Business Credit Application Vermont Form

What is the Business Credit Application Vermont

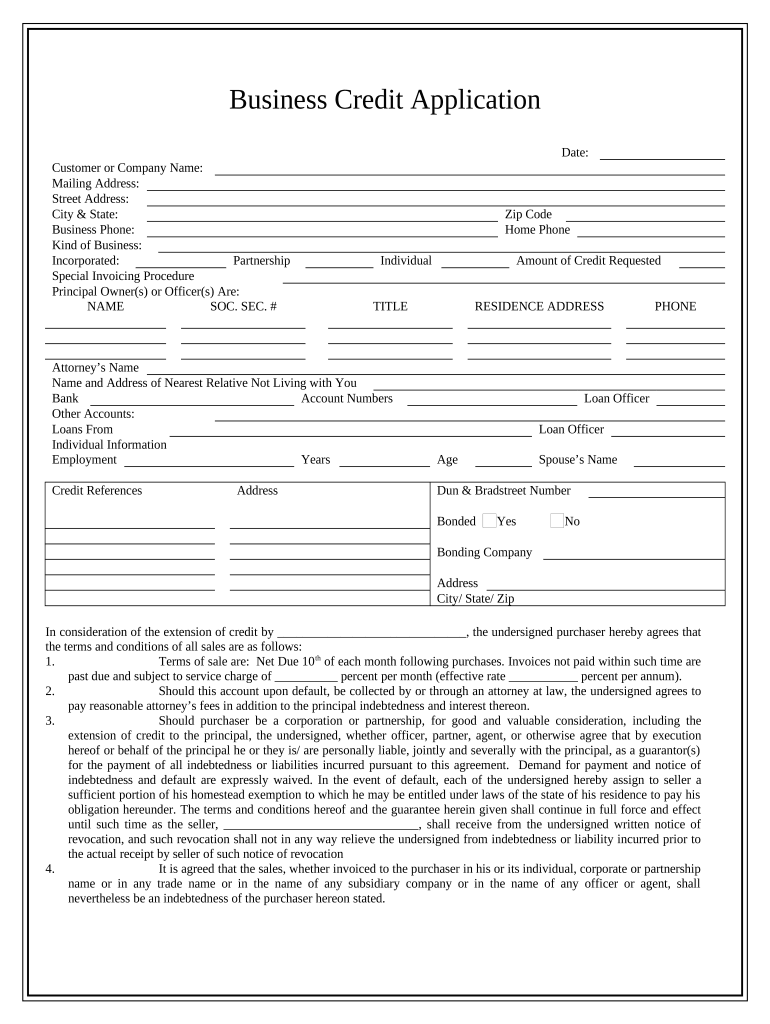

The Business Credit Application Vermont is a formal document that businesses in Vermont use to apply for credit from financial institutions or suppliers. This application collects essential information about the business, including ownership details, financial history, and creditworthiness. By providing this information, businesses can establish their eligibility for credit, which is crucial for funding operations, purchasing inventory, or expanding services.

Steps to Complete the Business Credit Application Vermont

Completing the Business Credit Application Vermont involves several key steps to ensure accuracy and compliance. First, gather all necessary information, such as the business's legal name, address, and tax identification number. Next, provide details about the business structure, whether it is a corporation, partnership, or sole proprietorship. Include financial statements and credit history to support the application. Once all information is compiled, review the application for completeness before submitting it to the lender or supplier.

Legal Use of the Business Credit Application Vermont

The legal use of the Business Credit Application Vermont requires adherence to specific regulations governing eSignatures and document submission. Under U.S. law, electronic signatures are recognized as legally binding, provided they meet the requirements set forth by the ESIGN Act and UETA. It is essential to use a compliant platform that ensures the security and authenticity of the signatures to maintain the document's legal validity.

Key Elements of the Business Credit Application Vermont

Key elements of the Business Credit Application Vermont include the business's contact information, ownership structure, financial statements, and a summary of credit history. Additionally, the application may require personal guarantees from business owners, especially in the case of small businesses. Providing accurate and comprehensive information in these sections is critical to the approval process.

Eligibility Criteria

Eligibility criteria for the Business Credit Application Vermont typically include factors such as the length of time the business has been operating, the credit score of the business and its owners, and the overall financial health of the business. Lenders may also consider the industry in which the business operates and its projected revenue. Meeting these criteria can enhance the chances of approval for credit.

Application Process & Approval Time

The application process for the Business Credit Application Vermont generally involves submitting the completed form along with any required documentation to the lender or supplier. After submission, the approval time can vary based on the institution's policies and the complexity of the application. Typically, businesses can expect a response within a few days to a couple of weeks, depending on the thoroughness of the application and the lender's workload.

Quick guide on how to complete business credit application vermont

Easily prepare Business Credit Application Vermont on any device

Digital document management has gained traction among businesses and individuals. It presents a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Business Credit Application Vermont on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

Effortlessly edit and electronically sign Business Credit Application Vermont

- Locate Business Credit Application Vermont and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Business Credit Application Vermont and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application Vermont?

A Business Credit Application Vermont is a formal document that businesses use to apply for credit from lenders or suppliers in the state of Vermont. By utilizing airSlate SignNow, you can streamline the process of sending and eSigning this application, making it easy and efficient.

-

How does airSlate SignNow help with the Business Credit Application Vermont process?

airSlate SignNow simplifies the Business Credit Application Vermont process by providing an intuitive platform for creating, sending, and managing applications. Users can easily eSign documents, ensuring quick turnaround times and reducing the need for paper-based processes.

-

What are the pricing options for using airSlate SignNow for Business Credit Application Vermont?

airSlate SignNow offers a range of pricing plans to suit different business needs, including features specifically designed for managing Business Credit Application Vermont. By selecting the right plan, you can access essential tools for an affordable monthly fee.

-

What features should I look for in a Business Credit Application Vermont solution?

When considering a Business Credit Application Vermont solution, look for features like customizable templates, cloud storage, and eSigning capabilities. airSlate SignNow provides all these features, which enhance your application's efficiency and security.

-

What are the benefits of using airSlate SignNow for a Business Credit Application Vermont?

Using airSlate SignNow for your Business Credit Application Vermont offers numerous benefits, including faster processing times, improved tracking, and enhanced collaboration. The solution allows you to focus on your business while ensuring a seamless application process.

-

Can airSlate SignNow integrate with other software for Business Credit Application Vermont?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing the Business Credit Application Vermont process. This allows users to connect their workflows and manage their documents more efficiently.

-

Is airSlate SignNow user-friendly for completing a Business Credit Application Vermont?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and complete a Business Credit Application Vermont. The platform provides guided steps to help users through the entire process.

Get more for Business Credit Application Vermont

- Pilot license template form

- Fill free fillable report of mishap form ds 1663 pdf form

- Mechanical bond packet minnesota department of labor and form

- Will vs living trust whats best for youlegalzoom form

- Uscis i 690 form

- Nj wills and estates guide theodore sliwinski esq east form

- Change of address exempt organizationsinternal revenue form

- Employee notice form

Find out other Business Credit Application Vermont

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile