Virginia Dissolve Form

What is the Virginia Dissolve

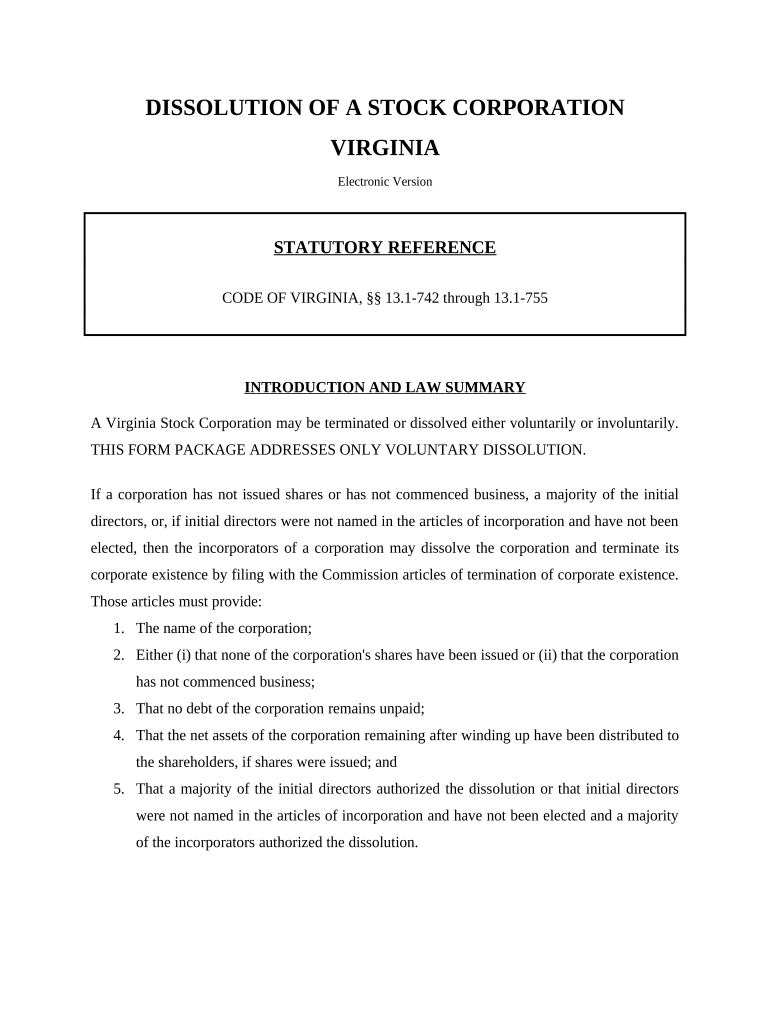

The Virginia dissolve form is a legal document used to formally dissolve a business entity in the state of Virginia. This process is essential for businesses that are ceasing operations, ensuring that all legal obligations are fulfilled and that the dissolution is recognized by the state. The form provides a clear record of the decision to dissolve the business and outlines the necessary steps for compliance with state regulations.

How to use the Virginia Dissolve

Using the Virginia dissolve form involves several key steps. First, the business owners must agree to dissolve the entity, which typically requires a vote or written consent from the members or shareholders. Once the decision is made, the appropriate form must be completed accurately. This includes providing essential details such as the business name, the date of dissolution, and any other required information. After completing the form, it should be submitted to the Virginia State Corporation Commission along with any applicable fees.

Steps to complete the Virginia Dissolve

Completing the Virginia dissolve form involves a series of straightforward steps:

- Gather necessary information about the business, including its legal name and registration details.

- Obtain consent from all members or shareholders regarding the dissolution.

- Fill out the Virginia dissolve form with accurate information.

- Review the form for completeness and correctness before submission.

- Submit the form to the appropriate state authority along with any required fees.

Legal use of the Virginia Dissolve

The legal use of the Virginia dissolve form is crucial for ensuring that the dissolution process is recognized by the state. The form must be filed in accordance with Virginia state laws to protect the interests of the business owners and any stakeholders. Proper legal use also involves settling any outstanding debts, obligations, and taxes before the business is officially dissolved, which helps prevent future liabilities.

Required Documents

To successfully complete the Virginia dissolve process, several documents may be required. These typically include:

- The completed Virginia dissolve form.

- Consent documentation from members or shareholders.

- Financial statements showing the status of the business.

- Any additional forms required by the Virginia State Corporation Commission.

Form Submission Methods

The Virginia dissolve form can be submitted through various methods, including:

- Online submission via the Virginia State Corporation Commission's website.

- Mailing the completed form to the appropriate address.

- In-person submission at designated state offices.

Who Issues the Form

The Virginia dissolve form is issued by the Virginia State Corporation Commission. This state agency is responsible for regulating business entities in Virginia and ensuring compliance with state laws. By filing the form with this agency, businesses can ensure that their dissolution is officially recognized and documented.

Quick guide on how to complete virginia dissolve

Complete Virginia Dissolve effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the proper form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Virginia Dissolve on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Virginia Dissolve effortlessly

- Obtain Virginia Dissolve and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure confidential information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Virginia Dissolve to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to 'virginia dissolve' a company?

To 'virginia dissolve' a company means to formally close a corporation or LLC in Virginia. This process involves filing the necessary paperwork with the state to ensure the business is officially dissolved and that no further obligations remain. Understanding how to 'virginia dissolve' a business is crucial for compliance and financial clarity.

-

How much does it cost to 'virginia dissolve' a business?

The fees associated with 'virginia dissolve' include a filing fee to submit the appropriate forms to the Virginia Secretary of State. Generally, it's a straightforward process, and the total cost can vary depending on the type of entity being dissolved. Always check the Virginia state website for the most current fee information when considering how to 'virginia dissolve' your business.

-

What documents are needed to 'virginia dissolve' an LLC?

To 'virginia dissolve' an LLC, you will typically need to file Articles of Cancellation with the Virginia Secretary of State. It may also be necessary to settle any outstanding debts or obligations before proceeding. Having the right documents prepared ensures a smooth and compliant 'virginia dissolve' process.

-

Can I use airSlate SignNow to manage my 'virginia dissolve' paperwork?

Yes, airSlate SignNow offers a seamless solution to manage all your 'virginia dissolve' paperwork electronically. You can easily create, send, and eSign the necessary documents from anywhere, improving your workflow and ensuring important deadlines are met. Utilizing airSlate SignNow streamlines the entire 'virginia dissolve' process.

-

What are the benefits of dissolving a business in Virginia?

Dissolving a business in Virginia, or 'virginia dissolve,' can help prevent ongoing tax obligations and potential legal issues. Properly dissolving your business ensures that you are not liable for future debts and allows you to focus on new ventures. It’s a beneficial step for business owners who have concluded their operations.

-

How long does the 'virginia dissolve' process take?

The time it takes to 'virginia dissolve' a business can vary based on the complexity of the assets and liabilities involved. Generally, once you have submitted the necessary forms, the state reviews them and processes the dissolution within a few weeks. Planning ahead ensures you complete the 'virginia dissolve' process in a timely manner.

-

Are there specific taxes involved in the 'virginia dissolve' process?

Yes, there could be potential tax implications when you 'virginia dissolve' a business, especially if the business has income, assets, or retains employees. It's important to consult with a tax professional to ensure all financial obligations are satisfied during the 'virginia dissolve' process. Being proactive about taxes can save you from complications later.

Get more for Virginia Dissolve

- Instruction methods management standards flashcards form

- This letter is to confirm our telephone conversation of form

- Biblical scholar smacks down piers morgan when asked to form

- Enclosed herewith please find a copy of an order granting our motion for leave to file a form

- Correction deed information and forms correcting a

- Abstract of judgment filing a judgment lien sacramento county form

- Enclosed herewith please find a copy of a fiat setting this matter for hearing on form

- Enclosed herewith please find the original land deed of trust which has been recorded in form

Find out other Virginia Dissolve

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template