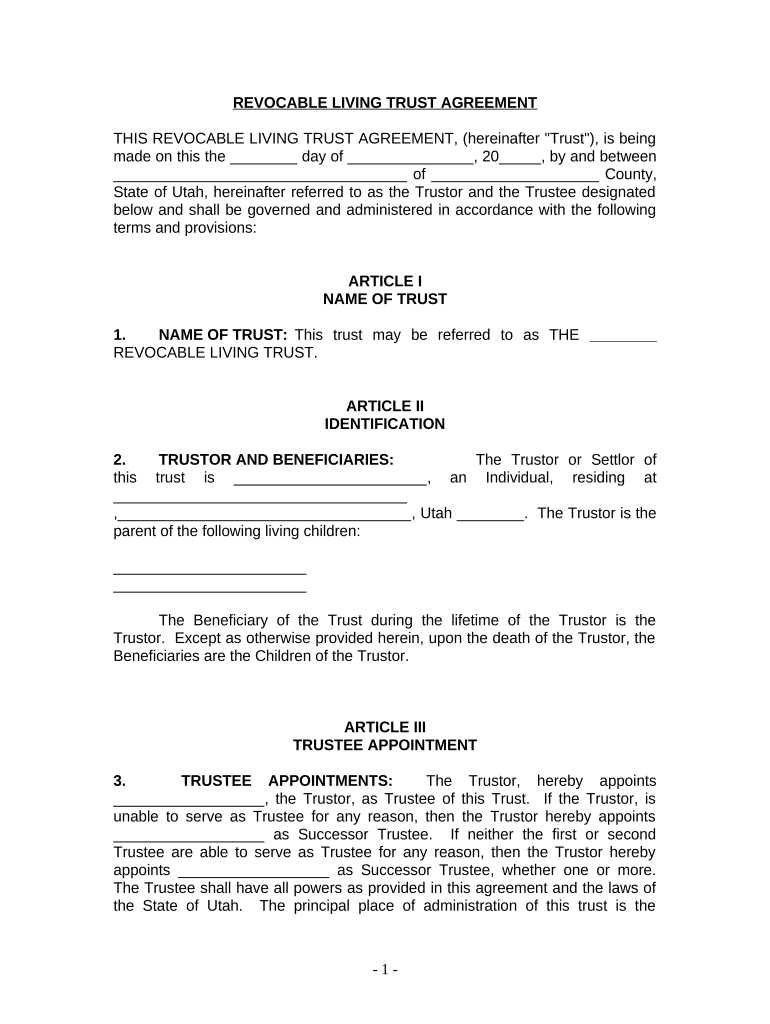

A living trust is a legal document that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. For individuals who are single, divorced, or widowed with children in Utah, a living trust can provide several benefits, including avoiding probate, maintaining privacy, and ensuring that children are taken care of according to the individual's wishes. This type of trust can be particularly important for those who want to ensure that their children receive their inheritance without unnecessary delays or complications.

Steps to Complete the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Utah

Completing a living trust involves several key steps:

- Determine your assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and personal property.

- Choose a trustee: Select a trusted individual or institution to manage the trust. This person will be responsible for carrying out your wishes.

- Draft the trust document: Create the trust document, outlining how assets will be managed during your lifetime and distributed after your death.

- Sign the document: Sign the trust in front of a notary public to ensure its legality.

- Fund the trust: Transfer ownership of your assets into the trust. This step is crucial for the trust to be effective.

Legal Use of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Utah

The legal framework for living trusts in Utah allows individuals to create these documents without the need for court involvement. This means that once the trust is established and funded, the assets held within it can be managed according to the terms set forth by the grantor. A living trust can be amended or revoked at any time during the grantor's lifetime, providing flexibility in managing one’s estate. It is essential to ensure that the trust complies with Utah state laws to be valid and enforceable.

Key Elements of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Utah

Several key elements are essential for a living trust to function effectively:

- Grantor: The individual creating the trust, who retains control over the assets.

- Trustee: The person or entity responsible for managing the trust's assets.

- Beneficiaries: The individuals or entities who will receive the assets after the grantor's death.

- Trust document: The legal document that outlines the terms of the trust, including how assets are to be managed and distributed.

State-Specific Rules for the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Utah

Utah law provides specific guidelines for creating and managing living trusts. It is important to adhere to these regulations to ensure the trust is valid. For instance, Utah requires that the trust document be signed by the grantor and notarized. Additionally, any real estate included in the trust must be retitled in the name of the trust to avoid probate. Consulting with a legal professional familiar with Utah estate planning laws can help ensure compliance and effectiveness.

How to Obtain the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Utah

Obtaining a living trust typically involves working with an estate planning attorney or using reputable online legal services. An attorney can provide personalized guidance based on individual circumstances and ensure that the trust meets all legal requirements. Alternatively, individuals may choose to use online platforms that offer templates and guidance for creating a living trust. Regardless of the method chosen, it is important to ensure that the final document is legally sound and properly executed.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children utah

Complete Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Handle Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah without hassle

- Acquire Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah and select Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just a few seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah is a legal document that helps manage and distribute your assets during your lifetime and after your death. It allows individuals in these circumstances to have more control over their estate and provides a smoother transfer of assets to their children.

-

How does a Living Trust benefit someone who is single, divorced, or a widow/widower with children?

A Living Trust provides added security and ensures that your assets are managed according to your wishes, especially for individuals who are single, divorced, or widowed with children. It can also help avoid probate, making the process easier and faster for your heirs.

-

What are the costs associated with setting up a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah?

The costs for creating a Living Trust can vary depending on complexity and any legal assistance you might need. Generally, they are more cost-effective compared to other estate planning options, especially when considering the potential savings on probate fees.

-

Can I modify my Living Trust after it has been created?

Yes, one of the advantages of a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah is that it is revocable. This means you can update or change the terms, assets, or beneficiaries whenever necessary to reflect your current wishes.

-

How does airSlate SignNow integrate with the Living Trust process?

airSlate SignNow simplifies the process of signing and managing your Living Trust documents by providing an easy-to-use platform for electronic signatures. You can efficiently send, sign, and store your documents all in one place, ensuring that everything is organized and easily accessible.

-

What documents do I need to create a Living Trust?

To create a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah, you typically need documents like a list of assets, information about your beneficiaries, and any existing estate planning documents. Consulting with a legal professional can help ensure all necessary documents are prepared.

-

Is a Living Trust necessary if I have a will?

While having a will is important, a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah offers additional benefits like avoiding probate and providing privacy. It can be a complementary tool that works alongside your will to enhance your estate planning strategy.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Utah

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free