Deed Gift Trust Form

What is the Deed Gift Trust

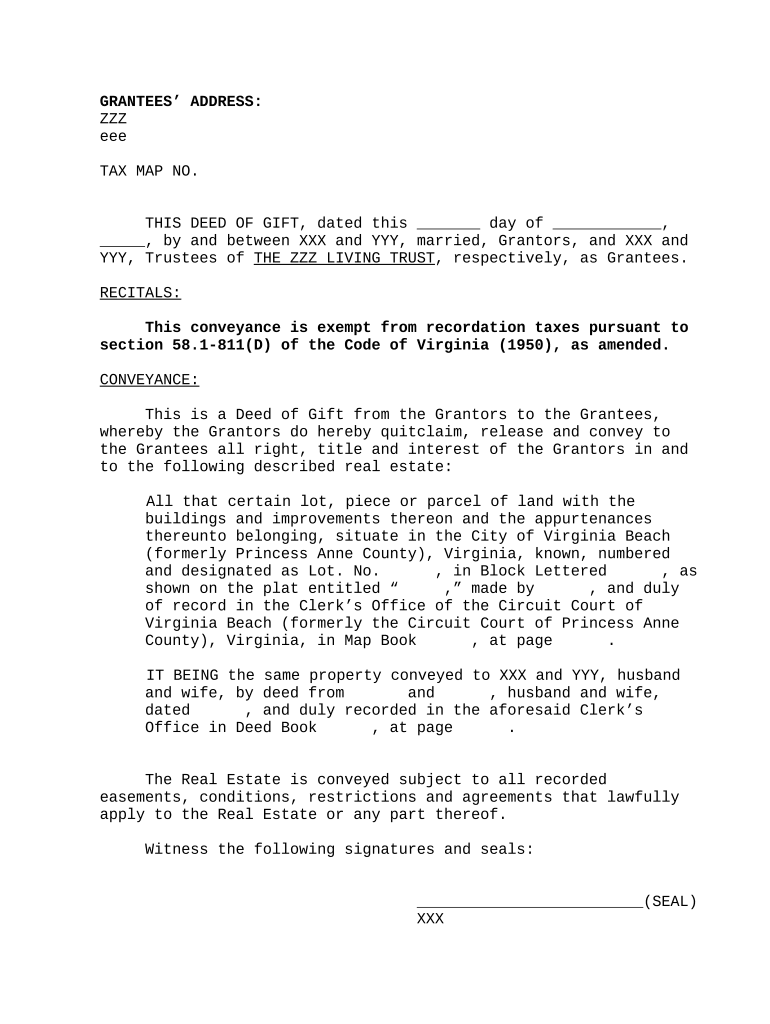

A deed gift trust is a legal arrangement that allows an individual to transfer assets to beneficiaries while retaining certain rights over those assets. This type of trust can be particularly useful for estate planning, as it enables the grantor to manage how and when the beneficiaries receive the assets. The deed gift trust is often structured to minimize tax implications and provide a clear framework for asset distribution.

How to use the Deed Gift Trust

Using a deed gift trust involves several key steps. First, the grantor must decide which assets to transfer into the trust. This can include real estate, investments, or cash. Next, the grantor should draft the trust document, outlining the terms and conditions of the trust, including the rights of the beneficiaries and any stipulations regarding asset management. Finally, the grantor must execute the deed gift trust by signing the document and transferring the assets into the trust. It is advisable to consult with a legal professional during this process to ensure compliance with state laws.

Steps to complete the Deed Gift Trust

Completing a deed gift trust involves a systematic approach:

- Identify the assets to be placed in the trust.

- Draft the trust document, specifying the terms and conditions.

- Sign the document in the presence of a notary public to ensure legal validity.

- Transfer ownership of the assets to the trust, which may require additional paperwork, such as changing titles for real estate.

- Inform the beneficiaries about the trust and its terms.

Legal use of the Deed Gift Trust

The legal use of a deed gift trust is governed by state laws, which can vary significantly. It is essential to ensure that the trust complies with relevant legal requirements, including proper documentation and execution. Additionally, the trust must adhere to tax regulations to avoid penalties. Consulting with an attorney who specializes in estate planning can provide clarity on the legal implications and ensure that the trust is established correctly.

Key elements of the Deed Gift Trust

Several key elements define a deed gift trust:

- Grantor: The individual who creates the trust and transfers assets into it.

- Beneficiaries: The individuals or entities designated to receive the assets held in the trust.

- Trust Document: The legal document that outlines the terms and conditions of the trust.

- Asset Transfer: The process of moving ownership of assets from the grantor to the trust.

- Tax Implications: Considerations regarding how the trust affects the grantor's tax situation and the beneficiaries' tax responsibilities.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the taxation of gifts and trusts. When assets are transferred into a deed gift trust, the grantor may be subject to gift tax regulations. It is important to understand the annual exclusion limits and the lifetime gift tax exemption. Additionally, the IRS requires that the trust be properly documented to ensure compliance with tax laws. Keeping accurate records and consulting with a tax professional can help navigate these regulations effectively.

Quick guide on how to complete deed gift trust 497428353

Effortlessly Create Deed Gift Trust on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Deed Gift Trust on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Deed Gift Trust with ease

- Obtain Deed Gift Trust and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious document searching, or mistakes that necessitate the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Deed Gift Trust to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed gift trust?

A deed gift trust is a legal arrangement where a grantor transfers assets into a trust for the benefit of specific beneficiaries. This type of trust can help minimize tax implications while ensuring that assets are managed according to the grantor's wishes. Understanding how a deed gift trust works is essential for effective estate planning.

-

How does airSlate SignNow facilitate the creation of a deed gift trust?

airSlate SignNow simplifies the document management process for creating a deed gift trust. Our platform allows you to easily draft, edit, and eSign trust documents, ensuring that all necessary legal requirements are met. With our user-friendly interface, you can streamline the creation of your trust documents online.

-

Are there any costs associated with using airSlate SignNow for a deed gift trust?

Yes, there are pricing options available for using airSlate SignNow to manage your deed gift trust documents. We offer competitive rates based on the features you need, including unlimited eSigning and document templates specifically for trusts. Check our pricing page for more details on the plans that fit your budget.

-

What features does airSlate SignNow offer for managing a deed gift trust?

airSlate SignNow offers numerous features for managing a deed gift trust, including secure eSigning, document storage, and customizable templates. You can also collaborate with other parties involved in the trust, providing a seamless experience. These tools help ensure that the trust is managed effectively and in compliance with legal standards.

-

Can airSlate SignNow integrate with other tools for managing a deed gift trust?

Yes, airSlate SignNow can integrate with various productivity tools to enhance the management of your deed gift trust. This includes CRM systems, cloud storage solutions, and accounting software, allowing for a more efficient workflow. Integrating with these tools can help you keep track of all trust activities and documents in one place.

-

What benefits can I expect from using airSlate SignNow for my deed gift trust?

Using airSlate SignNow for your deed gift trust offers several benefits, including cost savings, convenience, and improved document security. With our platform, you can execute trust documents anytime, anywhere, while ensuring compliance and reducing the likelihood of errors. This streamlines the trust management process, making it easier for both grantors and beneficiaries.

-

Is airSlate SignNow secure for handling sensitive deed gift trust documents?

Absolutely! airSlate SignNow prioritizes the security of your sensitive deed gift trust documents. We use advanced encryption methods and comply with industry standards to ensure that your information is protected. You can trust us to handle your documents securely while you focus on managing your trust.

Get more for Deed Gift Trust

- Psira registration form

- Business permit mandaluyong form

- Labour registration form

- Apprenticeship form for tailoring in nigeria

- Tax preparation checklist 2021 pdf form

- Labcorp test menu form

- 24 ice rental agreement form

- Media feat1 wagov development digital wa gov aundis worker screening check application guide form

Find out other Deed Gift Trust

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure