Sales Tax Form PDF

What is the Sales Tax Form PDF

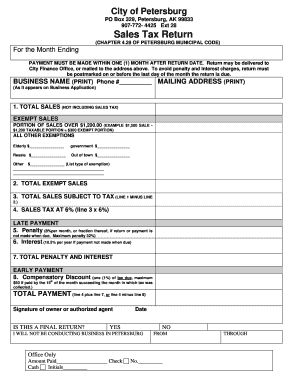

The sales tax form PDF is an official document used by businesses to report and remit sales tax collected from customers to state tax authorities. This form varies by state, as each has its own regulations and requirements regarding sales tax. Typically, the form includes sections for reporting total sales, taxable sales, and the amount of sales tax due. It serves as a crucial tool for ensuring compliance with state tax laws and maintaining accurate financial records.

Steps to Complete the Sales Tax Form PDF

Completing the sales tax form PDF involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records for the reporting period. This includes invoices, receipts, and any documentation related to sales tax collected. Next, enter the total sales amount and determine the taxable sales based on state regulations. Calculate the sales tax due by applying the appropriate tax rate to the taxable sales amount. Finally, review the completed form for accuracy before submitting it to the relevant tax authority.

How to Obtain the Sales Tax Form PDF

To obtain the sales tax form PDF, visit your state’s department of revenue or taxation website. Most states provide downloadable versions of their sales tax forms directly on their official sites. You can also find these forms at local government offices or request them via mail. Ensure you are accessing the correct version for your specific state and reporting period to avoid any compliance issues.

Legal Use of the Sales Tax Form PDF

The sales tax form PDF is legally binding when completed and submitted according to state regulations. It must be filled out accurately, reflecting all sales transactions and tax collected. Electronic signatures are accepted in many states, provided they comply with eSignature laws. It's essential to retain copies of submitted forms and related documentation for record-keeping and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the sales tax form PDF vary by state and can depend on the frequency of your tax reporting, such as monthly, quarterly, or annually. Typically, businesses must submit their forms by the end of the month following the reporting period. It is crucial to be aware of these deadlines to avoid penalties and interest on late payments. Check your state’s tax authority website for specific dates and any changes to the filing schedule.

Form Submission Methods

Businesses can submit the sales tax form PDF through various methods, including online filing, mail, or in-person submission. Many states offer online portals for electronic filing, which can streamline the process and provide immediate confirmation of submission. If submitting by mail, ensure that you send the form to the correct address and allow sufficient time for delivery. In-person submissions may be available at local tax offices, providing an opportunity to ask questions if needed.

Penalties for Non-Compliance

Failure to comply with sales tax filing requirements can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. Each state has its own penalty structure, which can escalate based on the duration of non-compliance. It is essential for businesses to stay informed about their obligations and adhere to all filing guidelines to avoid these consequences.

Quick guide on how to complete sales tax form pdf

Complete Sales Tax Form Pdf effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Sales Tax Form Pdf on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Sales Tax Form Pdf effortlessly

- Locate Sales Tax Form Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with features that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any gadget of your preference. Modify and electronically sign Sales Tax Form Pdf and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sales tax form pdf?

A sales tax form pdf is a digital document that helps businesses report and calculate sales tax obligations. It provides a standardized format for collecting necessary information, making it easier to maintain compliance with local tax regulations. Using an electronic version like airSlate SignNow's services can streamline this process signNowly.

-

How can airSlate SignNow assist in managing sales tax form pdf?

airSlate SignNow allows users to easily create, send, and eSign sales tax form pdfs, enhancing the efficiency of tax document management. With its user-friendly interface, businesses can ensure accurate completion and timely submission of their sales tax forms. This not only saves time but also reduces errors and elevates compliance.

-

Is there a cost associated with using airSlate SignNow for sales tax form pdf?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. The plans are designed to provide signNow savings when managing documents, including sales tax form pdfs. By adopting a cost-effective solution, businesses can ensure they have the tools necessary for efficient document handling.

-

What features does airSlate SignNow offer for sales tax form pdf handling?

airSlate SignNow provides features such as customizable templates, secure eSignature collection, and document tracking specifically for sales tax form pdfs. These features empower businesses to maintain organized records and get approvals more quickly. Streamlined workflows can signNowly enhance efficiency when processing tax documents.

-

Can I integrate airSlate SignNow with other software when handling sales tax form pdf?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and business software, making it easier to manage sales tax form pdfs. This connectivity allows for smooth data transfer, reducing manual entry and errors. Integrating with your existing software ensures a more comprehensive approach to your sales tax documentation.

-

What are the benefits of using airSlate SignNow for sales tax form pdfs?

Using airSlate SignNow for sales tax form pdfs provides enhanced security, remote access, and improved processing speed. Businesses benefit from a reliable and compliant solution that minimizes the risk of errors. The platform’s ease of use also ensures that team members can quickly adapt and efficiently manage tax-related documents.

-

How does airSlate SignNow ensure the security of my sales tax form pdfs?

airSlate SignNow employs robust security measures, including end-to-end encryption and secure cloud storage, to protect your sales tax form pdfs. This means that your sensitive information remains safe and compliant with regulations. Additionally, user access controls help ensure that only authorized personnel can access critical tax documents.

Get more for Sales Tax Form Pdf

- Childcare resolution payment form cd 147

- 100 greatest discoveries in biology answer key form

- Landstar rider policy form

- Aajmal talent exem book form

- Form 139rep authorized representative form dcf vermont

- Pakistan renunciation certificate sample 448296085 form

- Fullmakt privatperson pdf form

- Basha diagnostics price list form

Find out other Sales Tax Form Pdf

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament