Revocable Living Trust Form

What is the Revocable Living Trust

A revocable living trust is a legal entity created to hold and manage an individual's assets during their lifetime and distribute them after death. This type of trust allows the creator, often referred to as the grantor, to retain control over the assets and make changes as needed. It can be revoked or amended at any time, providing flexibility in estate planning. Unlike a will, which only takes effect after death, a revocable living trust is effective immediately upon its creation.

How to use the Revocable Living Trust

Using a revocable living trust involves several key steps. First, the grantor must identify the assets they wish to place into the trust, which can include real estate, bank accounts, and investments. Next, the grantor executes the trust document, which outlines the terms of the trust, including how assets will be managed and distributed. The grantor then transfers ownership of the identified assets into the trust. This process ensures that the assets are managed according to the grantor's wishes and can help avoid probate upon death.

Steps to complete the Revocable Living Trust

Completing a revocable living trust involves a systematic approach:

- Determine your goals: Consider what you want to achieve with the trust.

- Select a trustee: Choose an individual or institution to manage the trust.

- Draft the trust document: Create a legal document that outlines the terms and conditions of the trust.

- Fund the trust: Transfer assets into the trust to ensure they are covered under its terms.

- Review and update: Regularly review the trust to ensure it meets your current needs and make adjustments as necessary.

Legal use of the Revocable Living Trust

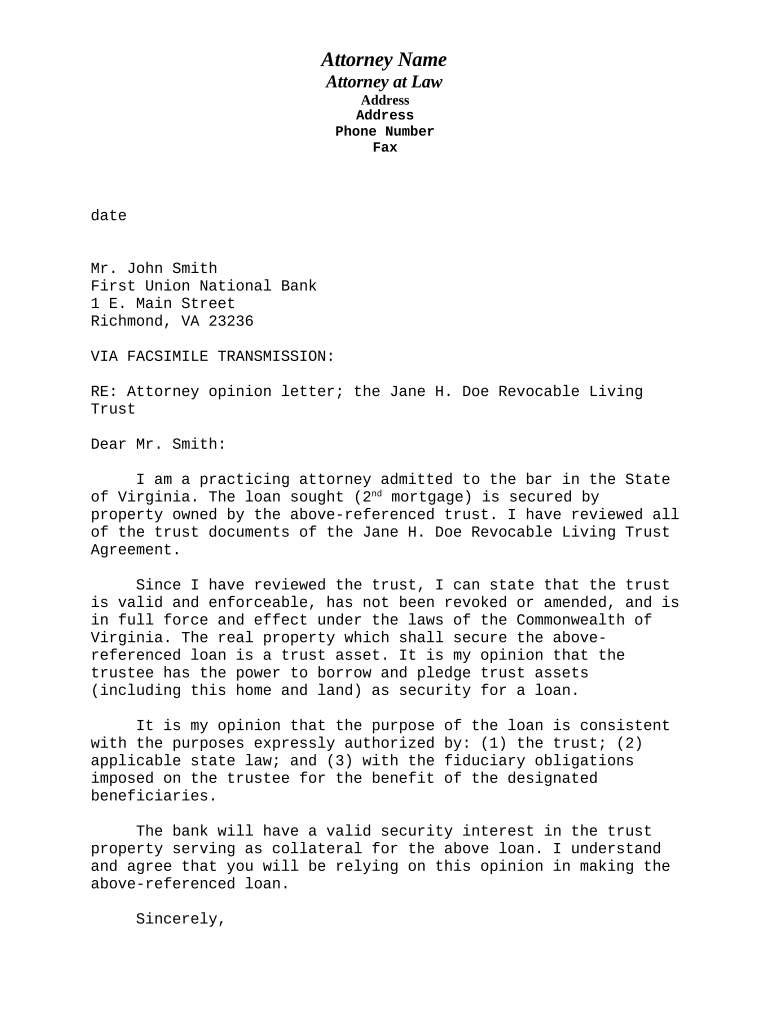

The legal use of a revocable living trust is governed by state laws, which can vary significantly. In Virginia, for instance, the trust must be properly executed to be legally binding. This includes having the document signed by the grantor and, in some cases, witnessed or notarized. Additionally, the trust should comply with the requirements set forth in the Virginia Uniform Trust Code to ensure its validity and enforceability.

Key elements of the Revocable Living Trust

Key elements of a revocable living trust include:

- Grantor: The person who creates the trust.

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiaries: Those who will receive the assets from the trust upon the grantor's death.

- Trust document: The legal document outlining the terms of the trust.

- Funding: The process of transferring assets into the trust.

State-specific rules for the Revocable Living Trust

State-specific rules for revocable living trusts can affect their creation and management. In Virginia, trusts must adhere to the Virginia Uniform Trust Code, which outlines the rights and responsibilities of trustees and beneficiaries. Additionally, Virginia law requires that certain formalities, such as witnessing and notarization, be observed for the trust to be valid. Understanding these regulations is crucial for ensuring that the trust operates as intended.

Quick guide on how to complete revocable living trust

Complete Revocable Living Trust effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Revocable Living Trust on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign Revocable Living Trust without hassle

- Locate Revocable Living Trust and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Revocable Living Trust and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can a Virginia attorney benefit from using airSlate SignNow?

A Virginia attorney can streamline their document management process by using airSlate SignNow. Our platform allows for secure electronic signatures, reducing the turnaround time for contracts and legal documents signNowly. Additionally, it ensures compliance with Virginia state laws regarding electronic signatures, helping attorneys serve their clients more efficiently.

-

What features does airSlate SignNow offer specifically for Virginia attorneys?

AirSlate SignNow includes features tailored for Virginia attorneys, such as customizable document templates and automated workflows. These features enable attorneys to create, send, and track documents effortlessly, ensuring that all signatures are obtained and recorded correctly. This not only saves time but also enhances organizational efficiency.

-

Is airSlate SignNow affordable for Virginia attorneys?

Yes, airSlate SignNow is a cost-effective solution for Virginia attorneys, offering tiered pricing plans to fit various budgets. With transparent pricing, attorneys can choose a plan that suits their practice needs without unexpected costs. This affordability allows Virginia attorneys to invest more in their practice while saving on document management.

-

Can airSlate SignNow integrate with other tools used by Virginia attorneys?

Absolutely! AirSlate SignNow can integrate seamlessly with popular legal management software and productivity tools commonly used by Virginia attorneys. This includes integration with platforms like Google Drive, Dropbox, and CRM systems, allowing for a smooth flow of information and enhanced productivity in legal practices.

-

How does airSlate SignNow ensure the security of documents for Virginia attorneys?

AirSlate SignNow prioritizes security by using advanced encryption technologies to protect documents and data. For Virginia attorneys, this means that sensitive client information is safeguarded, ensuring compliance with confidentiality requirements. Our secure platform gives attorneys peace of mind when managing legal documents.

-

What types of documents can Virginia attorneys send for eSigning using airSlate SignNow?

Virginia attorneys can send a wide variety of documents for eSigning through airSlate SignNow, including contracts, agreements, retainer letters, and legal notices. The platform is versatile, accommodating any document type that requires a signature, making it an essential tool for every attorney's practices in Virginia.

-

How can airSlate SignNow help Virginia attorneys improve client relationships?

Using airSlate SignNow helps Virginia attorneys enhance client relationships by providing a user-friendly eSigning experience. Quick and easy document management fosters better communication and turnaround times. Clients appreciate swift access and processing of their legal documents, leading to higher satisfaction and loyalty.

Get more for Revocable Living Trust

- Acknowledgement sale on consignment form

- Agreement general form

- Speaking engagement form

- Agreement letter of understanding regarding terms of proposed contract form

- New pricing policy form

- I recently purchased fifty widgets from your company and upon receiving my shipment i form

- Apology to customer for accounting error form

- Apology for misconduct employee to boss form

Find out other Revocable Living Trust

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement