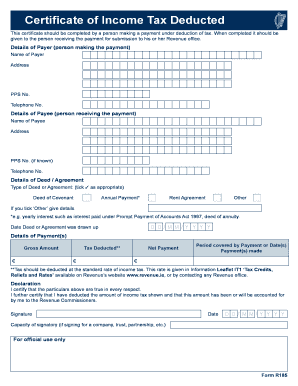

Certificate of Deduction of Income Tax Form

What is the Certificate of Deduction of Income Tax?

The Certificate of Deduction of Income Tax, often referred to as the R185 form, is a crucial document used in the United States to verify the amount of tax that has been deducted from income. This form is particularly relevant for individuals who receive income from sources where tax has been withheld, such as employment or certain investments. The R185 serves as proof of tax deductions, which can be beneficial for tax reporting and filing purposes.

Steps to Complete the Certificate of Deduction of Income Tax

Completing the R185 form involves several important steps to ensure accuracy and compliance. Follow these steps to fill out the form correctly:

- Gather necessary information, including your personal details and income sources.

- Indicate the total amount of income received during the tax year.

- Document the total tax deducted from your income, ensuring it matches your records.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate your submission.

Legal Use of the Certificate of Deduction of Income Tax

The R185 form holds legal significance as it provides evidence of tax deductions that can be used in various legal and financial contexts. This form is essential for individuals when filing their annual tax returns, as it substantiates claims for tax credits or refunds. Additionally, the R185 may be required during audits or financial assessments to demonstrate compliance with tax regulations.

How to Obtain the Certificate of Deduction of Income Tax

To obtain the R185 form, individuals typically need to request it from their employer or the entity that issued the income. Many organizations provide this form automatically at the end of the tax year, but if it is not received, individuals can contact the payroll department or financial institution directly. In some cases, the form may also be available through official tax websites or financial service providers.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use and submission of the R185 form. It is important for individuals to familiarize themselves with these guidelines to ensure compliance. The IRS outlines the necessary documentation required for tax deductions and the proper methods for submitting the form. Adhering to these guidelines can help avoid potential penalties and ensure accurate tax reporting.

Required Documents

When completing the R185 form, several documents may be required to support the information provided. These documents can include:

- W-2 forms from employers

- 1099 forms for independent contractors

- Statements from financial institutions detailing income and tax withheld

- Any additional records of income sources and deductions

Penalties for Non-Compliance

Failure to accurately complete and submit the R185 form can result in various penalties. The IRS may impose fines for incorrect reporting or failure to provide necessary documentation. Additionally, individuals may face delays in processing their tax returns or receiving refunds. It is crucial to ensure that the form is completed accurately and submitted on time to avoid these potential issues.

Quick guide on how to complete certificate of deduction of income tax

Complete Certificate Of Deduction Of Income Tax easily on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Certificate Of Deduction Of Income Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign Certificate Of Deduction Of Income Tax effortlessly

- Obtain Certificate Of Deduction Of Income Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional handwritten signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from your chosen device. Adjust and eSign Certificate Of Deduction Of Income Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of deduction of income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable form r185?

A fillable form r185 is a digital document designed to streamline the process of collecting information from users. It allows individuals to input data directly into the form fields, making it perfect for various applications such as tax filings or client intake forms. Utilizing airSlate SignNow, you can create, distribute, and eSign fillable form r185 easily and efficiently.

-

How can I create a fillable form r185 using airSlate SignNow?

Creating a fillable form r185 with airSlate SignNow is straightforward. Simply upload your document, use the editing tools to add fillable fields, and customize it according to your needs. Once completed, your fillable form r185 is ready to be shared with clients or team members for easy completion and eSigning.

-

What are the benefits of using a fillable form r185?

The benefits of using a fillable form r185 include enhanced accuracy, improved efficiency, and reduced paper waste. By allowing users to fill out the form digitally, you minimize the chances of errors and streamline the data collection process. Additionally, airSlate SignNow ensures that all responses are securely stored and easily accessible.

-

Is there a cost associated with using a fillable form r185 on airSlate SignNow?

Yes, there is a cost for utilizing airSlate SignNow, which varies based on the subscription plan you choose. Each plan offers different features and capabilities for managing fillable form r185 effectively. It's best to explore the pricing page on the website to find a plan that fits your budget and requirements.

-

Can I integrate a fillable form r185 into my existing workflows?

Absolutely! airSlate SignNow allows for seamless integration of fillable form r185 into various business workflows. Whether you’re using CRM software or project management tools, you can easily incorporate the form into your existing systems for a unified experience. This integration enhances productivity and ensures smooth document management.

-

Are there templates available for the fillable form r185?

Yes, airSlate SignNow offers various templates for the fillable form r185 that you can utilize. These templates are designed for different purposes, making it easy to find one that suits your specific needs. By starting with a template, you can save time and focus on customizing the details unique to your situation.

-

What security features are included with the fillable form r185 on airSlate SignNow?

Security is a top priority for airSlate SignNow. The fillable form r185 comes with robust security features, including encryption, secure access controls, and audit trails. These measures ensure that your document remains safe and that all signatures are verifiable and legally binding.

Get more for Certificate Of Deduction Of Income Tax

- Fillable online statements to the court under pdffiller form

- Name of opposing party form

- Arizona affidavit of financial information pdffiller

- Respondent party bs name or lawyers name form

- Arizona petition for dissolution of marriage divorce with form

- Family department sensitive data coversheet with children confidential record drsds10f c form

- Notice is hereby given pursuant to the provision of our lease agreement with form

- How to serve the other party using acceptance of service form

Find out other Certificate Of Deduction Of Income Tax

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure