Vermont Small Estate Form

What is the Vermont Small Estate

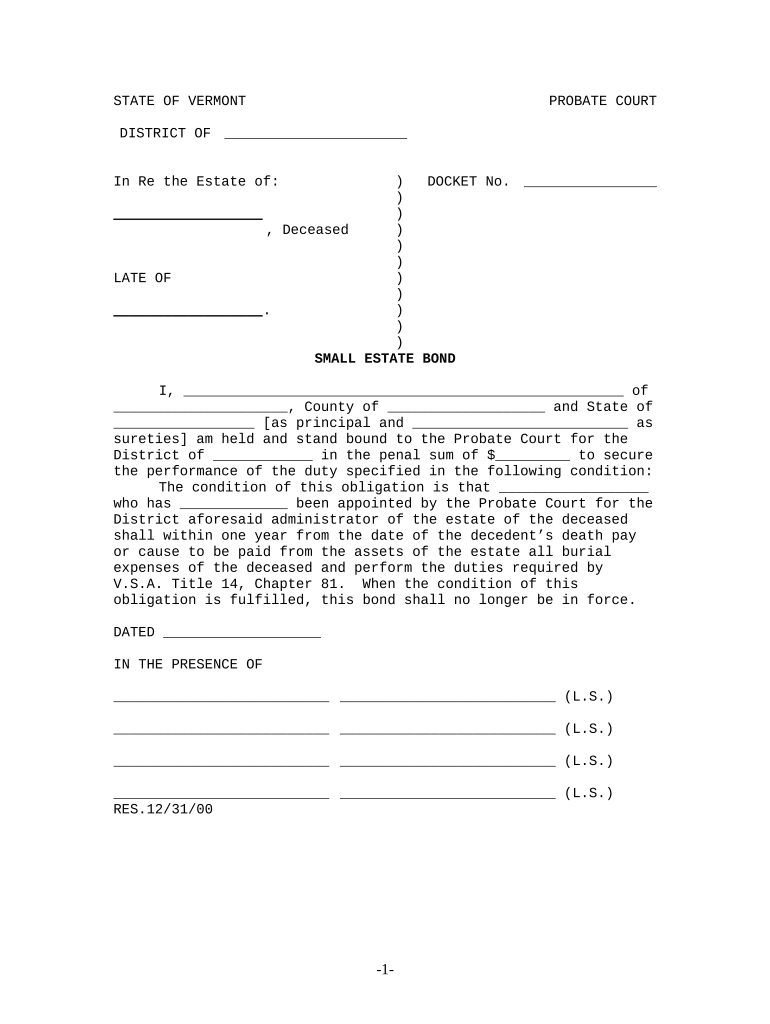

The Vermont small estate is a legal process that simplifies the transfer of assets from a deceased individual to their heirs without the need for formal probate. This process is designed for estates that fall below a certain value threshold, making it more accessible and less costly for families. In Vermont, the small estate limit is set at a specific dollar amount, which can change, so it is important to verify the current threshold. This process allows for a more efficient resolution of estate matters, ensuring that beneficiaries can access their inheritance with minimal delay.

Key elements of the Vermont Small Estate

Several key elements define the Vermont small estate process. First, the estate must meet the value limit established by state law. Second, the decedent's assets typically include personal property, bank accounts, and real estate, but not all assets may qualify. Third, the heirs must provide necessary documentation, including a death certificate and an affidavit, to confirm their relationship to the deceased. Finally, the process often requires that all debts and taxes owed by the estate are settled before distribution can occur. Understanding these elements is crucial for anyone looking to navigate the small estate process in Vermont.

Steps to complete the Vermont Small Estate

Completing the Vermont small estate process involves several clear steps. First, determine if the estate qualifies as a small estate based on the current value limit. Next, gather all necessary documents, including the death certificate and any relevant financial records. After that, prepare the small estate affidavit, which outlines the heirs and their rights to the assets. Once the affidavit is completed, it must be signed and notarized. Finally, present the affidavit to the appropriate financial institutions or courts to facilitate the transfer of assets. Following these steps ensures a smoother process for all involved.

Legal use of the Vermont Small Estate

The legal use of the Vermont small estate process is governed by state law, which provides specific guidelines for its application. This process allows heirs to claim their inheritance without the lengthy and often costly probate process. It is essential for executors and administrators to understand the legal implications of utilizing the small estate procedure, including compliance with state regulations. Proper legal use ensures that the transfer of assets is recognized by courts and financial institutions, safeguarding the rights of heirs and preventing potential disputes.

Required Documents

To successfully complete the Vermont small estate process, certain documents are required. These typically include:

- A certified copy of the death certificate

- The small estate affidavit, detailing the heirs and their claims

- Any relevant financial statements or property deeds

- Documentation of debts and taxes owed by the estate

Having these documents prepared and organized is essential for a smooth transition of assets to the rightful heirs.

Eligibility Criteria

Eligibility for the Vermont small estate process is primarily determined by the total value of the decedent's estate. The estate must fall below the established value limit set by Vermont law. Additionally, heirs must be legally recognized beneficiaries, such as spouses, children, or other relatives. It is also important that the decedent did not leave a will that specifies a different process for asset distribution. Understanding these eligibility criteria helps potential claimants assess whether they can utilize the small estate process effectively.

Quick guide on how to complete vermont small estate

Effortlessly prepare Vermont Small Estate on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Vermont Small Estate on any device using airSlate SignNow's Android or iOS applications and simplify your document-centric processes today.

How to edit and electronically sign Vermont Small Estate with ease

- Obtain Vermont Small Estate and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether via email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Vermont Small Estate and guarantee seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for handling a Vermont small estate?

The process for handling a Vermont small estate typically involves filing a simplified probate procedure, which is designed for estates with limited value. You can use airSlate SignNow to eSign and send necessary documents quickly, ensuring compliance with Vermont laws. This cost-effective solution simplifies the handling of small estates, saving time and resources.

-

How much does it cost to manage a Vermont small estate using airSlate SignNow?

Using airSlate SignNow to manage a Vermont small estate is budget-friendly, with affordable pricing options that cater to businesses and individuals alike. You'll benefit from a transparent pricing model with no hidden fees, allowing you to control your expenses while efficiently managing your estate documents. SignNow offers a free trial, so you can explore its features before committing.

-

What features does airSlate SignNow offer for Vermont small estate management?

airSlate SignNow provides a variety of features that streamline the management of Vermont small estates, including templates for estate documents and intuitive eSigning capabilities. You can easily customize documents to meet Vermont's legal requirements and ensure they are completed efficiently. The platform also includes cloud storage for quick access and organization of your estate paperwork.

-

Can airSlate SignNow help with estate planning in Vermont?

Absolutely! airSlate SignNow is an excellent tool for estate planning in Vermont small estates. The platform allows users to create, send, and sign essential planning documents electronically, ensuring compliance with state regulations. This not only simplifies the process but also makes estate planning more accessible and efficient for everyone.

-

What are the benefits of using airSlate SignNow for Vermont small estates?

The primary benefits of using airSlate SignNow for Vermont small estates include cost-effectiveness, ease of use, and efficient document handling. By digitizing the estate management process, users can save time and reduce errors in documentation. Additionally, the ability to eSign documents from anywhere makes it convenient for all parties involved.

-

Are there integrations available with airSlate SignNow for Vermont small estate documentation?

Yes, airSlate SignNow offers integrations with numerous platforms that can aid in managing Vermont small estate documentation. This includes integration with popular tools for project management and communication, which can enhance workflow efficiency. These integrations further streamline the process, ensuring that all aspects of estate management are seamlessly connected.

-

Is airSlate SignNow secure for handling Vermont small estate documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive Vermont small estate documents. The platform utilizes industry-standard encryption to protect your data and ensure confidentiality. Furthermore, all eSigned documents are securely stored, complying with legal standards to safeguard your estate information.

Get more for Vermont Small Estate

Find out other Vermont Small Estate

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online