Living Trust for Husband and Wife with One Child Washington Form

What is the Living Trust For Husband And Wife With One Child Washington

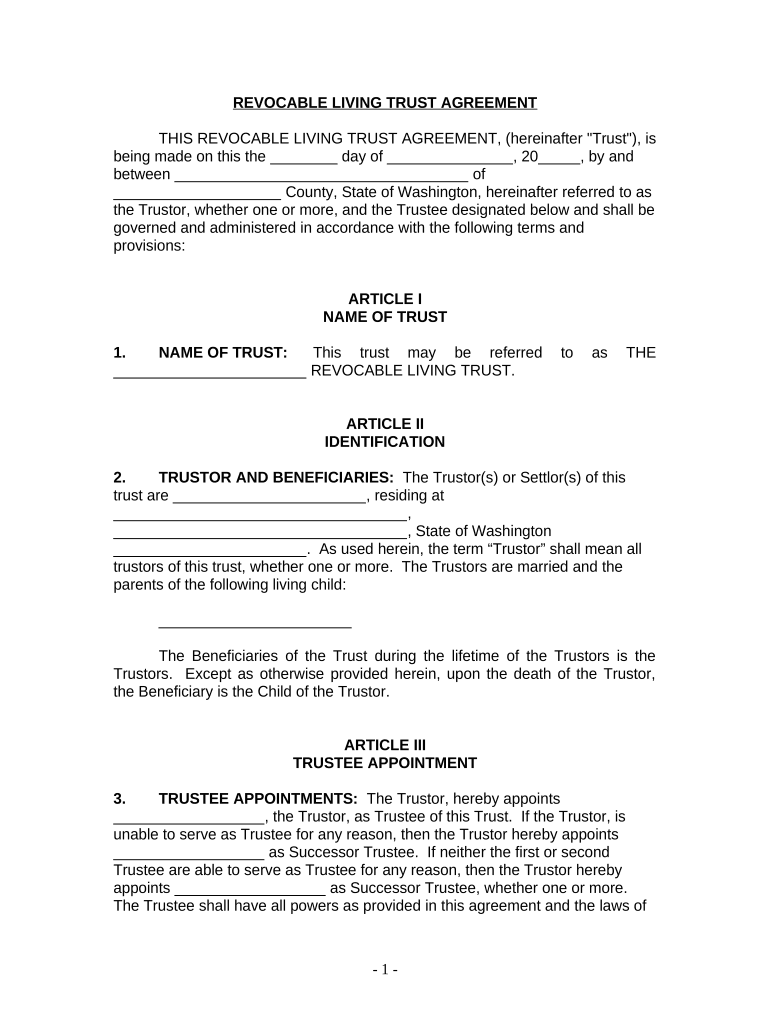

A Living Trust for husband and wife with one child in Washington is a legal document designed to manage and distribute assets during the lifetime of the trust creators and after their passing. This type of trust allows both spouses to retain control over their assets while providing a clear plan for their child’s inheritance. It helps avoid the lengthy probate process, ensuring that the couple's wishes are honored efficiently. By establishing this trust, couples can specify how their assets will be managed and distributed, providing peace of mind for their family's future.

Key Elements of the Living Trust For Husband And Wife With One Child Washington

Several key elements define a Living Trust for husband and wife with one child in Washington. These include:

- Trustees: Typically, both spouses act as trustees, allowing them to manage the trust assets during their lifetime.

- Beneficiaries: The couple's child is usually the primary beneficiary, receiving the assets upon the death of both parents.

- Asset Management: The trust outlines how assets should be managed, including any specific instructions regarding investments and distributions.

- Revocability: This type of trust can be revoked or amended by the creators at any time, providing flexibility as family circumstances change.

Steps to Complete the Living Trust For Husband And Wife With One Child Washington

Completing a Living Trust for husband and wife with one child in Washington involves several important steps:

- Gather Information: Collect details about all assets, including property, bank accounts, and investments.

- Draft the Trust Document: Create the trust document, outlining the terms, trustees, and beneficiaries.

- Sign and Notarize: Both spouses must sign the document in front of a notary public to ensure its legal validity.

- Fund the Trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Living Trust For Husband And Wife With One Child Washington

The legal use of a Living Trust for husband and wife with one child in Washington is to provide a structured way to manage and distribute assets. This trust is recognized by state law, allowing couples to specify their wishes regarding asset distribution without going through probate. It can also provide tax benefits and protect assets from creditors, ensuring that the couple's child receives their intended inheritance without unnecessary delays or complications.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Washington

Washington state has specific rules governing the creation and management of Living Trusts. Key considerations include:

- Witness Requirements: While notarization is essential, having witnesses can further strengthen the trust's validity.

- Property Transfer: Assets must be properly transferred into the trust, requiring specific legal documentation for real estate and other significant assets.

- Tax Implications: Understanding how the trust affects state and federal taxes is crucial for compliance and financial planning.

How to Use the Living Trust For Husband And Wife With One Child Washington

Using a Living Trust for husband and wife with one child in Washington involves actively managing the trust assets and adhering to its terms. The trustees, typically the spouses, handle day-to-day management, ensuring that the trust's provisions are followed. This includes making decisions about investments, distributions, and any changes to the trust as family circumstances evolve. Regular reviews of the trust are advisable to ensure it remains aligned with the couple's wishes and legal requirements.

Quick guide on how to complete living trust for husband and wife with one child washington

Accomplish Living Trust For Husband And Wife With One Child Washington effortlessly on any device

Online document organization has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documentation, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents swiftly without delays. Manage Living Trust For Husband And Wife With One Child Washington on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Living Trust For Husband And Wife With One Child Washington effortlessly

- Locate Living Trust For Husband And Wife With One Child Washington and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tiresome form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Living Trust For Husband And Wife With One Child Washington while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child Washington?

A Living Trust For Husband And Wife With One Child Washington is a legal document that allows parents to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust provides flexibility and control over your estate plan, ensuring that your child is cared for in the way you intend.

-

What are the benefits of creating a Living Trust For Husband And Wife With One Child Washington?

Creating a Living Trust For Husband And Wife With One Child Washington offers numerous benefits, including avoiding probate, protecting your assets from creditors, and ensuring a smoother transition for your child. It helps maintain privacy and can be modified as circumstances change.

-

How much does a Living Trust For Husband And Wife With One Child Washington cost?

The cost of setting up a Living Trust For Husband And Wife With One Child Washington can vary based on the complexity of your estate and whether you seek professional assistance. Generally, prices can range from a few hundred to several thousand dollars, depending on the services you require.

-

Can I change my Living Trust For Husband And Wife With One Child Washington after it is created?

Yes, you can change your Living Trust For Husband And Wife With One Child Washington at any time, as long as you are alive and competent. This flexibility allows you to update beneficiaries, modify distribution instructions, or make other adjustments as your life changes.

-

How does a Living Trust For Husband And Wife With One Child Washington integrate with estate planning?

A Living Trust For Husband And Wife With One Child Washington serves as a vital component of your overall estate plan, working alongside wills and powers of attorney. It ensures that your assets are distributed according to your wishes and can provide clarity for your family regarding your intentions.

-

Are there tax benefits to setting up a Living Trust For Husband And Wife With One Child Washington?

While a Living Trust For Husband And Wife With One Child Washington does not generally provide direct tax benefits, it can be part of a broader tax strategy. Properly structuring your trust can help reduce estate taxes and facilitate a more efficient transfer of assets.

-

What happens to a Living Trust For Husband And Wife With One Child Washington if one spouse passes away?

If one spouse passes away, a Living Trust For Husband And Wife With One Child Washington typically allows the surviving spouse to retain control of the trust assets. This ensures continued management of the estate for the benefit of your child and simplifies the transfer of assets without going through probate.

Get more for Living Trust For Husband And Wife With One Child Washington

- Files its requests for admission to be answered in form

- This case was tried to a jury of twelve persons in the circuit form

- By and through counsel and files this hisher complaint form

- Prosecution and it appearing to the court that notice of said motion has been given to all form

- A minor by and through hisher parents form

- Plaintiffs response to motion for summary judgment form

- Pursuant to rule 56 of the mississippi rules of civil procedure and the court having form

- Order approving third party settlement form

Find out other Living Trust For Husband And Wife With One Child Washington

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free