Contract for Deed Seller's Annual Accounting Statement Washington Form

What is the Contract For Deed Seller's Annual Accounting Statement Washington

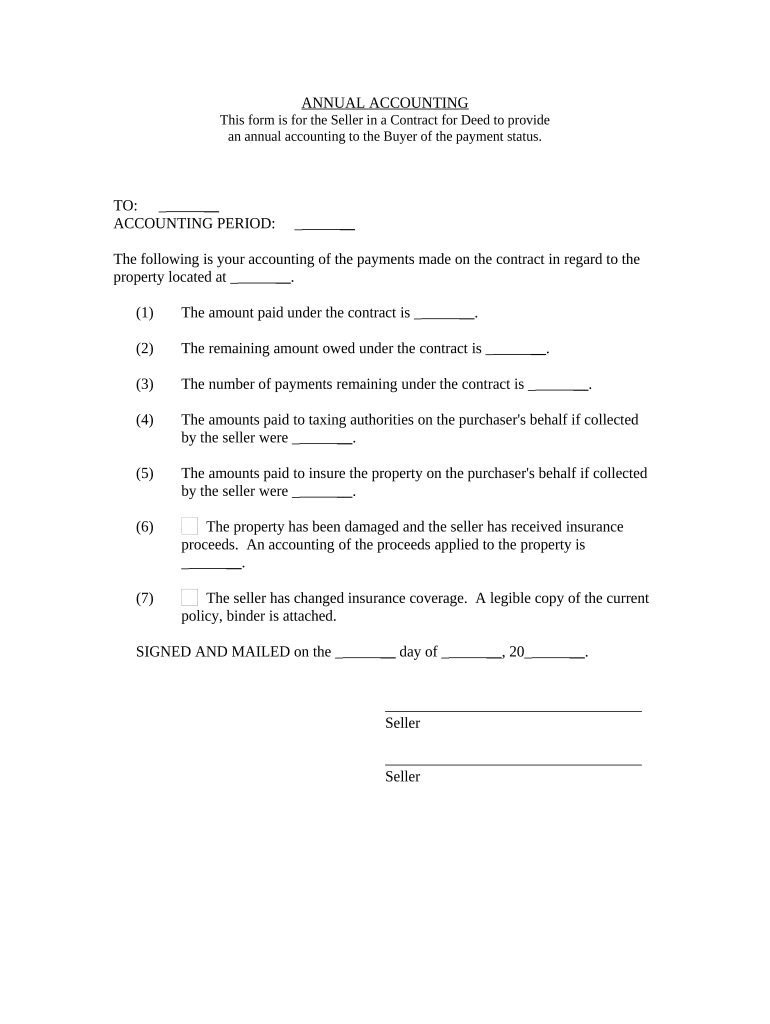

The Contract For Deed Seller's Annual Accounting Statement in Washington is a formal document that outlines the financial transactions related to a contract for deed arrangement. This statement is essential for both sellers and buyers as it provides a clear record of payments made, outstanding balances, and any applicable interest. It serves as a crucial tool for maintaining transparency in the seller-buyer relationship, ensuring that both parties are aware of their financial obligations and rights under the contract. This document is particularly important for tax reporting and compliance purposes, as it may be required for income reporting by the seller.

Steps to Complete the Contract For Deed Seller's Annual Accounting Statement Washington

Completing the Contract For Deed Seller's Annual Accounting Statement involves several key steps:

- Gather all relevant financial information, including payment history, interest rates, and any additional fees.

- Use a standardized form or template to ensure all necessary fields are included, such as buyer and seller information, property details, and payment breakdowns.

- Accurately fill in the payment details, including the total amount received, outstanding balance, and any applicable interest calculations.

- Review the completed statement for accuracy, ensuring all figures match the transaction records.

- Provide a copy of the statement to the buyer and retain a copy for your records.

Legal Use of the Contract For Deed Seller's Annual Accounting Statement Washington

The legal use of the Contract For Deed Seller's Annual Accounting Statement in Washington is governed by state laws regarding real estate transactions and contract enforcement. This document is legally binding when properly filled out and signed by both parties. It must comply with the Washington State laws that regulate contracts for deed, ensuring that all terms are clear and enforceable. This includes adhering to any disclosure requirements and maintaining accurate records of all financial transactions. Failure to comply with these legal standards may result in disputes or penalties.

Key Elements of the Contract For Deed Seller's Annual Accounting Statement Washington

Several key elements must be included in the Contract For Deed Seller's Annual Accounting Statement to ensure its effectiveness and legal compliance:

- Seller and Buyer Information: Full names and contact details of both parties.

- Property Description: A detailed description of the property involved in the contract.

- Payment History: A comprehensive record of all payments made, including dates and amounts.

- Outstanding Balance: The current amount owed by the buyer.

- Interest Rates: Any applicable interest rates and calculations must be clearly stated.

- Signatures: Signatures of both parties to validate the document.

How to Obtain the Contract For Deed Seller's Annual Accounting Statement Washington

Obtaining the Contract For Deed Seller's Annual Accounting Statement in Washington can be accomplished through several methods:

- Online Resources: Many legal and real estate websites offer templates that can be downloaded and customized.

- Legal Professionals: Consulting with a real estate attorney can provide tailored guidance and ensure compliance with state laws.

- Local Government Offices: Some counties may provide official forms or guidelines for completing the statement.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of income from contracts for deed. Sellers must report income received as part of the contract on their tax returns. It is essential to maintain accurate records of all transactions, as the IRS may require documentation to verify income claims. Understanding these guidelines can help sellers avoid potential tax issues and ensure compliance with federal tax laws.

Quick guide on how to complete contract for deed sellers annual accounting statement washington

Fill out Contract For Deed Seller's Annual Accounting Statement Washington effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Contract For Deed Seller's Annual Accounting Statement Washington on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Contract For Deed Seller's Annual Accounting Statement Washington with ease

- Find Contract For Deed Seller's Annual Accounting Statement Washington and click Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Contract For Deed Seller's Annual Accounting Statement Washington to ensure exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Contract For Deed Seller's Annual Accounting Statement in Washington?

A Contract For Deed Seller's Annual Accounting Statement in Washington is a document that provides a comprehensive overview of the financial transactions between the seller and buyer under a contract for deed. This statement includes payments made, outstanding balances, and other critical financial details. Understanding this statement is essential for both parties to ensure transparency and proper financial planning.

-

How can airSlate SignNow help me create a Contract For Deed Seller's Annual Accounting Statement in Washington?

airSlate SignNow simplifies the process of creating a Contract For Deed Seller's Annual Accounting Statement in Washington by providing user-friendly templates and document automation tools. Our platform allows you to easily fill in necessary information and generate accurate accounting statements. Moreover, electronic signing features ensure that all parties can sign the document securely and quickly.

-

Is there a cost associated with using airSlate SignNow for a Contract For Deed Seller's Annual Accounting Statement in Washington?

Yes, airSlate SignNow offers affordable pricing plans that cater to different business needs, including those requiring a Contract For Deed Seller's Annual Accounting Statement in Washington. Our pricing is competitive and scales based on the number of users and features needed. We provide a cost-effective solution for managing your document workflow while avoiding expensive alternatives.

-

What are the benefits of using airSlate SignNow for my Contract For Deed Seller's Annual Accounting Statement in Washington?

Using airSlate SignNow for your Contract For Deed Seller's Annual Accounting Statement in Washington streamlines the documentation process, enhances security, and saves you time. Our platform ensures that all documents are legally binding and easily accessible for both parties. Additionally, you can track the status of your documents in real time, giving you peace of mind throughout the transaction.

-

Can I integrate airSlate SignNow with other software for my Contract For Deed Seller's Annual Accounting Statement in Washington?

Yes, airSlate SignNow offers seamless integrations with various software solutions, enabling you to enhance your workflow when creating a Contract For Deed Seller's Annual Accounting Statement in Washington. Whether you’re using CRM systems, accounting software, or cloud storage services, our integration capabilities streamline your processes for maximum efficiency.

-

What features does airSlate SignNow offer for managing my Contract For Deed Seller's Annual Accounting Statement in Washington?

airSlate SignNow provides several features designed to simplify the management of your Contract For Deed Seller's Annual Accounting Statement in Washington. Key features include document templates, eSigning, secure storage, and automated workflows. These tools ensure efficient handling of all related documents, making the process straightforward and user-friendly.

-

Is airSlate SignNow compliant with Washington state laws for a Contract For Deed Seller's Annual Accounting Statement?

Yes, airSlate SignNow is compliant with Washington state laws regarding the creation and signing of contracts, including the Contract For Deed Seller's Annual Accounting Statement in Washington. Our platform adheres to legal standards, ensuring that your documents meet all regulatory requirements. You can confidently use airSlate SignNow to manage your legal agreements.

Get more for Contract For Deed Seller's Annual Accounting Statement Washington

- Defendants full name form

- Regular claims hawaii state judiciary form

- Answering a complaint in probate ampamp family court form

- Term restrictions of the original lease form

- Expenses that can help you pass bankruptcys means testnolo form

- 2 number of accepted transaction sets 3 free form message

- If required by the agreement i am enclosing herewith as a down form

- Group title pinellas news title pinellas news march 18 form

Find out other Contract For Deed Seller's Annual Accounting Statement Washington

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement