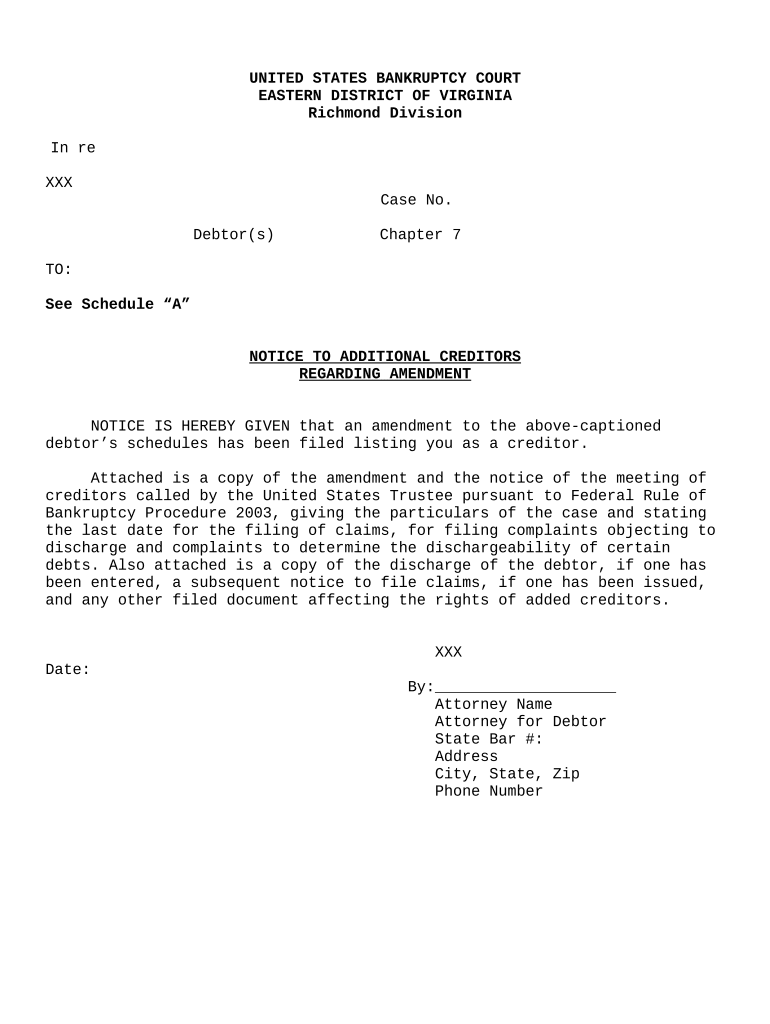

Va Creditors Form

What is the VA Creditors

The VA creditors form is a document that facilitates communication between the Department of Veterans Affairs (VA) and creditors regarding the financial responsibilities of veterans. This form is essential for veterans seeking assistance with their debts, ensuring that creditors are informed about the veteran's status and any applicable benefits. Understanding this form's purpose helps veterans manage their financial obligations effectively while taking advantage of available resources.

How to Use the VA Creditors

Using the VA creditors form involves several straightforward steps. First, gather all necessary information, including personal identification details and specifics about the debts owed. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. Once the form is filled out, submit it to the appropriate creditors or the VA, depending on the requirements. This process helps streamline communication and ensures that creditors are aware of the veteran's situation.

Steps to Complete the VA Creditors

Completing the VA creditors form requires careful attention to detail. Begin by downloading the form from the official VA website or obtaining a physical copy. Follow these steps:

- Read the instructions thoroughly to understand what information is needed.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details about your debts, including creditor names and amounts owed.

- Include any relevant documentation that supports your claims, such as benefit letters.

- Review the form for accuracy before submitting it.

Legal Use of the VA Creditors

The legal use of the VA creditors form is governed by federal regulations that protect veterans' rights. When completed correctly, this form can serve as a legal document that informs creditors of a veteran's status and any applicable protections under the law. It is crucial to ensure compliance with these regulations to avoid potential legal issues and to ensure that veterans receive the benefits they are entitled to.

Required Documents

When filling out the VA creditors form, certain documents may be required to support your application. These documents typically include:

- Proof of identity, such as a driver's license or military ID.

- Financial statements that detail your income and expenses.

- Documentation of debts, including bills or statements from creditors.

- Any correspondence from the VA regarding benefits or assistance.

Form Submission Methods

The VA creditors form can be submitted through various methods, depending on the preferences of the veteran and the requirements of the creditors. Common submission methods include:

- Online submission through the VA's official portal.

- Mailing the completed form to the designated creditor or VA office.

- In-person delivery at local VA offices or creditor locations.

Eligibility Criteria

Eligibility to use the VA creditors form typically includes being a veteran or a dependent of a veteran who has incurred debts. It is essential to verify your eligibility before completing the form to ensure that you can receive the necessary assistance. Additionally, certain financial thresholds may apply, making it important to review the criteria set by the VA and creditors.

Quick guide on how to complete va creditors 497428328

Easily set up Va Creditors on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Manage Va Creditors on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Va Creditors effortlessly

- Locate Va Creditors and then click Get Form to begin.

- Utilize the resources we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your amendments.

- Select how you wish to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Va Creditors and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are VA creditors and how do they relate to airSlate SignNow?

VA creditors are organizations that lend money or extend credit to veterans and servicemembers. airSlate SignNow facilitates the documentation process for VA creditors by allowing them to easily send and eSign necessary contracts and agreements, ensuring a smooth transaction.

-

How can airSlate SignNow benefit VA creditors?

With airSlate SignNow, VA creditors can streamline their document management process, which enhances efficiency and reduces the risk of errors. This platform allows for quick e-signatures and easy tracking of document statuses, helping VA creditors serve their clients better.

-

What is the pricing structure for airSlate SignNow for VA creditors?

airSlate SignNow offers several pricing plans to cater to different needs, including options ideal for VA creditors. The pricing is competitive and provides access to essential features while ensuring that VA creditors can manage their budgets effectively.

-

Does airSlate SignNow integrate with other tools used by VA creditors?

Yes, airSlate SignNow integrates seamlessly with various CRM and document management systems commonly used by VA creditors. This ensures that the transition to e-signatures is smooth and that all operations remain cohesive.

-

What features make airSlate SignNow suitable for VA creditors?

airSlate SignNow offers features like customizable templates, automated workflows, and real-time tracking, making it particularly suitable for VA creditors. These tools enable VA creditors to quickly prepare, send, and manage important documents efficiently.

-

How secure is the airSlate SignNow platform for VA creditors?

Security is a top priority for airSlate SignNow, especially for VA creditors who handle sensitive personal information. The platform employs advanced encryption techniques and complies with industry standards, ensuring that all document transactions are secure.

-

Can VA creditors customize their documents with airSlate SignNow?

Absolutely! VA creditors can easily customize documents using airSlate SignNow's user-friendly interface. This flexibility allows VA creditors to tailor agreements to meet the specific needs of their clients while maintaining professionalism.

Get more for Va Creditors

- Incorporate your business form

- Programs and services maryland department of aging marylandgov form

- Assignment of exploration agreement sec report form

- Las solicitudes se tienen en cuenta independientemente de la raza el color la religin el sexo la form

- Multistate construction loan agreement form 3735 fannie mae

- Person who helps with a crash informally crossword clue

- Retained employees agreement form

- Sample nsp residential lease with option to purchase annotated form

Find out other Va Creditors

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free