Delaware Estimated Income Tax 2018-2026

What is the Delaware Estimated Income Tax

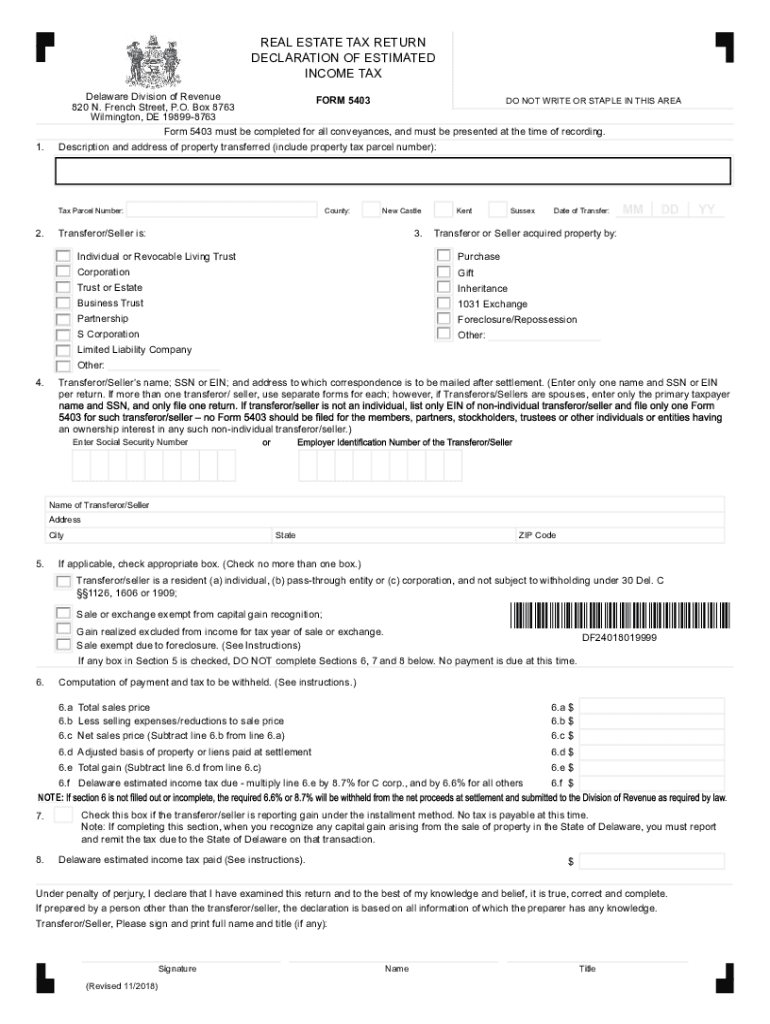

The Delaware estimated income tax is a tax that individuals and businesses in Delaware must pay on income that is not subject to withholding. This includes income from self-employment, rental properties, and investments. The estimated tax is calculated based on expected income for the year and is typically paid in four quarterly installments. Understanding this tax is essential for ensuring compliance and avoiding penalties.

How to use the Delaware Estimated Income Tax

Using the Delaware estimated income tax involves several steps. First, taxpayers need to estimate their total income for the year, including any sources not subject to withholding. Next, they must calculate the estimated tax liability based on the current tax rates. After determining the amount owed, taxpayers can submit their payments online, by mail, or in person. It's important to keep accurate records of all payments made to ensure proper credit is applied to their account.

Steps to complete the Delaware Estimated Income Tax

Completing the Delaware estimated income tax involves a systematic approach. Start by gathering all necessary financial documents, such as income statements and expense records. Then, follow these steps:

- Estimate your total income for the year.

- Calculate your expected tax liability using the current tax rates.

- Determine the amount to be paid for each quarter.

- Fill out the appropriate forms, ensuring all information is accurate.

- Submit your payment by the specified deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware estimated income tax are crucial for compliance. Payments are typically due on April 30, June 30, September 30, and January 31 of the following year. It is essential to mark these dates on your calendar to avoid late fees and penalties. Additionally, taxpayers should be aware of any changes in deadlines that may arise due to state regulations or holidays.

Legal use of the Delaware Estimated Income Tax

The legal use of the Delaware estimated income tax requires adherence to state tax laws. Taxpayers must ensure that they are accurately reporting their income and paying the correct amount of tax. Failure to comply can result in penalties, interest on unpaid taxes, and potential legal action. Using a reliable electronic signature solution can help ensure that all documents related to the estimated tax are executed properly and securely.

Key elements of the Delaware Estimated Income Tax

Key elements of the Delaware estimated income tax include understanding the tax rates, payment schedules, and the types of income that are taxable. Taxpayers should be aware of the specific forms required, such as the Delaware Estimated Tax Payment Form, and the information needed to complete these forms accurately. Additionally, knowing how to track payments and maintain records is vital for effective tax management.

Quick guide on how to complete delaware estimated income tax

Prepare Delaware Estimated Income Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documentation, as you can easily locate the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Delaware Estimated Income Tax on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Delaware Estimated Income Tax effortlessly

- Obtain Delaware Estimated Income Tax and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Delaware Estimated Income Tax and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware estimated income tax

Create this form in 5 minutes!

People also ask

-

What is the Delaware estimated income tax process?

The Delaware estimated income tax process involves calculating your expected tax liability for the year and making scheduled payments to the state. Using airSlate SignNow, you can easily sign and submit your estimated income tax forms electronically, ensuring you meet deadlines efficiently.

-

How can airSlate SignNow help with filing Delaware estimated income tax?

airSlate SignNow streamlines the process of filing Delaware estimated income tax by allowing you to eSign your tax documents quickly. This eliminates the need for printing and mailing, speeding up your filing process and helping you stay compliant with state requirements.

-

Are there any fees associated with using airSlate SignNow for Delaware estimated income tax?

While airSlate SignNow offers a competitive pricing model, specific fees for filing Delaware estimated income tax may vary. It’s important to review the subscription plans to find the best value for your business needs while effectively managing tax documentation.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as templates for various tax forms, automated reminders for deadlines, and secure storage of your Delaware estimated income tax documents. These tools help you organize and manage your tax responsibilities with ease.

-

Can I integrate airSlate SignNow with my accounting software for Delaware estimated income tax?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easier to manage your Delaware estimated income tax data. This integration ensures that your financial information is synchronized, reducing errors in tax filings.

-

What are the benefits of using airSlate SignNow for Delaware estimated income tax?

Using airSlate SignNow for Delaware estimated income tax offers several benefits, including convenience, time-saving eSigning capabilities, and secure document management. These features help simplify your tax process while ensuring compliance with Delaware tax laws.

-

Is airSlate SignNow suitable for small businesses handling Delaware estimated income tax?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses managing Delaware estimated income tax. With its features tailored for efficiency, small businesses can easily navigate their tax obligations.

Get more for Delaware Estimated Income Tax

- Rto form 27 sample filled

- Vestibular objective assessment biru vestibular objective assessment template for physiotherapists at princess alexandra form

- Chicago city sticker affidavit form

- One of these days story pdf form

- Alivuokrasopimus pohja word form

- Amart warranty form

- Accuro claim form

- Compliance form poea sample

Find out other Delaware Estimated Income Tax

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free