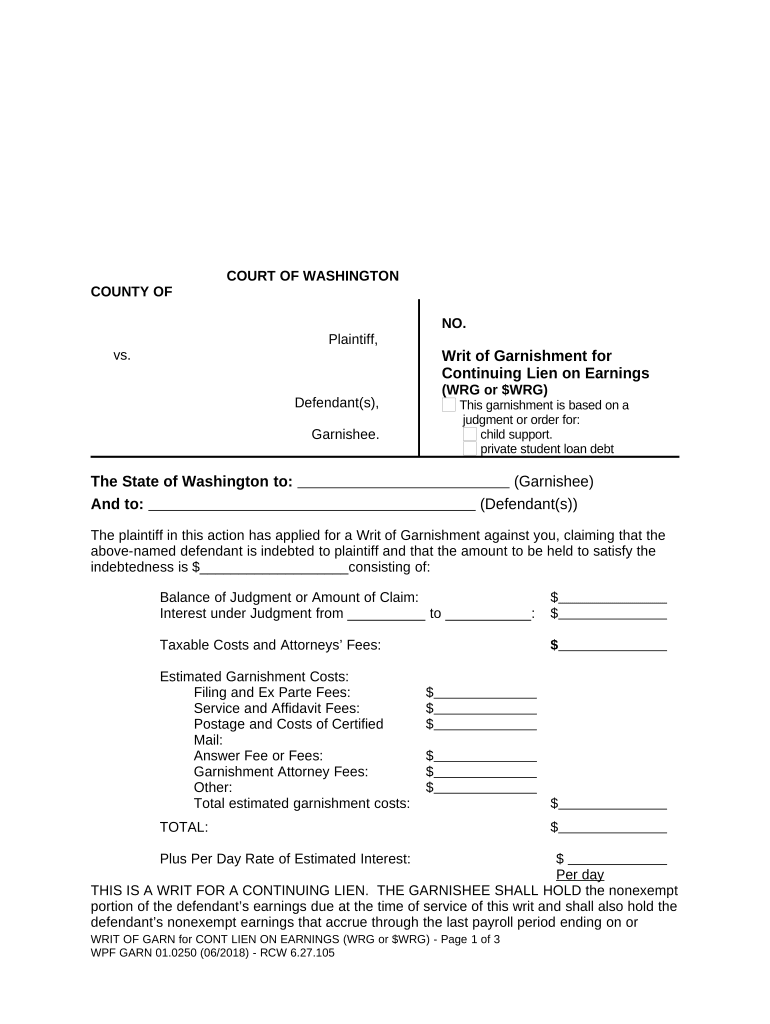

Lien Earnings Form

What is the lien earnings?

The term "lien earnings" refers to the income that can be garnished from an individual's wages or bank accounts to satisfy a debt. This process is often initiated through a legal mechanism known as a writ of garnishment. In the context of garnishment continuing, lien earnings are specifically the ongoing payments that may be subject to garnishment until the debt is fully paid. Understanding this concept is crucial for both creditors seeking repayment and debtors who want to know their rights and obligations.

How to use the lien earnings

Using lien earnings effectively involves understanding how garnishment works and ensuring compliance with relevant legal requirements. Creditors must file a writ of garnishment with the appropriate court, detailing the amount owed and the source of the lien earnings. Once approved, the court issues an order that directs the debtor's employer or bank to withhold a specified portion of the earnings. Debtors should be aware of their rights, including the ability to contest the garnishment if they believe it is unjust or exceeds legal limits.

Steps to complete the lien earnings

Completing the process for lien earnings involves several key steps:

- File a writ of garnishment with the court, including necessary documentation to support the claim.

- Receive a court order that specifies the amount to be garnished from the debtor's earnings.

- Notify the employer or financial institution of the garnishment order.

- Monitor the payments received to ensure compliance with the court's order.

- Keep records of all transactions related to the garnishment for future reference.

Legal use of the lien earnings

The legal use of lien earnings is governed by federal and state laws, which outline the permissible amounts that can be garnished. Typically, a creditor can garnish a percentage of disposable earnings, which is the amount remaining after mandatory deductions. It is essential for creditors to adhere to these regulations to avoid legal repercussions. Debtors also have protections under the law, including limits on the amount that can be garnished and the requirement for proper notification before garnishment begins.

State-specific rules for the lien earnings

Each state in the U.S. has its own rules regarding lien earnings and garnishment. These rules can vary significantly, affecting the percentage of earnings that can be garnished and the procedures creditors must follow. For example, some states may allow a higher percentage of garnishment for certain types of debts, while others may have stricter limits. It is important for both creditors and debtors to familiarize themselves with their state's specific laws to ensure compliance and protect their rights.

Examples of using the lien earnings

Examples of lien earnings in action can help clarify how the process works. For instance, if an employee owes a debt of $5,000, a creditor may file a writ of garnishment to collect a portion of the employee's wages. If the court allows a garnishment of 25% of the employee's disposable earnings, the employer will withhold that amount from each paycheck until the debt is satisfied. Another example could involve bank accounts, where a creditor may freeze a debtor's account to collect funds directly to cover the owed amount.

Quick guide on how to complete lien earnings

Prepare Lien Earnings effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Lien Earnings on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign Lien Earnings with ease

- Locate Lien Earnings and then click Get Form to begin.

- Utilize the resources we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your adjustments.

- Select how you wish to deliver your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form hunting, or errors that require the printing of new document copies. airSlate SignNow addresses your document management needs within a few clicks from any device you prefer. Modify and eSign Lien Earnings and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does garnishment continuing mean in the context of SignNow?

Garnishment continuing refers to the ongoing process of deducting payments from a person's wages to satisfy a debt through legal means. With airSlate SignNow, you can easily manage the documentation needed for garnishment continuing, ensuring compliance and timely processing of necessary documents.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to fit businesses of all sizes. Each plan includes features that support processes like garnishment continuing, allowing you to efficiently manage your document workflows at a competitive price.

-

How can airSlate SignNow simplify the garnishment continuing process?

airSlate SignNow simplifies the garnishment continuing process by providing an intuitive platform for eSigning and document management. You can automate notifications and reminders for documentation updates, ensuring that all parties are informed and that the process is seamless.

-

Are there integrations available that support garnishment continuing with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications like Google Drive, Dropbox, and more, which can help streamline your garnishment continuing documentation. These integrations provide flexibility and enhance your workflow efficiency.

-

What features does airSlate SignNow offer to help manage garnishment continuing?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure eSigning capabilities that assist in managing garnishment continuing processes. These tools help reduce errors and save time, making your operations more efficient.

-

How does airSlate SignNow ensure compliance during garnishment continuing?

airSlate SignNow ensures compliance in garnishment continuing by providing legally binding eSignatures and audit trails. This visibility helps organizations maintain proper records and stay compliant with legal requirements related to document handling.

-

Can I track the status of garnishment continuing documents in airSlate SignNow?

Absolutely! airSlate SignNow offers tracking features that allow you to monitor the status of your garnishment continuing documents in real-time. This transparency ensures that you are aware of where documents are in the workflow, preventing delays.

Get more for Lien Earnings

Find out other Lien Earnings

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now