K 3e Form

What is the K 3e

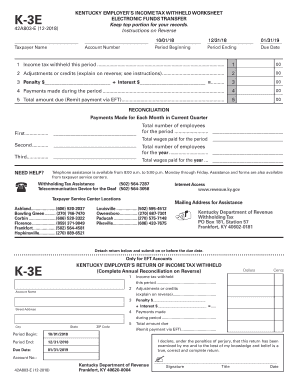

The K 3e form is a specific document utilized primarily for tax purposes in the United States. It serves as a means for reporting certain types of income and deductions to the Internal Revenue Service (IRS). Understanding the K 3e form is essential for individuals and businesses alike, as it ensures compliance with federal tax regulations. This form is particularly relevant for those who may have unique tax situations, such as self-employed individuals or businesses with specific reporting requirements.

How to use the K 3e

Utilizing the K 3e form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form carefully, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Once completed, the K 3e can be submitted electronically or via mail, depending on your preference and the requirements set by the IRS.

Steps to complete the K 3e

Completing the K 3e form requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather all relevant financial documents.

- Fill out the form with accurate income and deduction information.

- Double-check all entries for accuracy.

- Sign and date the form as required.

- Submit the form electronically through an approved platform or mail it to the designated IRS address.

Legal use of the K 3e

The legal use of the K 3e form hinges on its compliance with IRS regulations. To be considered valid, the form must be filled out completely and accurately. Additionally, it must be submitted by the appropriate deadlines to avoid penalties. Utilizing a reliable eSignature tool can enhance the legal standing of the form, ensuring that it meets all necessary requirements for electronic submission.

Key elements of the K 3e

Several key elements are essential for the K 3e form to be effective and compliant. These include:

- Accurate identification of the taxpayer.

- Complete reporting of income sources.

- Detailed documentation of deductions claimed.

- Signature and date to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the K 3e form are crucial for compliance. Typically, the form must be submitted by the tax return deadline, which is usually April 15 for most taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines or requirements each tax year to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The K 3e form can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via an e-filing platform, which is often the fastest method.

- Mailing a physical copy of the form to the IRS, ensuring it is postmarked by the deadline.

- In-person submission at designated IRS offices, though this may require an appointment.

Quick guide on how to complete k 3e

Effortlessly prepare K 3e on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle K 3e on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign K 3e with ease

- Locate K 3e and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically available for that purpose from airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing additional document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign K 3e while ensuring effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 3e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is k 3e and how does it relate to airSlate SignNow?

k 3e is a key feature of airSlate SignNow that allows businesses to streamline their document signing process. With k 3e, users can easily send and eSign documents virtually, ensuring efficiency and security in their transactions.

-

How does airSlate SignNow pricing work for k 3e users?

The pricing for k 3e on airSlate SignNow is designed to be budget-friendly for businesses of all sizes. Users can choose from various plans based on their needs, ensuring they only pay for the features they require to enhance their eSigning experience.

-

What features are included with the k 3e functionality?

The k 3e functionality in airSlate SignNow includes features like customizable templates, real-time status tracking, and integration with popular applications. These tools help users optimize their workflow and improve overall document management.

-

What are the benefits of using airSlate SignNow with k 3e?

Using airSlate SignNow with k 3e allows businesses to save time and reduce errors in their document workflows. The solution's user-friendly interface and robust features simplify the signing process, leading to increased productivity and quicker turnaround times.

-

Can k 3e be integrated with other software applications?

Yes, k 3e can seamlessly integrate with various software applications to enhance functionality. This integration facilitates smoother workflow processes, allowing users to manage documents from different platforms without hassle.

-

Is airSlate SignNow secure for using the k 3e feature?

Absolutely! airSlate SignNow prioritizes security for k 3e users by employing advanced encryption and compliance with industry standards. This ensures that all documents are protected during transmission and storage, providing peace of mind to users.

-

Who can benefit from using airSlate SignNow's k 3e solution?

Businesses of all sizes, from startups to enterprises, can benefit from airSlate SignNow's k 3e solution. It is particularly useful for teams that need to manage a high volume of documents and require a reliable eSigning platform.

Get more for K 3e

- Maryland birth certificate sample form

- Limited license renewal form dhmh dhmh maryland

- Proflicm maryland department of health marylandgov form

- To the person filing the complaint form

- Maine living will form formstopcom

- 2565 facility admission notice form

- Dhs 1925 request by adult adoptee for identifying information permits michigan

- General instructionsdistribution michigan form

Find out other K 3e

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online