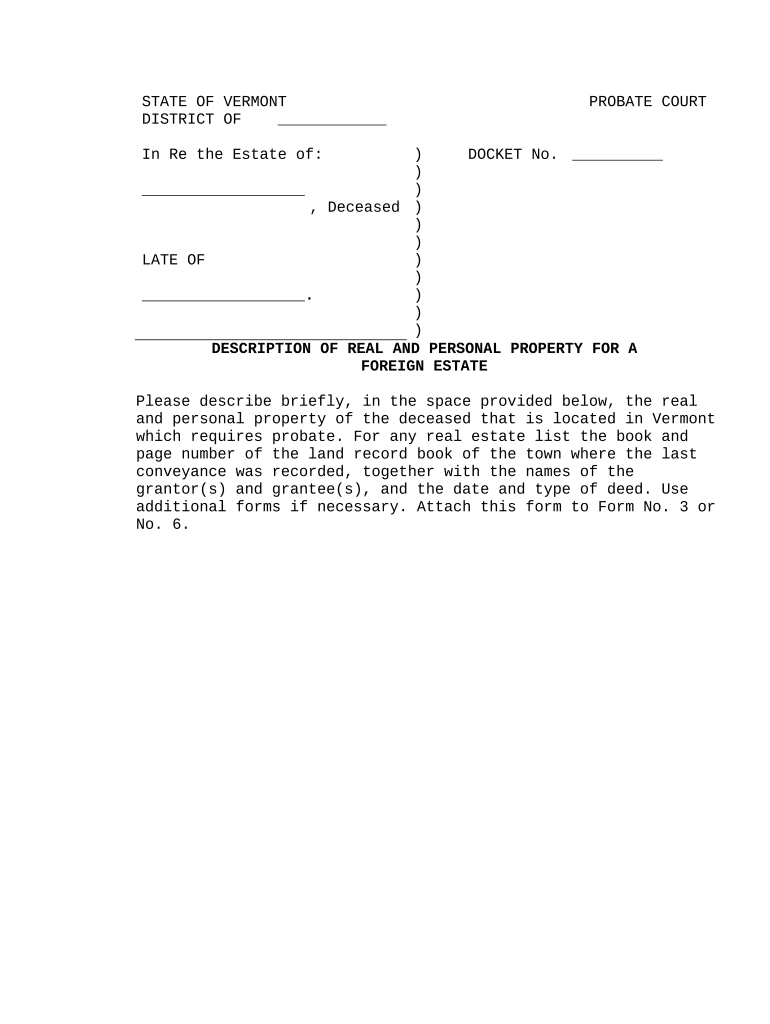

Vermont Foreign Form

What is the Vermont Foreign

The Vermont Foreign form is a legal document used by businesses and individuals to report foreign income or transactions to the state of Vermont. This form is essential for compliance with state tax regulations, particularly for those who have foreign investments or income sources. By accurately completing the Vermont Foreign form, taxpayers can ensure they meet their reporting obligations and avoid potential penalties.

How to use the Vermont Foreign

To use the Vermont Foreign form effectively, begin by gathering all necessary information regarding your foreign income or transactions. This includes details about the nature and amount of income, as well as any relevant foreign tax credits. Once you have the required information, proceed to fill out the form carefully, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate state agency.

Steps to complete the Vermont Foreign

Completing the Vermont Foreign form involves several key steps:

- Collect all relevant financial documents related to your foreign income.

- Access the Vermont Foreign form from the state’s official website or through authorized sources.

- Fill out the form, providing accurate details about your foreign income and any applicable deductions or credits.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, ensuring you follow the submission guidelines provided.

Legal use of the Vermont Foreign

The legal use of the Vermont Foreign form is crucial for compliance with state tax laws. This form must be filed by individuals and businesses with foreign income to report earnings accurately and fulfill tax obligations. Failure to file the Vermont Foreign form can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is essential for maintaining compliance.

Required Documents

When preparing to complete the Vermont Foreign form, certain documents are necessary to ensure accurate reporting. These may include:

- Foreign income statements or records

- Documentation of any foreign taxes paid

- Proof of residency or citizenship status, if applicable

- Any additional forms required by the state for foreign income reporting

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Vermont Foreign form. Typically, the form must be submitted by the same deadline as your state income tax return. Keeping track of these deadlines helps avoid late fees and ensures compliance with state regulations. Always check the Vermont Department of Taxes website for the most current deadlines and any changes to filing requirements.

Quick guide on how to complete vermont foreign

Prepare Vermont Foreign effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Handle Vermont Foreign on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign Vermont Foreign with ease

- Locate Vermont Foreign and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or out-of-place files, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Vermont Foreign and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing for Vermont foreign transactions?

airSlate SignNow offers competitive pricing tailored for businesses in Vermont foreign operations. The pricing plans provide flexibility to accommodate different business sizes and needs. You can start with a free trial to see how it suits your Vermont foreign document workflows.

-

How does airSlate SignNow facilitate Vermont foreign document signing?

airSlate SignNow enables fast and secure eSigning for Vermont foreign documents through its user-friendly interface. Users can easily upload, send, and sign documents electronically, streamlining the process and eliminating the need for physical paperwork. This feature simplifies document management for Vermont foreign transactions.

-

What features does airSlate SignNow provide for Vermont foreign users?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking designed for Vermont foreign users. These functionalities enhance document efficiency and ensure that all necessary steps are followed for compliance. Moreover, integrations with various applications make it easier for Vermont foreign businesses to streamline their processes.

-

Can I integrate airSlate SignNow with other software for Vermont foreign operations?

Yes, airSlate SignNow offers integrations with several third-party applications commonly used in Vermont foreign operations, such as CRM systems and cloud storage services. This interoperability helps businesses leverage their existing tools while optimizing document workflows. Integrating airSlate SignNow can enhance efficiency and reduce duplication of efforts in Vermont foreign tasks.

-

What benefits does airSlate SignNow offer for managing Vermont foreign contracts?

airSlate SignNow provides signNow benefits for managing Vermont foreign contracts, such as increased speed and reduced costs associated with traditional contract management. With eSignatures, businesses can finalize contracts quickly, ensuring timely agreements. The platform also enhances security and compliance, essential for Vermont foreign businesses dealing with sensitive documents.

-

Is airSlate SignNow compliant with Vermont foreign regulations?

Yes, airSlate SignNow is designed to comply with various regulations affecting Vermont foreign transactions, including eSignature laws. The platform adheres to the necessary legal requirements, ensuring that your documents are legally binding. This compliance helps businesses in Vermont foreign operations maintain trust and credibility with their clients.

-

What support does airSlate SignNow offer for Vermont foreign users?

airSlate SignNow provides dedicated support for Vermont foreign users through various channels, including email, live chat, and comprehensive help documentation. Users can access resources to help them navigate features and troubleshoot any issues they may encounter. Responsive customer support ensures a seamless experience for Vermont foreign businesses.

Get more for Vermont Foreign

- Form c 24d rev

- Alabama circuit courts wikipedia form

- In the court of alabama form

- For unlawful detainer alabama administrative office of courts form

- Form c 26

- Circuit or district form

- Alabamas judicial circuits alabama administrative office of form

- Request and affidavit for pre judgment writ of seizure forms

Find out other Vermont Foreign

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free