Vermont Unsecured Installment Payment Promissory Note for Fixed Rate Vermont Form

What is the Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont

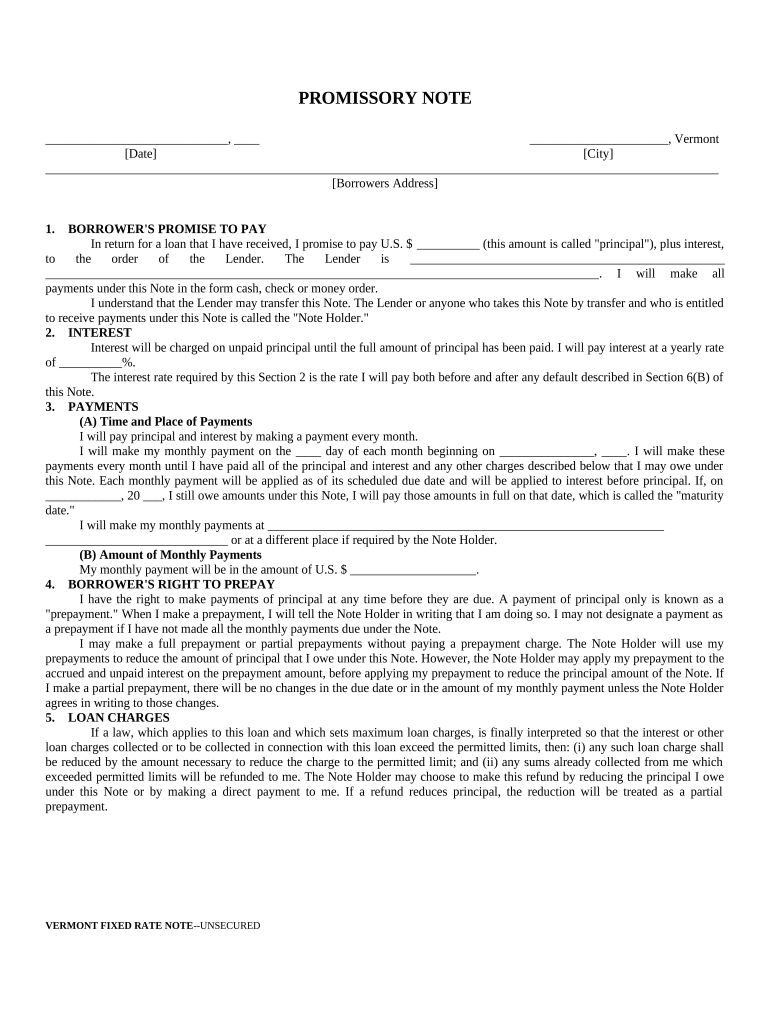

The Vermont Unsecured Installment Payment Promissory Note for Fixed Rate Vermont is a legal document that outlines a borrower's promise to repay a loan in fixed installments over a specified period. This form is typically used when the borrower does not provide collateral for the loan, making it unsecured. The note includes essential details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. It serves as a binding agreement between the lender and borrower, ensuring clarity and legal protection for both parties.

How to use the Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont

To effectively use the Vermont Unsecured Installment Payment Promissory Note for Fixed Rate Vermont, both the lender and borrower should first review the terms of the loan. The borrower must fill out the form with accurate information, including their personal details, the loan amount, and the agreed-upon interest rate. Once completed, both parties should sign the document to validate the agreement. It is advisable to keep copies of the signed note for future reference, as it can be crucial in case of disputes or misunderstandings regarding the loan terms.

Steps to complete the Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont

Completing the Vermont Unsecured Installment Payment Promissory Note requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source.

- Fill in the borrower's name and contact information accurately.

- Specify the loan amount and the fixed interest rate.

- Outline the repayment schedule, including the number of payments and due dates.

- Include any additional terms, such as penalties for late payments.

- Both the lender and borrower should review the document for accuracy.

- Sign and date the form to finalize the agreement.

Legal use of the Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont

The Vermont Unsecured Installment Payment Promissory Note is legally binding when executed properly. For the note to be enforceable, it must include clear terms regarding the loan amount, repayment schedule, and interest rate. Both parties must sign the document, and it is recommended to have it witnessed or notarized to enhance its legal standing. Compliance with state laws and regulations is crucial, as this ensures that the note adheres to the legal framework governing unsecured loans in Vermont.

Key elements of the Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont

Key elements of the Vermont Unsecured Installment Payment Promissory Note include:

- Borrower and Lender Information: Names and contact details of both parties.

- Loan Amount: The total sum being borrowed.

- Interest Rate: The fixed rate applicable to the loan.

- Repayment Schedule: Detailed timeline of payments, including due dates.

- Late Payment Penalties: Any fees associated with missed or late payments.

- Signatures: Both parties must sign to validate the agreement.

State-specific rules for the Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont

In Vermont, specific rules govern the use of unsecured installment payment promissory notes. These rules include requirements for clear disclosure of the loan terms, adherence to state interest rate limits, and compliance with consumer protection laws. It is essential for both lenders and borrowers to familiarize themselves with these regulations to ensure that the note is valid and enforceable. Consulting with a legal professional can provide additional guidance on state-specific requirements.

Quick guide on how to complete vermont unsecured installment payment promissory note for fixed rate vermont

Complete Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without any delays. Manage Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont with ease

- Find Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key parts of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont?

A Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont is a legal document that outlines the terms of repayment for a loan without collateral. It features a fixed interest rate, allowing borrowers to understand their obligations clearly and plan their payments effectively. This type of note is ideal for personal or business loans where securing collateral may not be feasible.

-

How can airSlate SignNow help with my Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont?

airSlate SignNow offers a seamless platform to create, send, and eSign your Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont. This easy-to-use solution simplifies the entire process, ensuring that your documents are completed efficiently and securely. With customizable templates, you can tailor your promissory note to meet specific needs.

-

Are there any fees associated with using airSlate SignNow for a Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont?

Yes, while airSlate SignNow provides a cost-effective solution, there are subscription plans which may include different features and pricing structures. By choosing the right plan, you can leverage all the functionalities required for your Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont, while managing costs effectively.

-

What are the benefits of using a Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont?

The primary benefits of a Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont include predictable payment schedules and a clear understanding of debtor obligations. This format helps in maintaining financial transparency and reducing potential disputes, making it easier for both borrowers and lenders to adhere to agreed terms.

-

Is it possible to integrate airSlate SignNow with other tools for managing my Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont?

Yes, airSlate SignNow integrates with various business tools such as CRM systems, workflow platforms, and document management services. This allows you to streamline the process of handling your Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont and enhances productivity by keeping all necessary documents connected and accessible.

-

How do I create a Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont using airSlate SignNow?

Creating your Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont with airSlate SignNow is straightforward. Simply select a customizable template, fill out the required fields, and adjust any provisions as needed. Once you've drafted the document, you can easily send it for eSignature to complete the process.

-

Can I store my Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont securely with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, ensuring that your Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont is stored safely in a secure cloud environment. All your documents benefit from advanced encryption and secure access, giving you peace of mind about sensitive information.

Get more for Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont

- Tour the ct supreme court ct judicial branch form

- Form jd es 47 pretrial memo connecticut templateroller

- Americans with disabilities act ct judicial branch form

- Application for appearance of legal intern connecticut form

- Income withholding for support hhsgov form

- Appeal from family support magistrate form

- Upon failure of payer of form

- Order to maintain health insurance for minor children form

Find out other Vermont Unsecured Installment Payment Promissory Note For Fixed Rate Vermont

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple