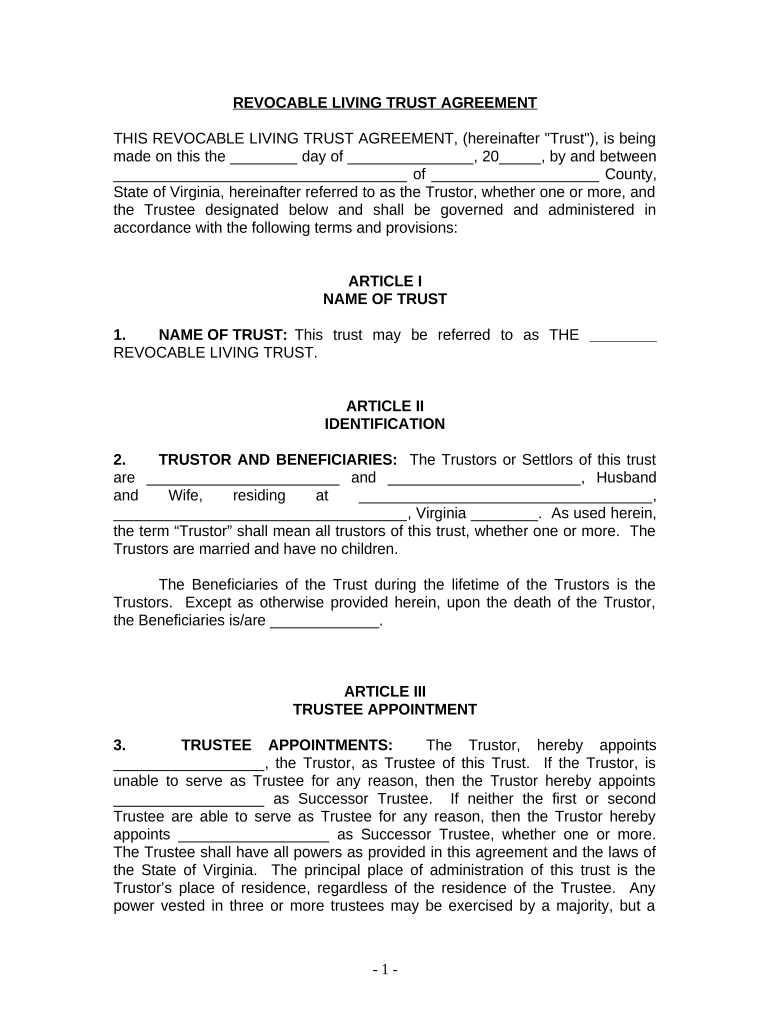

Living Trust for Husband and Wife with No Children Virginia Form

What makes the living trust for husband and wife with no children virginia form legally binding?

Because the society ditches in-office working conditions, the completion of paperwork increasingly takes place online. The living trust for husband and wife with no children virginia form isn’t an exception. Handling it utilizing digital means is different from doing this in the physical world.

An eDocument can be considered legally binding provided that specific requirements are met. They are especially vital when it comes to signatures and stipulations related to them. Entering your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it executed. You need a trustworthy solution, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your living trust for husband and wife with no children virginia form when completing it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make form execution legal and safe. In addition, it offers a lot of possibilities for smooth completion security wise. Let's quickly go through them so that you can be assured that your living trust for husband and wife with no children virginia form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: key privacy regulations in the USA and Europe.

- Two-factor authentication: adds an extra layer of security and validates other parties' identities through additional means, such as a Text message or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information safely to the servers.

Completing the living trust for husband and wife with no children virginia form with airSlate SignNow will give better confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete living trust for husband and wife with no children virginia

Complete Living Trust For Husband And Wife With No Children Virginia effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers a great eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without setbacks. Handle Living Trust For Husband And Wife With No Children Virginia on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest method to modify and eSign Living Trust For Husband And Wife With No Children Virginia without hassle

- Acquire Living Trust For Husband And Wife With No Children Virginia and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then press the Done button to store your modifications.

- Choose how you wish to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Living Trust For Husband And Wife With No Children Virginia and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in Virginia?

A Living Trust For Husband And Wife With No Children in Virginia is a legal arrangement that allows couples to manage their assets during their lifetime and specify how they should be distributed after their passing. This type of trust helps avoid probate, ensuring a smoother transition of assets.

-

How much does it cost to set up a Living Trust For Husband And Wife With No Children in Virginia?

The cost to set up a Living Trust For Husband And Wife With No Children in Virginia can vary based on the complexity of your estate and whether you choose to work with a lawyer or use an online service. Typically, the fees can range from a few hundred to over a thousand dollars, depending on your specific needs.

-

What are the benefits of creating a Living Trust For Husband And Wife With No Children in Virginia?

Creating a Living Trust For Husband And Wife With No Children in Virginia offers several benefits, including avoiding probate, maintaining privacy, and providing flexibility in managing your assets. Moreover, it ensures that your wishes are followed precisely after your death.

-

Can I change my Living Trust For Husband And Wife With No Children in Virginia after it's created?

Yes, you can modify your Living Trust For Husband And Wife With No Children in Virginia at any time as long as you are alive and mentally competent. This flexibility allows you to adapt the trust as your financial situation or family circumstances change.

-

What assets can be included in a Living Trust For Husband And Wife With No Children in Virginia?

Assets that can be included in a Living Trust For Husband And Wife With No Children in Virginia typically include real estate, bank accounts, investments, and personal property. By transferring these assets into the trust, you ensure they are managed according to your wishes.

-

Is a lawyer necessary to create a Living Trust For Husband And Wife With No Children in Virginia?

While it is not legally required to hire a lawyer to create a Living Trust For Husband And Wife With No Children in Virginia, consulting with one can be beneficial. A lawyer can provide guidance to ensure that the trust meets all legal requirements and is tailored to your specific needs.

-

How does airSlate SignNow help in managing a Living Trust For Husband And Wife With No Children in Virginia?

AirSlate SignNow empowers you to send, sign, and manage documents related to your Living Trust For Husband And Wife With No Children in Virginia efficiently and securely. Its easy-to-use platform simplifies the e-signing process and keeps your documents organized.

Get more for Living Trust For Husband And Wife With No Children Virginia

- Chancery clerkyazoo county form

- Dhmh ifb template form

- Certificate of mailingfirm united states postal service form

- How to write a professional letter of acknowledgment thoughtco form

- Corporate administrative dissolution ampamp reinstatementct corporation form

- The food recall manual american association of meat processors form

- How does return receipt electronic for usps certified mail work form

- Dear professor king please find enclosed the revised version form

Find out other Living Trust For Husband And Wife With No Children Virginia

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now