Individual Credit Application Washington Form

What is the Individual Credit Application Washington

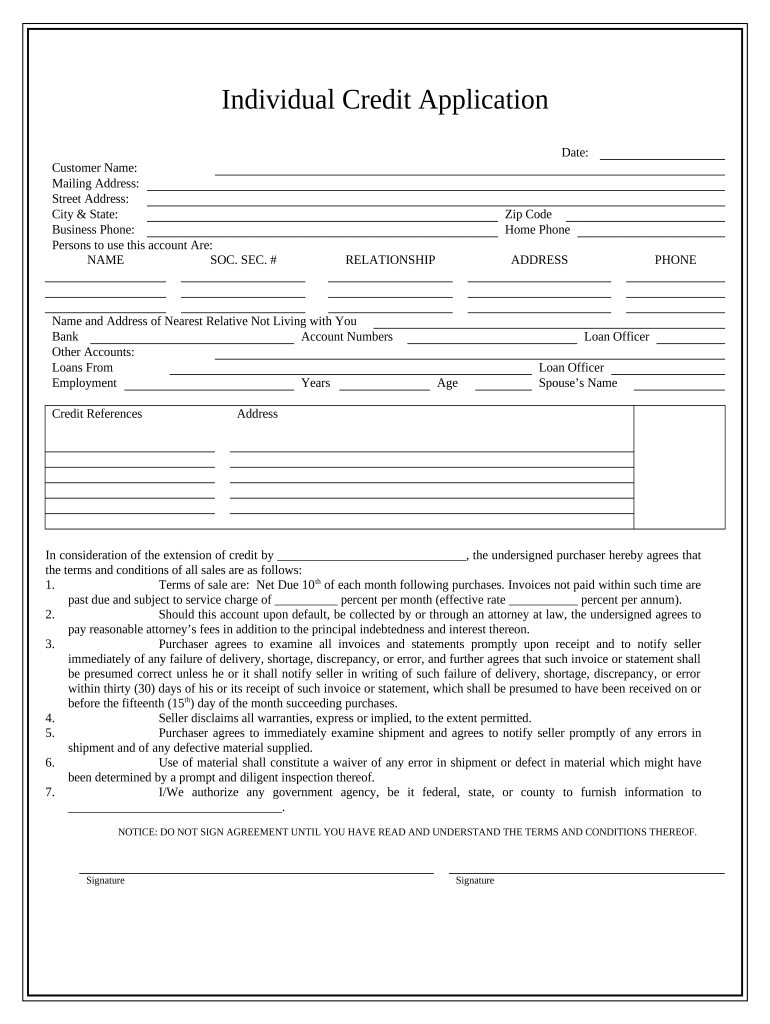

The Individual Credit Application Washington is a formal document used by individuals seeking credit from financial institutions or lenders in Washington State. This application gathers essential information about the applicant's financial history, employment status, and personal details to assess creditworthiness. It typically includes sections for personal identification, income verification, and consent for credit checks. Understanding this application is crucial for anyone looking to secure loans, credit cards, or mortgages in Washington.

Steps to complete the Individual Credit Application Washington

Completing the Individual Credit Application Washington involves several key steps to ensure accuracy and completeness. First, gather all necessary personal information, including your Social Security number, employment details, and income sources. Next, fill out the application form carefully, ensuring that all sections are completed. It is important to double-check the information for any errors or omissions. After filling out the form, review it one last time before submitting. This thorough approach can help streamline the credit approval process.

Legal use of the Individual Credit Application Washington

The legal use of the Individual Credit Application Washington is governed by various federal and state regulations designed to protect consumers. This includes compliance with the Fair Credit Reporting Act (FCRA), which mandates that lenders inform applicants about their rights regarding credit reports. Additionally, the application must be used solely for the purpose of assessing creditworthiness and should not be misused for any other purposes. Understanding these legal frameworks can help applicants navigate the credit process with confidence.

Key elements of the Individual Credit Application Washington

Key elements of the Individual Credit Application Washington include personal identification information, financial history, and consent for credit inquiries. Applicants are typically required to provide their full name, address, date of birth, and Social Security number. Financial information may include current employment status, monthly income, existing debts, and assets. Consent for credit checks is crucial, as it allows lenders to access the applicant's credit report to evaluate their creditworthiness.

Eligibility Criteria

Eligibility criteria for the Individual Credit Application Washington vary by lender but generally include age, residency, and credit history requirements. Applicants must be at least eighteen years old and a legal resident of Washington State. Lenders often assess the applicant's credit score and history to determine eligibility, as well as their ability to repay the requested credit. Meeting these criteria is essential for a successful application process.

Form Submission Methods

The Individual Credit Application Washington can typically be submitted through various methods, including online, by mail, or in person. Many lenders offer digital platforms where applicants can complete and submit the form electronically, providing a quick and efficient process. Alternatively, applicants may choose to print the form, fill it out, and send it via postal mail. In-person submissions may also be available at local branches of financial institutions, allowing for direct interaction with loan officers.

Examples of using the Individual Credit Application Washington

Examples of using the Individual Credit Application Washington can be found in various scenarios, such as applying for a personal loan, a mortgage, or a credit card. For instance, an individual seeking a personal loan might fill out this application to provide lenders with the necessary information to assess their creditworthiness. Similarly, someone looking to purchase a home would use the application to apply for a mortgage, allowing lenders to evaluate their financial situation and make informed lending decisions.

Quick guide on how to complete individual credit application washington

Complete Individual Credit Application Washington effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the features necessary to create, alter, and eSign your documents swiftly without delays. Manage Individual Credit Application Washington on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The most effective way to alter and eSign Individual Credit Application Washington with ease

- Locate Individual Credit Application Washington and click on Get Form to initiate.

- Utilize the features we offer to complete your form.

- Select relevant sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Alter and eSign Individual Credit Application Washington and guarantee seamless communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Individual Credit Application Washington process and how does it work?

The Individual Credit Application Washington is a streamlined process that allows individuals to apply for credit online. With airSlate SignNow, users can easily complete and eSign their applications, ensuring efficient processing. This eliminates paperwork and reduces the time required for approval, making it a convenient choice.

-

What features does airSlate SignNow offer for the Individual Credit Application Washington?

airSlate SignNow provides several features for the Individual Credit Application Washington, including customizable templates, real-time collaboration, and secure eSignature capabilities. Users can also track application status and receive notifications, ensuring a smooth workflow. These functionalities enhance the user experience and promote efficient document management.

-

How much does it cost to use the Individual Credit Application Washington with airSlate SignNow?

The pricing for using the Individual Credit Application Washington with airSlate SignNow is competitive and tailored to different business needs. Plans vary based on features, the number of users, and document volume. By choosing airSlate SignNow, you can access cost-effective solutions that help optimize your credit application processes.

-

What are the benefits of using airSlate SignNow for my Individual Credit Application Washington?

Using airSlate SignNow for your Individual Credit Application Washington offers numerous benefits, such as speed, efficiency, and security. The digital platform simplifies the application process and reduces the risk of error associated with paper forms. Additionally, you can achieve compliance with regulatory standards effortlessly.

-

Is airSlate SignNow secure for submitting the Individual Credit Application Washington?

Yes, airSlate SignNow utilizes advanced security measures to ensure that your Individual Credit Application Washington is safe. This includes data encryption, secure server storage, and strict compliance with industry regulations. Users can submit their applications with confidence, knowing their data is well-protected.

-

Can I integrate airSlate SignNow with other applications for the Individual Credit Application Washington?

AirSlate SignNow offers seamless integration with a variety of applications, enhancing the usability of the Individual Credit Application Washington. You can easily connect with CRM systems, accounting software, and other tools to streamline your workflow. This integration ensures that all relevant data is synchronized efficiently.

-

What types of businesses can benefit from the Individual Credit Application Washington?

Any business that requires credit evaluations can benefit from the Individual Credit Application Washington offered by airSlate SignNow. This includes financial institutions, lenders, and service providers who need to assess individual creditworthiness. The user-friendly interface caters to businesses of all sizes seeking to simplify their credit application process.

Get more for Individual Credit Application Washington

- Wwwuslegalformscomform library536336 md ccmd cc dr 20 2021 2022 fill and sign printable template

- Go2bank voided check pdf form

- Fact sheet healthcare providers form

- Marketwatchcominvestingsecfilemarketwatchcom form

- Wwwaowmacomfilesfillable registration form edmontonmemo alberta onsite wastewater management association

- Concealed permit application form

- Mri and ct requisition formsscreening form mri safetyscreening form mri safetyscreening form mri safety

- As 52 solicitud cambio form

Find out other Individual Credit Application Washington

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself