Chapter 13 Plan Fillable Form

What is the Chapter 13 Plan Fillable

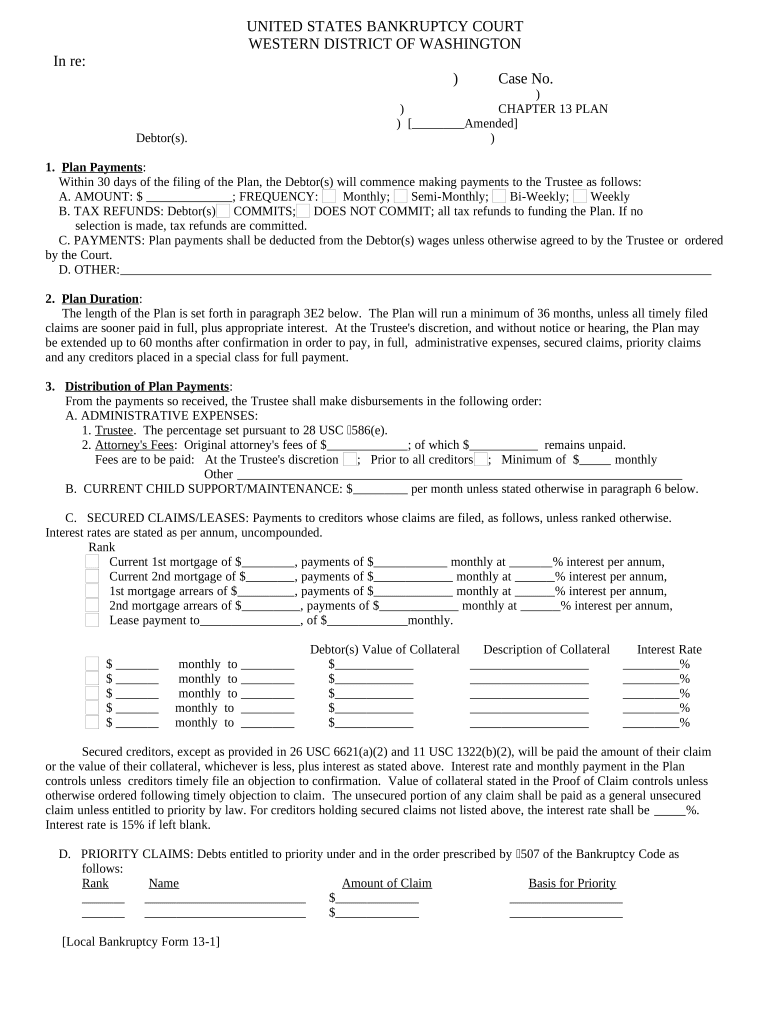

The Chapter 13 plan fillable form is a legal document used in the United States for individuals seeking to restructure their debts under Chapter 13 of the Bankruptcy Code. This form outlines how the debtor intends to repay creditors over a specified period, typically three to five years. It is essential for individuals who wish to keep their assets while repaying debts in a manageable way. The fillable format allows users to complete the form digitally, ensuring clarity and accuracy in the information provided.

How to Use the Chapter 13 Plan Fillable

Using the Chapter 13 plan fillable form involves several key steps. First, gather all necessary financial information, including income, expenses, and debt details. Next, access the fillable form through a reliable digital platform. Carefully enter the required information, ensuring that all details are accurate and complete. Once the form is filled out, review it for any errors. Finally, sign the document electronically, which will provide a secure and legally binding signature, and submit it as per the guidelines set by the bankruptcy court.

Steps to Complete the Chapter 13 Plan Fillable

Completing the Chapter 13 plan fillable form can be streamlined by following these steps:

- Collect all relevant financial documents, including income statements and a list of debts.

- Access the fillable form on a trusted digital platform.

- Fill in your personal information, including your name, address, and case number.

- Detail your income and expenses to demonstrate your ability to repay debts.

- Outline your proposed repayment plan, including the amounts and timelines for payments.

- Review the completed form for accuracy and completeness.

- Sign the form electronically to ensure it is legally binding.

Key Elements of the Chapter 13 Plan Fillable

The Chapter 13 plan fillable form includes several critical elements that must be addressed:

- Debtor Information: This section requires personal details of the debtor, including name and address.

- Income Details: Debtors must provide a comprehensive overview of their monthly income.

- Expense Breakdown: A detailed list of monthly expenses helps establish repayment capability.

- Debt Summary: This section outlines all debts, including secured and unsecured obligations.

- Proposed Repayment Plan: Debtors must clearly state how they intend to repay creditors over the plan duration.

Legal Use of the Chapter 13 Plan Fillable

The Chapter 13 plan fillable form is legally binding when completed and signed according to the regulations set forth by the bankruptcy court. For it to be valid, the debtor must adhere to specific legal requirements, including providing accurate financial information and proposing a feasible repayment plan. Utilizing a trusted platform for electronic signatures enhances the form's legitimacy, ensuring compliance with federal laws governing electronic documents.

Eligibility Criteria for the Chapter 13 Plan Fillable

To utilize the Chapter 13 plan fillable form, individuals must meet certain eligibility criteria. Primarily, the debtor must have a regular income to support the repayment plan. Additionally, there are limits on the amount of unsecured and secured debt a debtor can have, which are adjusted periodically. Individuals who have previously filed for bankruptcy may also need to meet specific conditions related to their prior cases. Understanding these criteria is essential for a successful filing.

Quick guide on how to complete chapter 13 plan fillable

Easily Prepare Chapter 13 Plan Fillable on Any Device

Digital document management has gained popularity among companies and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Chapter 13 Plan Fillable on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

The Easiest Way to Edit and eSign Chapter 13 Plan Fillable Stress-Free

- Locate Chapter 13 Plan Fillable and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, shareable link, or download it to your computer.

Eliminate the worry of misplaced or lost files, tedious form searching, or mistakes that necessitate printing out new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and eSign Chapter 13 Plan Fillable and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a chapter 13 plan fillable?

A chapter 13 plan fillable is a customizable document that allows individuals undergoing bankruptcy to outline their repayment plan. This fillable form simplifies the process by enabling users to enter their specific financial details directly. By using a chapter 13 plan fillable, users ensure their repayment terms are clear and legally binding.

-

How can I create a chapter 13 plan fillable with airSlate SignNow?

Creating a chapter 13 plan fillable with airSlate SignNow is quick and straightforward. Simply select the chapter 13 template, fill in your financial details, and customize it as needed. With our user-friendly interface, you can have your chapter 13 plan fillable ready for e-signature in no time.

-

What are the benefits of using a chapter 13 plan fillable?

The benefits of using a chapter 13 plan fillable include ease of use and improved accuracy in your repayment proposal. This tool helps ensure that all necessary information is included, reducing the risk of errors. Additionally, with a fillable format, you can update your plan easily if your financial situation changes.

-

Is there a cost associated with the chapter 13 plan fillable on airSlate SignNow?

Yes, there is a cost to access the chapter 13 plan fillable feature on airSlate SignNow. However, we offer competitive pricing and various subscription options that provide excellent value for businesses. Our service is designed to be cost-effective while delivering powerful functionalities for e-signing documents.

-

Can I integrate the chapter 13 plan fillable with other tools?

Absolutely! airSlate SignNow allows seamless integrations with various applications and platforms. This means you can easily incorporate your chapter 13 plan fillable into your existing workflow, whether you're using CRM systems, Google Workspace, or other software solutions to enhance efficiency.

-

Is the chapter 13 plan fillable secure to use?

Yes, the chapter 13 plan fillable created through airSlate SignNow is highly secure. We prioritize data protection, employing advanced encryption and compliance with industry standards to ensure that your sensitive information remains confidential. You can e-sign your document confidently, knowing that it is well-protected.

-

Can multiple parties e-sign a chapter 13 plan fillable?

Yes, multiple parties can easily e-sign a chapter 13 plan fillable on airSlate SignNow. Our platform allows you to send documents to multiple signers, making collaboration simple and efficient. This ensures that all necessary parties can review and sign the plan without any hassle.

Get more for Chapter 13 Plan Fillable

- Fail to correct the above conditions i shall take advantage of all remedies under the law form

- Wwwlsnjlaworg form

- If i do not hear from you i will assume you have relented form

- Lease agreement and applicable law form

- Affidavit of work authorization brentwood mo form

- Full text of ampquotmissouri department of labor and industrial form

- Get the installment purchase and security agreement form

- How to get an adult conservatorship in californiaa form

Find out other Chapter 13 Plan Fillable

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe