Rpd 41096 2016-2026

What is the RPD 41096

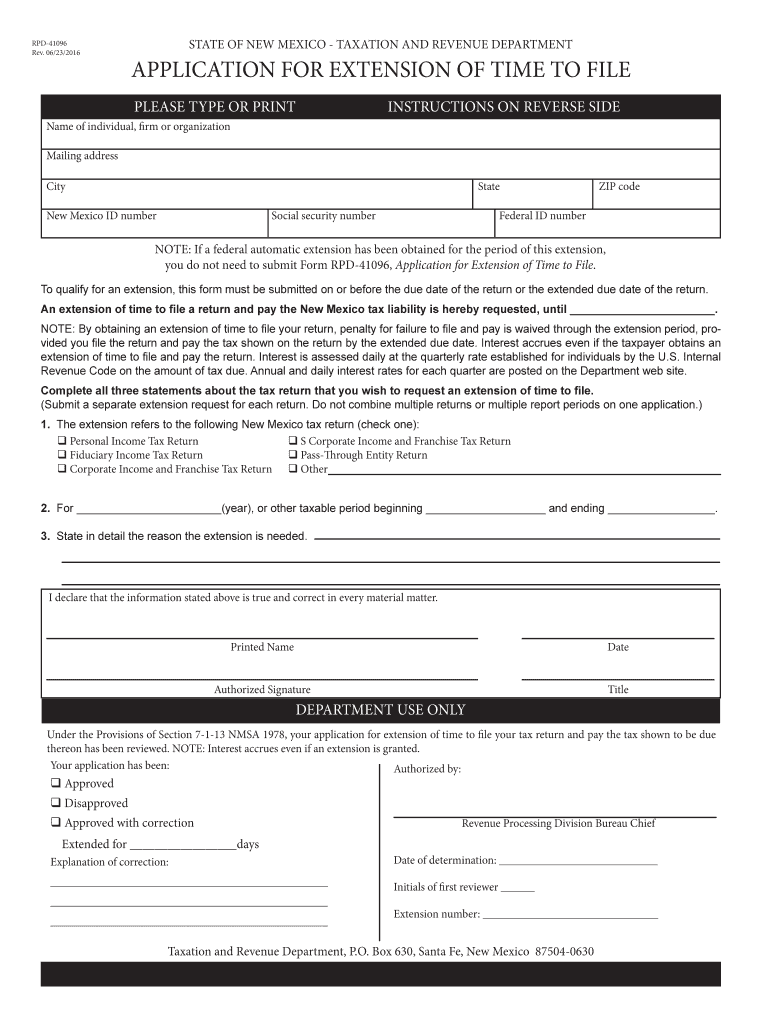

The RPD 41096 is a form used in New Mexico for filing a tax extension. This document allows taxpayers to request additional time to file their state income tax returns. By submitting the RPD 41096, individuals can avoid penalties associated with late filing, provided they meet the requirements and deadlines set by the state. It is essential for taxpayers to understand the purpose of this form to ensure compliance with state tax regulations.

How to use the RPD 41096

Using the RPD 41096 involves a few straightforward steps. First, gather all necessary information, including your Social Security number or taxpayer identification number, income details, and any deductions you plan to claim. Next, fill out the form accurately, ensuring that all fields are completed. Once the form is filled, you can submit it electronically through a secure platform or print it out for mailing. It is crucial to keep a copy of the submitted form for your records.

Steps to complete the RPD 41096

Completing the RPD 41096 requires careful attention to detail. Follow these steps for a successful submission:

- Download the RPD 41096 form from the New Mexico Taxation and Revenue Department website.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Indicate the type of extension you are requesting and the reason for the extension.

- Review the form for accuracy and completeness.

- Submit the form electronically or via mail before the deadline.

Legal use of the RPD 41096

The RPD 41096 is legally recognized by the New Mexico Taxation and Revenue Department. It provides taxpayers with an official means to request an extension for filing their state tax returns. To ensure legal compliance, it is vital to adhere to the guidelines set forth by the state, including submission deadlines and eligibility criteria. Utilizing this form correctly helps avoid penalties and maintains good standing with state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the RPD 41096 are critical to avoid penalties. Typically, taxpayers must submit the form by the original due date of their tax return. For most individuals, this date is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about these dates to ensure timely submission and compliance with state tax laws.

Required Documents

When completing the RPD 41096, certain documents may be necessary to support your request for an extension. These documents include:

- Your previous year's tax return for reference.

- Documentation of income sources, such as W-2s or 1099s.

- Any relevant information regarding deductions or credits you plan to claim.

Having these documents on hand can streamline the completion process and help ensure accuracy.

Penalties for Non-Compliance

Failing to submit the RPD 41096 by the deadline can result in penalties imposed by the New Mexico Taxation and Revenue Department. These penalties may include late filing fees and interest on any unpaid taxes. Understanding the consequences of non-compliance emphasizes the importance of timely submission and adherence to state tax regulations.

Quick guide on how to complete note by obtaining an extension of time to file your return penalty for failure to file and pay is waived through the extension

Your assistance manual for preparing your Rpd 41096

If you’re curious about how to finalize and submit your Rpd 41096, here are some concise guidelines to simplify tax processing.

First, you need to create your airSlate SignNow account to revolutionize your document handling online. airSlate SignNow is an intuitive and robust document solution that enables you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to update information as needed. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Rpd 41096 in just a few minutes:

- Create your account and start working on PDFs in no time.

- Browse our library to obtain any IRS tax form; search through various versions and schedules.

- Click Get form to access your Rpd 41096 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be advised that submitting paper forms can lead to increased errors and delayed refunds. Naturally, before e-filing your taxes, check the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct note by obtaining an extension of time to file your return penalty for failure to file and pay is waived through the extension

FAQs

-

For tax filing taxes if you file an extension and submit on the last date due on paper, is your return less likely to be audited?

It makes no difference in being audited. What matters on an audit pertains to amounts in question, or types of claimed deductions, etc. Also, there are several different types of audits and they may occur throughout different periods of processing the returns. Some audits are random, some computer generated, etc.Selection for an audit does not always suggest there’s a problem. The IRS uses several different methods:Random selection and computer screening - sometimes returns are selected based solely on a statistical formula. We compare your tax return against “norms” for similar returns. We develop these “norms” from audits of a statistically valid random sample of returns, as part of the National Research Program the IRS conducts. The IRS uses this program to update return selection information.Related examinations – we may select your returns when they involve issues or transactions with other taxpayers, such as business partners or investors, whose returns were selected for audit.Next, an experienced auditor reviews the return. They may accept it; or if the auditor notes something questionable, they will identify the items noted and forward the return for assignment to an examining group.Note: filing an amended return does not affect the selection process of the original return. However, amended returns also go through a screening process and the amended return may be selected for audit. Additionally, a refund is not necessarily a trigger for an audit.For additional information you may want to refer to this site: IRS Audits | Internal Revenue ServiceI hope this information is helpful.

Create this form in 5 minutes!

How to create an eSignature for the note by obtaining an extension of time to file your return penalty for failure to file and pay is waived through the extension

How to create an eSignature for the Note By Obtaining An Extension Of Time To File Your Return Penalty For Failure To File And Pay Is Waived Through The Extension online

How to create an electronic signature for your Note By Obtaining An Extension Of Time To File Your Return Penalty For Failure To File And Pay Is Waived Through The Extension in Google Chrome

How to generate an electronic signature for putting it on the Note By Obtaining An Extension Of Time To File Your Return Penalty For Failure To File And Pay Is Waived Through The Extension in Gmail

How to create an electronic signature for the Note By Obtaining An Extension Of Time To File Your Return Penalty For Failure To File And Pay Is Waived Through The Extension right from your smartphone

How to generate an electronic signature for the Note By Obtaining An Extension Of Time To File Your Return Penalty For Failure To File And Pay Is Waived Through The Extension on iOS

How to make an electronic signature for the Note By Obtaining An Extension Of Time To File Your Return Penalty For Failure To File And Pay Is Waived Through The Extension on Android

People also ask

-

What is Rpd 41096 and how does it work with airSlate SignNow?

Rpd 41096 refers to a specific document requirement that can be easily managed using airSlate SignNow. With our platform, businesses can upload, send, and eSign documents related to Rpd 41096 efficiently, ensuring compliance and streamlining workflows.

-

How much does airSlate SignNow cost for Rpd 41096 document processing?

The pricing for airSlate SignNow is competitive and designed to fit various budget needs, especially for businesses dealing with Rpd 41096. We offer flexible subscription plans that cater to small and large organizations, ensuring you get the best value for managing your document processes.

-

What features does airSlate SignNow offer for Rpd 41096 workflows?

airSlate SignNow provides robust features tailored for Rpd 41096 workflows, including customizable templates, automated reminders, and real-time tracking. These features enhance the efficiency of managing Rpd 41096 documentation while ensuring a smooth eSigning experience.

-

How can airSlate SignNow help reduce turnaround time for Rpd 41096 documents?

By utilizing airSlate SignNow, businesses can signNowly reduce the turnaround time for Rpd 41096 documents. Our platform automates the eSigning process, allowing multiple stakeholders to sign documents quickly and securely, thus accelerating your workflow.

-

Are there integrations available with airSlate SignNow for Rpd 41096?

Yes, airSlate SignNow offers various integrations that can enhance your Rpd 41096 document management. You can connect with popular tools like Google Drive, Salesforce, and Microsoft Office, enabling seamless data flow and collaboration across platforms.

-

What are the benefits of using airSlate SignNow for Rpd 41096 compliance?

Using airSlate SignNow for Rpd 41096 enhances compliance by providing secure and traceable eSigning capabilities. This ensures that all document transactions meet legal requirements, reducing the risk of errors and improving overall compliance management.

-

Can I customize my Rpd 41096 documents in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Rpd 41096 documents with ease. You can modify templates, add branding, and include necessary fields to tailor your documents according to your business needs.

Get more for Rpd 41096

- Application for reduced cigarette ignition propensity firemarshal wv form

- Wv dmv refund applications form

- Repo order 2000 form

- Online certificate fillable llc wv form

- Wv abca form

- Cosmetic total loss form

- Wv public accountant renewal form 2013

- I 030 wisconsin schedule cc request for a closing certificate for fiduciaries 794892428 form

Find out other Rpd 41096

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template