Real Property Interest Form

Understanding Real Property Interest

Real property interest refers to the legal rights that an individual or entity has in relation to real estate. This can encompass ownership rights, lease agreements, and other forms of interest in land or buildings. In the context of the Vermont disclaimer, understanding real property interest is crucial, as it determines how property rights are transferred or renounced. The Vermont disclaimer form is typically used to formally relinquish any claims to a property, ensuring that the individual is not held liable for any associated obligations or debts.

Steps to Complete the Vermont Disclaimer Form

Completing the Vermont disclaimer form involves several important steps to ensure its validity. First, gather all necessary information related to the property, including its legal description and any relevant ownership details. Next, fill out the form accurately, ensuring that all required fields are completed. It is essential to sign the form in the presence of a notary public to validate the signature. After signing, submit the form to the appropriate local government office, typically the town clerk or land records office, to officially record the disclaimer.

Legal Use of the Vermont Disclaimer

The legal use of the Vermont disclaimer is primarily to protect individuals from future liabilities associated with a property they no longer wish to claim. By filing this form, individuals can formally renounce their interest in the property, which can be particularly important in cases of inheritance or joint ownership. The disclaimer serves as a safeguard, ensuring that the individual is not responsible for debts or obligations linked to the property after the disclaimer is recorded.

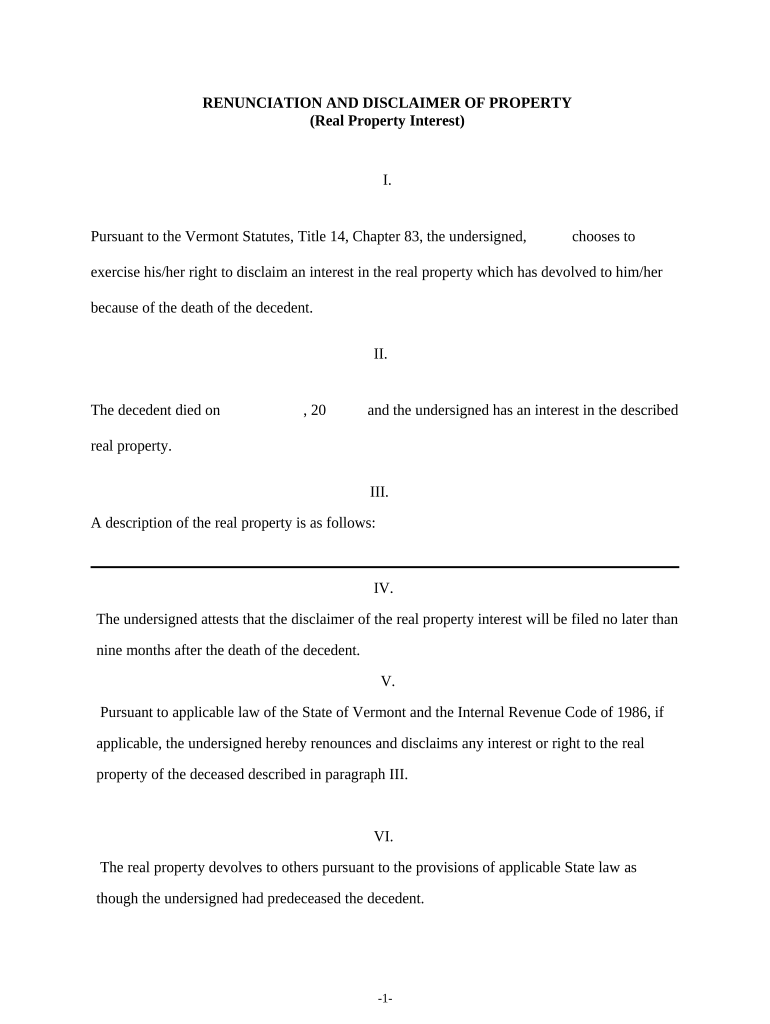

Key Elements of the Vermont Disclaimer Form

The Vermont disclaimer form includes several key elements that must be addressed for it to be legally binding. These elements typically include the name and address of the disclaimant, a clear description of the property, the nature of the interest being disclaimed, and the date of the disclaimer. Additionally, the form must be signed and notarized to ensure its authenticity. Each of these components plays a vital role in establishing the legitimacy of the disclaimer and protecting the rights of the individual.

State-Specific Rules for the Vermont Disclaimer

State-specific rules for the Vermont disclaimer are important to understand, as they may differ from regulations in other states. In Vermont, the disclaimer must be filed within a specific timeframe following the event that triggers the need for a disclaimer, such as inheritance. Additionally, the form must comply with Vermont state laws regarding property transfers and disclaimers to be considered valid. Familiarity with these rules helps ensure that the disclaimer is executed correctly and legally.

Examples of Using the Vermont Disclaimer

Examples of using the Vermont disclaimer can illustrate its practical applications. For instance, if an individual inherits a property but does not wish to take on the associated responsibilities, they may file a Vermont disclaimer to renounce their interest. Similarly, co-owners of a property may use the disclaimer to relinquish their rights, allowing the remaining owner to take full control without complications. These scenarios highlight the importance of the disclaimer in managing property interests effectively.

Quick guide on how to complete real property interest 497428723

Effortlessly Prepare Real Property Interest on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Manage Real Property Interest on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Real Property Interest with Ease

- Find Real Property Interest and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, monotonous form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your selected device. Alter and electronically sign Real Property Interest and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to vermont interest?

airSlate SignNow is a powerful eSignature platform that allows businesses to send and sign documents electronically. It can help streamline processes in Vermont, where understanding local regulations around vermont interest is crucial for compliance and efficiency.

-

How can airSlate SignNow help businesses considering vermont interest rates?

With airSlate SignNow, businesses can quickly send contracts that address vermont interest rates, ensuring that all parties are clear about their obligations. The platform provides templates that can be easily customized to reflect the latest vermont interest laws.

-

What pricing plans does airSlate SignNow offer for businesses in Vermont?

airSlate SignNow offers several pricing plans that are designed to cater to businesses of all sizes, including those in Vermont. By selecting a plan that fits their needs, businesses can efficiently manage their workflows while keeping vermont interest rates in mind.

-

Can I integrate airSlate SignNow with other software for handling vermont interest documentation?

Yes, airSlate SignNow offers integrations with various software solutions that can help businesses manage vermont interest documentation. By connecting with CRMs and other applications, users can streamline their operations and ensure compliance with local laws regarding vermont interest.

-

What features does airSlate SignNow provide for managing contracts with vermont interest clauses?

airSlate SignNow includes features like document templates and real-time collaboration, which are essential for drafting contracts that involve vermont interest clauses. These tools help users ensure that all necessary details are included, fostering transparency and reducing disputes.

-

Is airSlate SignNow secure for handling sensitive vermont interest agreements?

Absolutely, airSlate SignNow provides top-notch security features that protect sensitive information within vermont interest agreements. With industry-standard encryption and secure cloud storage, users can confidently manage their documents without concerns about data bsignNowes.

-

How does airSlate SignNow benefit small businesses in Vermont dealing with vermont interest?

For small businesses in Vermont, airSlate SignNow offers an affordable and user-friendly solution to manage vermont interest transactions. The platform's efficiency can save time and reduce costs, allowing small businesses to focus on growth while staying compliant.

Get more for Real Property Interest

- Fr900q form

- Fillable online tax virginia form oic fee offer in

- Oic individual doubtful collectibility package offer in compromise individual doubtful collectibility package form

- Np1 form

- Form np 1 sales and use tax exemption application for nonprofit organizations virginia form np 1 sales and use tax exemption

- New york form ia 123

- Specifications for bulk filing withholding fr 900q tax form

- Utah voter registration form

Find out other Real Property Interest

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed