Chattel Mortgage on Mobile Home Virginia Form

What is the Chattel Mortgage On Mobile Home Virginia

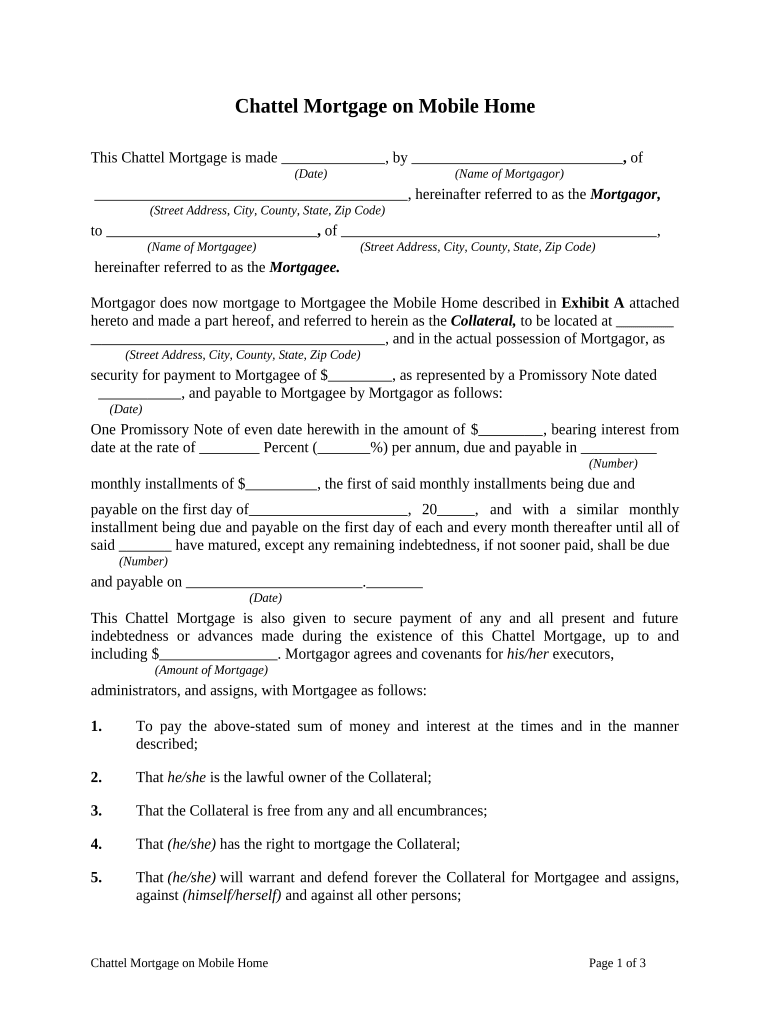

A chattel mortgage on a mobile home in Virginia is a secured loan that allows individuals to finance the purchase of a mobile home. Unlike traditional mortgages, which are tied to real property, a chattel mortgage is specifically designed for movable property. This type of financing secures the loan with the mobile home itself as collateral, meaning that if the borrower defaults, the lender can repossess the home. This arrangement often appeals to buyers who may not qualify for conventional home loans or who prefer the flexibility of mobile home ownership.

How to use the Chattel Mortgage On Mobile Home Virginia

Using a chattel mortgage on a mobile home in Virginia involves several steps. First, potential buyers should assess their financial situation to determine how much they can afford to borrow. Next, they should shop around for lenders who offer chattel mortgages, comparing interest rates and terms. Once a lender is selected, the borrower will need to complete an application, providing necessary documentation such as proof of income and credit history. After approval, the borrower can sign the chattel mortgage agreement, which will outline the repayment terms and conditions.

Steps to complete the Chattel Mortgage On Mobile Home Virginia

Completing the chattel mortgage on a mobile home in Virginia requires careful attention to detail. The following steps outline the process:

- Gather necessary documents, including identification, income verification, and credit history.

- Choose a lender and submit a mortgage application.

- Review the loan offer, including interest rates and repayment terms.

- Sign the chattel mortgage agreement, ensuring all terms are understood.

- Finalize the purchase of the mobile home and complete any required registration with local authorities.

Legal use of the Chattel Mortgage On Mobile Home Virginia

The legal use of a chattel mortgage on a mobile home in Virginia is governed by state laws that ensure the protection of both the lender and the borrower. For the mortgage to be legally binding, it must be executed properly, with all parties signing the agreement. Additionally, the lender must file a security interest in the mobile home with the appropriate state agency to establish their claim in the event of default. Compliance with these legal requirements is essential to ensure that the mortgage is enforceable in court.

Key elements of the Chattel Mortgage On Mobile Home Virginia

Several key elements define a chattel mortgage on a mobile home in Virginia. These include:

- The loan amount, which is typically based on the purchase price of the mobile home.

- The interest rate, which can vary depending on the lender and the borrower's creditworthiness.

- The repayment terms, including the duration of the loan and payment frequency.

- The collateral, which is the mobile home itself, clearly identified in the mortgage agreement.

- Any fees associated with the mortgage, such as origination fees or closing costs.

Eligibility Criteria

Eligibility for a chattel mortgage on a mobile home in Virginia often depends on several factors. Lenders typically assess the borrower's credit score, income level, and debt-to-income ratio. Additionally, the mobile home must meet specific criteria, such as being new or in good condition, and must be classified as personal property rather than real estate. Understanding these eligibility criteria can help prospective borrowers prepare for the application process.

Quick guide on how to complete chattel mortgage on mobile home virginia

Complete Chattel Mortgage On Mobile Home Virginia effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Chattel Mortgage On Mobile Home Virginia on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Chattel Mortgage On Mobile Home Virginia effortlessly

- Locate Chattel Mortgage On Mobile Home Virginia and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Chattel Mortgage On Mobile Home Virginia and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Chattel Mortgage On Mobile Home Virginia?

A Chattel Mortgage On Mobile Home Virginia is a type of loan specifically designed for purchasing mobile homes, where the home itself is the collateral rather than the land. This kind of financing is suitable for individuals who own or plan to purchase a mobile home but not the land it sits on. It allows for easier financing options compared to traditional mortgages.

-

What are the benefits of choosing a Chattel Mortgage On Mobile Home Virginia?

Choosing a Chattel Mortgage On Mobile Home Virginia offers several benefits, including lower interest rates and shorter terms than traditional mortgages. Additionally, it provides greater accessibility for those who may not qualify for a regular mortgage. This can make home ownership more achievable for a wider range of individuals.

-

How does the application process for a Chattel Mortgage On Mobile Home Virginia work?

The application process for a Chattel Mortgage On Mobile Home Virginia typically involves submitting basic personal information, proof of income, and details about the mobile home. Lenders will evaluate your creditworthiness and the value of the mobile home before making a decision. It is a straightforward process designed to get you approved quickly.

-

What are the typical interest rates associated with a Chattel Mortgage On Mobile Home Virginia?

Interest rates for a Chattel Mortgage On Mobile Home Virginia can vary based on factors like the lender and your credit score. Generally, these rates are competitive, often ranging from 5% to 10%. It's essential to shop around and compare offers to find the most favorable rates available to you.

-

Are there any fees associated with a Chattel Mortgage On Mobile Home Virginia?

Yes, there can be fees associated with obtaining a Chattel Mortgage On Mobile Home Virginia, including loan origination fees, appraisal fees, and closing costs. It's crucial to inquire about all potential fees upfront to avoid surprises later in the process. Understanding these costs will help you budget effectively.

-

Can I refinance my Chattel Mortgage On Mobile Home Virginia?

Yes, refinancing your Chattel Mortgage On Mobile Home Virginia is possible, provided you meet certain qualifications. This can be a great option if you're looking to obtain a lower interest rate or better terms on your loan. Consult with your lender to explore your refinancing options.

-

What are the key features of a Chattel Mortgage On Mobile Home Virginia?

Key features of a Chattel Mortgage On Mobile Home Virginia often include flexible repayment terms, availability for both new and used mobile homes, and less stringent credit requirements than traditional mortgages. These features make it easier for individuals to obtain financing for their mobile home needs. Additionally, many loans allow for early repayment without penalties.

Get more for Chattel Mortgage On Mobile Home Virginia

- Oral health in child care and early educationnational form

- Press pass request form digimarcon silicon valley 2020

- Housing authority rent public form

- How to file your case interdiction libguides at law library form

- Michigan state university application form

- Forms and instructions pdf

- Fillable online certificate of appropriateness project form

- Lost island of hy brasil page 1 form

Find out other Chattel Mortgage On Mobile Home Virginia

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template