Vermont Financing Statement Form

What is the Vermont Financing Statement

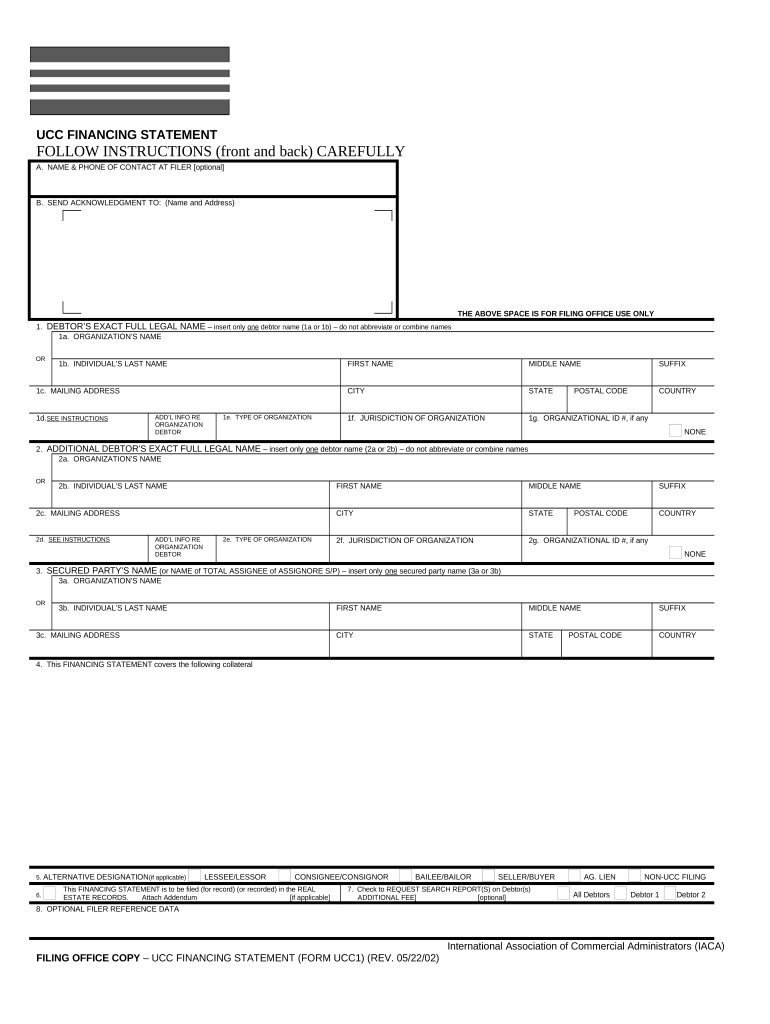

The Vermont financing statement is a legal document used to secure interests in personal property. It is primarily utilized by creditors to establish a public record of their security interests in the collateral offered by borrowers. This form is essential for businesses and individuals seeking to protect their financial interests when lending or borrowing money.

The financing statement is filed with the Vermont Secretary of State and serves to notify other potential creditors of the secured party's claim. By filing this statement, creditors can ensure that their rights are preserved in the event of a borrower's default.

How to Use the Vermont Financing Statement

To effectively use the Vermont financing statement, it is important to understand its purpose and the process involved in filing it. This document is typically filled out by the secured party, who is the lender or creditor, and must include specific information about the debtor and the collateral being secured.

Once completed, the financing statement should be filed with the appropriate state office, which in Vermont is the Secretary of State's office. This filing creates a public record, making it essential for establishing the priority of the creditor's claim against the collateral.

Steps to Complete the Vermont Financing Statement

Completing the Vermont financing statement involves several key steps:

- Gather necessary information about the debtor, including their legal name and address.

- Identify the collateral being secured, providing a clear description to avoid ambiguity.

- Fill out the financing statement form accurately, ensuring all required fields are completed.

- Review the document for accuracy and completeness before filing.

- File the completed financing statement with the Vermont Secretary of State, either online or by mail.

Key Elements of the Vermont Financing Statement

Several key elements must be included in the Vermont financing statement to ensure its validity:

- Debtor Information: The full legal name and address of the debtor must be clearly stated.

- Secured Party Information: The name and address of the secured party must also be included.

- Description of Collateral: A detailed description of the collateral being secured is necessary for clarity.

- Signature: The secured party must sign the document to validate it.

Legal Use of the Vermont Financing Statement

The Vermont financing statement serves a critical legal function in securing interests in personal property. It is governed by the Uniform Commercial Code (UCC), which provides the framework for secured transactions in the United States.

Filing this statement is essential for creditors to establish their rights over the collateral. Failure to file or improper filing can result in loss of priority in the event of bankruptcy or default by the debtor. Therefore, understanding the legal implications of this document is crucial for both creditors and debtors.

Form Submission Methods

The Vermont financing statement can be submitted through various methods, ensuring accessibility for all users. The primary submission methods include:

- Online Filing: This method allows for quick and efficient submission through the Vermont Secretary of State's website.

- Mail: Completed forms can be mailed to the Secretary of State's office for processing.

- In-Person: Individuals may also choose to file the statement in person at the Secretary of State's office.

Quick guide on how to complete vermont financing statement

Easily prepare Vermont Financing Statement on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly option to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents rapidly without delays. Handle Vermont Financing Statement on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Effortlessly modify and eSign Vermont Financing Statement

- Find Vermont Financing Statement and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or hide sensitive content with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Vermont Financing Statement and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Vermont financing statement and why is it important?

A Vermont financing statement is a legal document used to secure interest in a borrower's assets. It is crucial for creditors to file a Vermont financing statement to establish their rights to collateral in case of default. This statement helps protect lenders and ensures proper legal standing.

-

How can airSlate SignNow help with filing a Vermont financing statement?

AirSlate SignNow simplifies the process of preparing and filing a Vermont financing statement. Our platform allows users to easily fill out, sign, and submit documents electronically, saving time and reducing errors. With our user-friendly interface, managing financing statements becomes efficient and straightforward.

-

What are the benefits of using airSlate SignNow for a Vermont financing statement?

Using airSlate SignNow for your Vermont financing statement offers several benefits, including electronic signing, enhanced document security, and streamlined workflows. Our solution is cost-effective and ensures that your financing statements comply with state regulations, giving you peace of mind.

-

Is it affordable to use airSlate SignNow for Vermont financing statements?

Yes, airSlate SignNow is a cost-effective solution for handling Vermont financing statements. We offer pricing plans that cater to businesses of all sizes, ensuring that you only pay for the features you need. This affordability allows businesses to manage their document needs without breaking the bank.

-

Can I integrate airSlate SignNow with other business tools for Vermont financing statements?

Absolutely! airSlate SignNow offers integrations with various business tools to enhance your workflow when dealing with Vermont financing statements. You can connect with CRM, accounting, and project management software to streamline your document management process.

-

What features does airSlate SignNow provide for managing Vermont financing statements?

AirSlate SignNow provides features such as customizable templates, electronic signatures, and document tracking specifically designed for financing statements. These tools allow you to create and manage Vermont financing statements efficiently while ensuring compliance and accuracy.

-

How does airSlate SignNow ensure the security of my Vermont financing statement?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your Vermont financing statement and any sensitive information contained within. Our platform is designed to keep your documents safe from unauthorized access while providing you with easy access.

Get more for Vermont Financing Statement

- Western oklahoma state college transcript request form

- Adult model release form

- Arizona common grant application arizona grantmakers forum arizonagrantmakersforum form

- New boatboat transfer additional owners form transport wa gov

- Ocean county college transcript request form

- Autism elopement alert form

- Gainesville ga housing authority waiting list form

- Sc terms of employment form accuchex payroll services

Find out other Vermont Financing Statement

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document