How to Determine a Trust's Schedule of Distributions Dummies Form

What is the How To Determine A Trust's Schedule Of Distributions Dummies

The How To Determine A Trust's Schedule Of Distributions Dummies form is a crucial document for managing trust distributions. It outlines the specific schedule and conditions under which a trust will distribute its assets to beneficiaries. This form is particularly important for trustees and beneficiaries to ensure compliance with the trust's terms and applicable laws. Understanding this schedule helps in planning financial matters and ensures that all parties are aware of their rights and obligations regarding the trust's assets.

Steps to complete the How To Determine A Trust's Schedule Of Distributions Dummies

Completing the How To Determine A Trust's Schedule Of Distributions Dummies form involves several important steps:

- Gather necessary information about the trust, including its terms and the beneficiaries' details.

- Determine the timing and conditions for distributions as specified in the trust document.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Obtain the required signatures from the trustee and any other necessary parties.

- Submit the completed form according to the specified method, whether online, by mail, or in person.

Legal use of the How To Determine A Trust's Schedule Of Distributions Dummies

The legal use of the How To Determine A Trust's Schedule Of Distributions Dummies form is essential for ensuring that trust distributions are conducted in accordance with the law. This form serves as a formal record of the trustee's decisions regarding distributions, which can be important in case of disputes or audits. Adhering to the legal guidelines helps protect the trustee from liability and ensures beneficiaries receive their rightful distributions in a timely manner.

Key elements of the How To Determine A Trust's Schedule Of Distributions Dummies

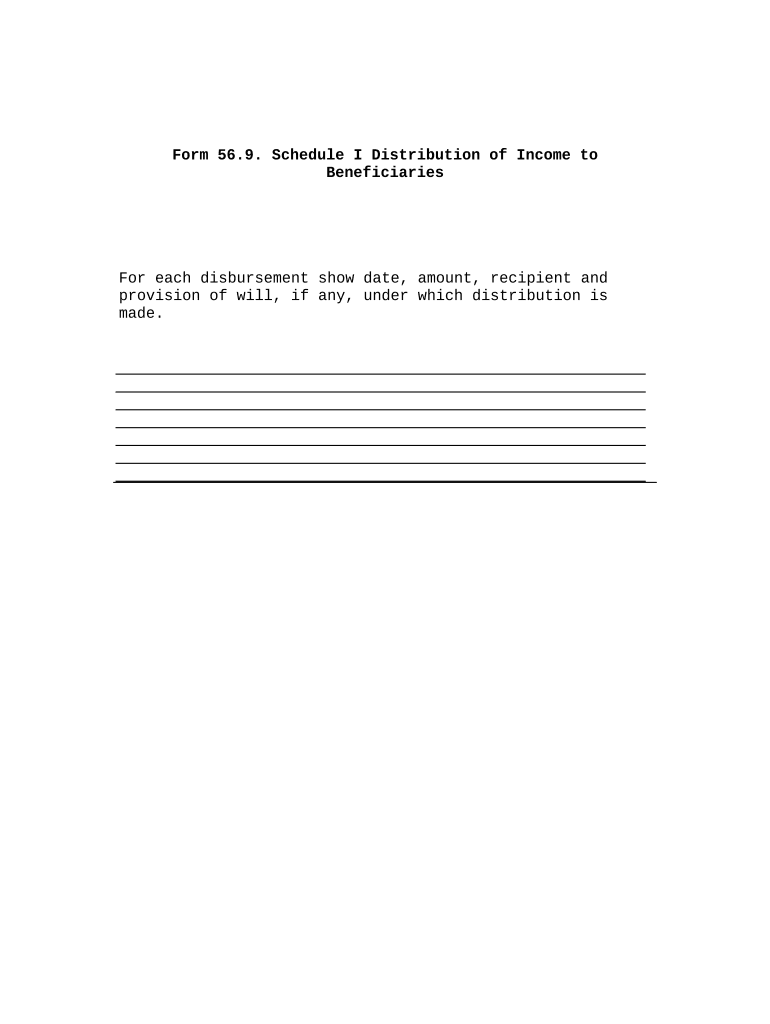

Several key elements must be included in the How To Determine A Trust's Schedule Of Distributions Dummies form:

- Trust Information: Details about the trust, including its name and date of establishment.

- Beneficiary Details: Names and contact information for all beneficiaries.

- Distribution Schedule: Specific dates or events that trigger distributions.

- Conditions: Any conditions that must be met before distributions are made.

- Signature Section: Spaces for the trustee and any other required signatories.

Examples of using the How To Determine A Trust's Schedule Of Distributions Dummies

Examples of using the How To Determine A Trust's Schedule Of Distributions Dummies form can help illustrate its practical applications:

- A trustee may use the form to outline annual distributions to beneficiaries based on the trust's income.

- In a family trust, the form may specify that distributions occur when a beneficiary reaches a certain age.

- The form can also be utilized to document one-time distributions for specific purposes, such as education or medical expenses.

IRS Guidelines

Understanding IRS guidelines related to trust distributions is vital for compliance. The IRS requires that all distributions from a trust be reported accurately on tax returns. Beneficiaries may need to report their share of the trust's income, which can affect their personal tax obligations. The How To Determine A Trust's Schedule Of Distributions Dummies form should align with these guidelines to ensure that all tax liabilities are met and that the trust operates within the legal framework.

Quick guide on how to complete how to determine a trusts schedule of distributions dummies

Complete How To Determine A Trust's Schedule Of Distributions Dummies seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, facilitating the ability to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your files quickly and without hindrance. Handle How To Determine A Trust's Schedule Of Distributions Dummies on any operating system with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign How To Determine A Trust's Schedule Of Distributions Dummies without any hassle

- Obtain How To Determine A Trust's Schedule Of Distributions Dummies and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information carefully and click on the Done button to save your edits.

- Choose how you wish to send your document, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Adjust and eSign How To Determine A Trust's Schedule Of Distributions Dummies and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Trust's Schedule of Distributions?

A Trust's Schedule of Distributions outlines how and when assets will be distributed to beneficiaries. Understanding this schedule is crucial for both trustees and beneficiaries to ensure compliance with trust terms. If you're looking to simplify this process, learn How To Determine A Trust's Schedule Of Distributions Dummies.

-

How can airSlate SignNow assist in managing a Trust's Schedule of Distributions?

airSlate SignNow provides tools to securely send, sign, and manage documents related to a Trust's Schedule of Distributions. This streamlined solution makes it easier to keep track of important dates and requirements. To grasp the process fully, discover How To Determine A Trust's Schedule Of Distributions Dummies with our helpful resources.

-

What features does airSlate SignNow offer for trust management?

airSlate SignNow offers features like eSigning, document storage, and automated workflows, all of which are essential in managing trusts efficiently. By utilizing these features, users can ensure they adhere to the established Schedule of Distributions. Learn more about these functionalities and How To Determine A Trust's Schedule Of Distributions Dummies.

-

Is airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow is a cost-effective solution suitable for businesses of all sizes, including small businesses. Our pricing plans are designed to cater to various needs while providing the essential tools necessary for trust management. Get started today to learn How To Determine A Trust's Schedule Of Distributions Dummies without breaking the bank.

-

Does airSlate SignNow integrate with other tools?

Absolutely! airSlate SignNow seamlessly integrates with various platforms, enhancing your trust management capabilities. This integration ensures you can efficiently manage your Trust's Schedule of Distributions while using the tools you already love. Don't forget to explore How To Determine A Trust's Schedule Of Distributions Dummies to maximize these integrations.

-

Can I track document status with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of documents in real time. This feature is invaluable for anyone managing a Trust's Schedule of Distributions, as it provides transparency and accountability throughout the process. Learn How To Determine A Trust's Schedule Of Distributions Dummies to enhance your document management skills.

-

Is there support available if I have questions about trust management?

Yes, airSlate SignNow offers extensive customer support to assist users with their queries about trust management. Whether you're asking about features or how to determine a Trust's Schedule of Distributions, our team is ready to help. Remember, understanding How To Determine A Trust's Schedule Of Distributions Dummies is just a question away.

Get more for How To Determine A Trust's Schedule Of Distributions Dummies

- Ucc1 ucc financing statement follow instructionsfront and form

- Addl info re 22e form

- Ucc 11 information request ucc 11pdf fpdf doc docx

- Ucc financing statement amendment indiana form

- Ucc3 addendum madisontitlecom form

- Additional debtors exact full legal name insert only one name 18a or 18b do not abbreviate or combine names form

- Name amp phone of person filing this statement optional form

- Petitioner plaintiff 490108962 form

Find out other How To Determine A Trust's Schedule Of Distributions Dummies

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement