Virginia Revocable Trust Form

What is the Virginia Revocable Trust

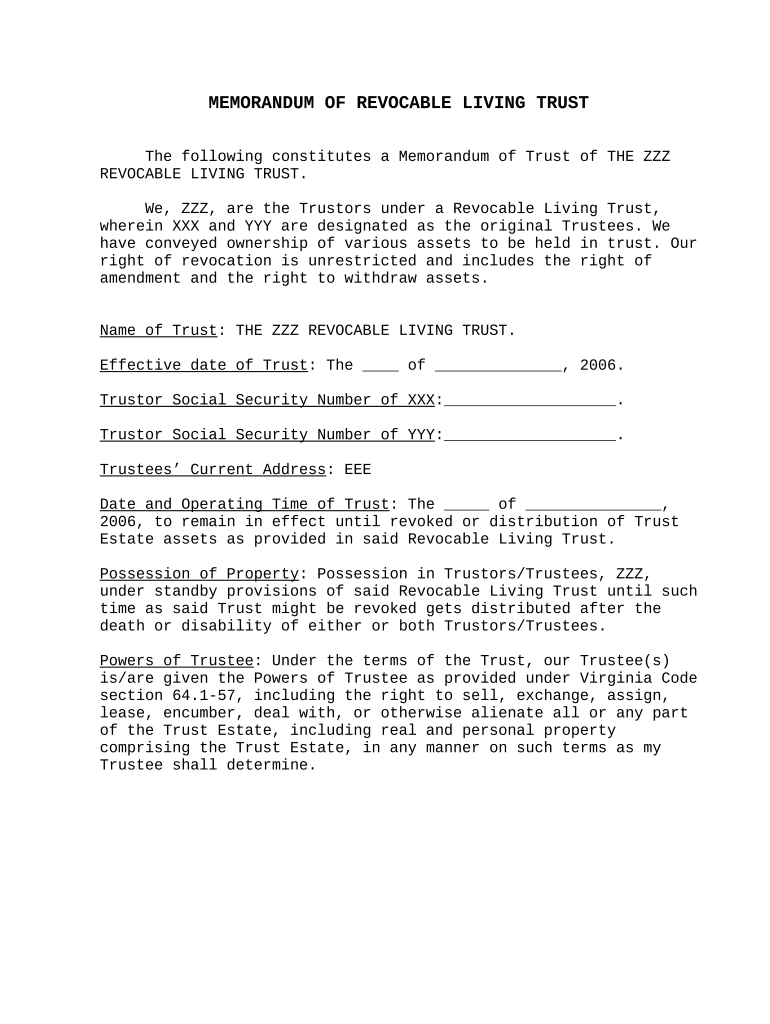

A Virginia revocable trust, often referred to as a revocable living trust, is a legal entity that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can be altered or revoked by the grantor at any time, providing flexibility in estate planning. The primary purpose of a revocable trust is to avoid probate, which can be a lengthy and costly process. By placing assets in a trust, they can be transferred directly to beneficiaries upon the grantor's passing, simplifying the distribution process.

How to use the Virginia Revocable Trust

Using a Virginia revocable trust involves several steps. Initially, the grantor must create the trust document, which outlines the terms of the trust, including the management of assets and the distribution plan. Once established, the grantor should transfer ownership of assets into the trust, which may include real estate, bank accounts, and investments. It is essential to designate a trustee, who will manage the trust according to the grantor's wishes. The grantor can also serve as the trustee during their lifetime, maintaining control over the assets while benefiting from the trust's advantages.

Steps to complete the Virginia Revocable Trust

Completing a Virginia revocable trust involves several key steps:

- Draft the trust document: This legal document should include the grantor's name, the trustee's name, and specific instructions regarding asset management and distribution.

- Transfer assets: The grantor must retitle assets in the name of the trust to ensure they are included in the trust's management.

- Sign the document: The trust document must be signed by the grantor, and it may need to be notarized to ensure its legality.

- Review periodically: The grantor should review the trust regularly to make any necessary adjustments as circumstances change.

Legal use of the Virginia Revocable Trust

The legal use of a Virginia revocable trust is governed by state law, which allows the grantor to maintain control over the trust assets while providing a clear plan for asset distribution. This trust can be beneficial in avoiding probate, protecting privacy, and potentially reducing estate taxes. It is important for the trust to comply with Virginia's legal requirements, including proper documentation and asset transfer procedures, to ensure its validity and enforceability.

Key elements of the Virginia Revocable Trust

Key elements of a Virginia revocable trust include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets according to the grantor's instructions.

- Beneficiaries: The individuals or entities designated to receive the trust assets upon the grantor's death.

- Trust terms: Specific instructions regarding the management and distribution of assets, which can be modified by the grantor at any time.

State-specific rules for the Virginia Revocable Trust

Virginia has specific rules governing revocable trusts, including requirements for the creation and management of the trust. The trust document must clearly outline the grantor's intentions and comply with state laws to be recognized as valid. Additionally, Virginia law allows for the seamless transfer of assets into the trust, provided that proper procedures are followed. Understanding these state-specific regulations is crucial for ensuring that the trust operates effectively and meets the grantor's objectives.

Quick guide on how to complete virginia revocable trust

Complete Virginia Revocable Trust effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly and without delays. Manage Virginia Revocable Trust on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Virginia Revocable Trust seamlessly

- Find Virginia Revocable Trust and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign Virginia Revocable Trust and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Virginia revocable trust?

A Virginia revocable trust is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust can be altered or revoked at any time, providing you with flexibility in your estate planning. It is an effective tool for avoiding probate and ensuring privacy regarding your estate.

-

How does a Virginia revocable trust differ from a will?

Unlike a will, which only takes effect after your death, a Virginia revocable trust becomes effective as soon as it's created. This allows for asset management during your lifetime and can help avoid the lengthy probate process. Additionally, a revocable trust offers privacy since it does not go through probate, whereas a will is a public document.

-

What are the benefits of setting up a Virginia revocable trust?

The primary benefits of a Virginia revocable trust include avoiding probate, maintaining privacy, and providing seamless asset management. It allows you to designate a successor trustee who can manage your assets if you become incapacitated. Furthermore, it can simplify your estate planning process, making it easier for your heirs to inherit your assets.

-

How much does a Virginia revocable trust cost to set up?

The cost of setting up a Virginia revocable trust can vary depending on the complexity of your estate and whether you choose to hire a professional, like an attorney. Typically, legal fees can range from a few hundred to thousands of dollars. However, the long-term savings from avoiding probate and ensuring efficient estate management can make it a worthwhile investment.

-

Can I change my Virginia revocable trust after it's created?

Yes, one of the main features of a Virginia revocable trust is that it can be changed or revoked at any time while you are still alive. This flexibility allows you to update beneficiaries, change assets, or modify any terms as your circumstances change. It's important to review your trust regularly to ensure it aligns with your current wishes.

-

Do I need an attorney to create a Virginia revocable trust?

While it's possible to create a Virginia revocable trust using online resources, consulting with an attorney is highly recommended. An attorney can provide tailored advice based on your specific situation and ensure the trust complies with Virginia law. Professional guidance can help you avoid costly mistakes and ensure that your trust meets all your estate planning goals.

-

What happens to my Virginia revocable trust if I move to another state?

If you move to another state, your Virginia revocable trust will still be valid; however, state laws regarding trusts can differ. You may want to review and potentially update your trust to comply with the new state's requirements. A legal professional can assist you in making any necessary adjustments to ensure your trust remains effective.

Get more for Virginia Revocable Trust

- Management package form

- Control number la p091 pkg form

- Control number ma p091a pkg form

- Control number md p091 pkg form

- Control number md p091a pkg form

- Maine notice of lien formfree downloadable template levelset

- Maine notice of lien formfree downloadable template

- Business forms ampamp fees minnesota secretary of state

Find out other Virginia Revocable Trust

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF