Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Virginia Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia

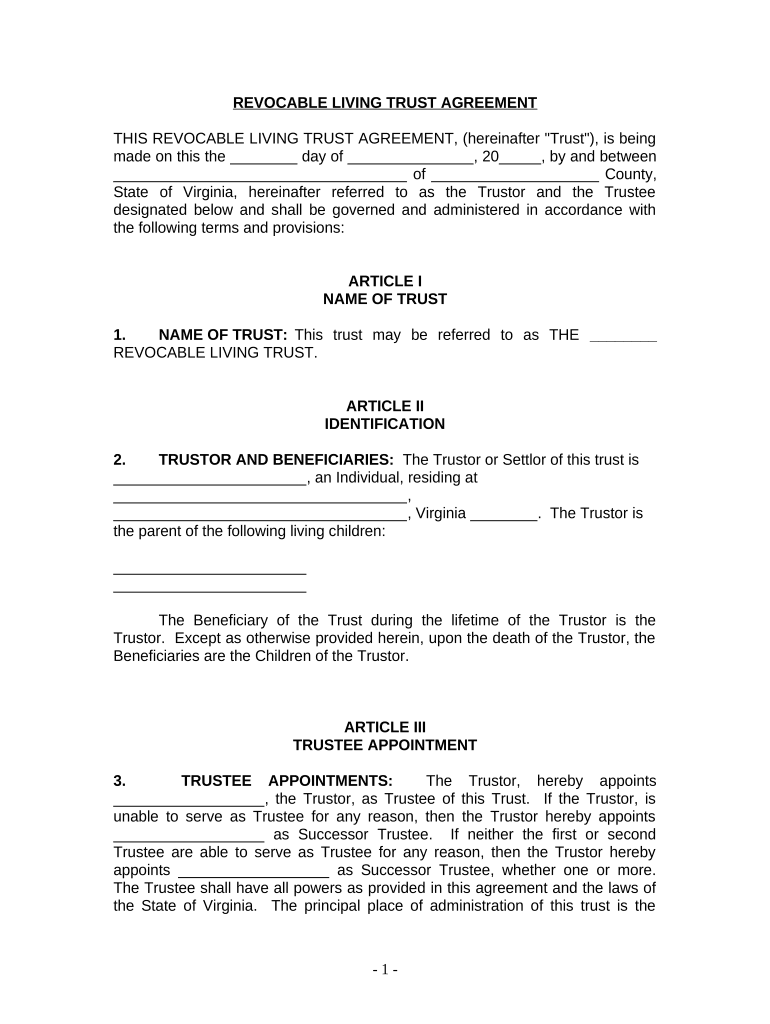

A living trust for individuals who are single, divorced, or widowed with children in Virginia is a legal document that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust is particularly beneficial for individuals in these circumstances as it can help avoid probate, provide for minor children, and ensure that assets are managed according to the individual's wishes. A living trust can be revocable, allowing the creator to make changes or dissolve it at any time, or irrevocable, meaning it cannot be altered once established.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia

Completing a living trust involves several key steps:

- Determine your assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and investments.

- Select a trustee: Choose a trustworthy individual or institution to manage the trust. This can be yourself or someone else.

- Draft the trust document: Create the trust document, outlining how assets will be managed and distributed. This can be done with legal assistance or through online templates.

- Fund the trust: Transfer ownership of the selected assets into the trust. This may involve changing titles or account ownership.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia

The legal use of a living trust in Virginia involves adhering to state laws regarding trusts and estate planning. A properly established living trust can help manage and protect assets, provide for children, and facilitate a smoother transition of assets upon death. It is essential to ensure that the trust is executed in compliance with Virginia law, including having the necessary signatures and notarization. Additionally, the trust should be funded correctly to be effective.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia

Virginia has specific rules governing living trusts that individuals must follow. These include:

- Trust creation: A living trust must be created in writing and signed by the grantor.

- Funding the trust: Assets must be transferred into the trust to be effectively managed under its terms.

- Revocation rights: In Virginia, a revocable living trust can be amended or revoked at any time by the grantor.

- Trustee duties: Trustees have a fiduciary duty to manage the trust assets in the best interest of the beneficiaries.

How to Obtain the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia

Obtaining a living trust in Virginia can be done through various methods:

- Legal assistance: Consult with an estate planning attorney who specializes in trusts to ensure compliance with state laws.

- Online resources: Use reputable online services that provide templates and guidance for creating a living trust.

- Do-it-yourself options: For those comfortable with legal documents, there are books and resources available that outline how to create a living trust.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia

Key elements of a living trust include:

- Grantor: The individual creating the trust.

- Trustee: The person or institution responsible for managing the trust.

- Beneficiaries: Individuals or entities that will receive assets from the trust.

- Trust terms: Specific instructions on how assets should be managed and distributed.

- Revocation clause: A provision allowing the grantor to amend or revoke the trust.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children virginia

Effortlessly Prepare Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the desired form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Simplest Way to Alter and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia Effortlessly

- Find Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for individuals who are single, divorced, or widowed with children in Virginia?

A Living Trust for individuals who are single, divorced, or widowed with children in Virginia is a legal arrangement that allows individuals to manage their assets while they are alive and specify how they should be distributed after their death. This type of trust can help avoid probate, making the transfer of assets smoother and quicker for your beneficiaries.

-

How can a Living Trust benefit a single parent in Virginia?

For single parents in Virginia, a Living Trust can offer signNow peace of mind by ensuring that your children are provided for according to your wishes. It allows you to appoint a guardian for your children and specify how their inheritance should be managed until they signNow adulthood.

-

What are the costs associated with setting up a Living Trust in Virginia?

The costs for setting up a Living Trust for individuals who are single, divorced, or widowed with children in Virginia can vary widely based on factors like the complexity of the trust and attorney fees. Typically, fees may range from a few hundred to several thousand dollars, but using airSlate SignNow can streamline the process, potentially reducing costs.

-

Are there any tax implications for establishing a Living Trust in Virginia?

Establishing a Living Trust for individuals who are single, divorced, or widowed with children in Virginia does not inherently change your tax status. Assets in the trust are typically still considered part of your estate and can be subject to estate taxes, but it can help in managing tax implications for your beneficiaries.

-

Can I modify my Living Trust after it's created in Virginia?

Yes, you can modify or revoke your Living Trust for individuals who are single, divorced, or widowed with children in Virginia at any time, as long as you are mentally competent. This flexibility allows you to make changes in response to life events such as marriage, divorce, or the birth of additional children.

-

What features should I look for in a Living Trust service in Virginia?

When choosing a service for a Living Trust for individuals who are single, divorced, or widowed with children in Virginia, look for features such as user-friendly document creation, eSignature capabilities, and reliable customer support. airSlate SignNow offers an easy-to-use platform that accommodates these needs effectively.

-

How does a Living Trust ensure my children's future in Virginia?

A Living Trust for individuals who are single, divorced, or widowed with children in Virginia allows you to dictate asset distribution directly to your children. This control ensures that your assets are managed or used for their benefit until they are mature enough to handle the inheritance themselves.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia

- Please find your copy of the courts order denying motion form

- Please be advised that the trial on the above referenced traffic ticket has been set for form

- I apologize for the delay in responding to your letter of form

- Please find enclosed herewith two ucc 1s which were recorded with the chancery clerk form

- Solved please type a breif statement for each line descrichegg form

- Enclosed herewith please find a copy of the lawsuit that was filed against form

- Enclosed herewith please find the judgment confirming tax title with regard to the above form

- Enclosed herewith please find notice of order of conversion in the above referenced form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Virginia

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple