Business Credit Application Wisconsin Form

What is the Business Credit Application Wisconsin

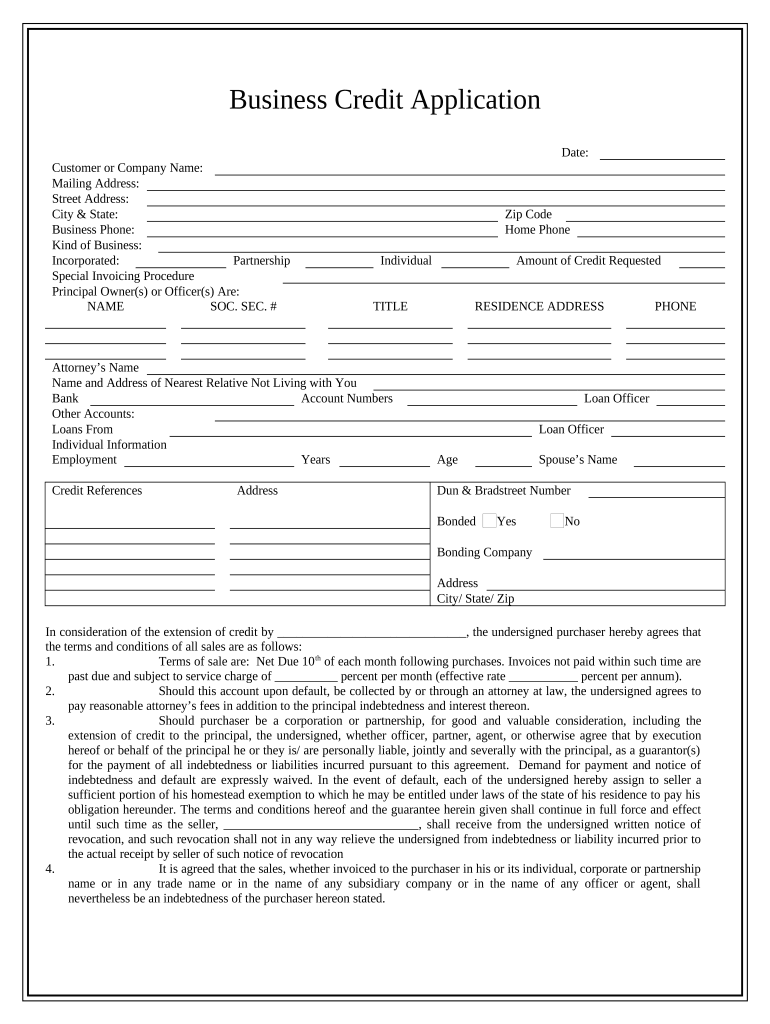

The Business Credit Application Wisconsin is a formal document that businesses in Wisconsin use to apply for credit from financial institutions or suppliers. This application typically requires detailed information about the business, including its legal structure, financial history, and creditworthiness. The purpose of this form is to assess the risk involved in extending credit to the business and to determine the appropriate credit limits.

Key elements of the Business Credit Application Wisconsin

When filling out the Business Credit Application Wisconsin, several key elements must be included to ensure a comprehensive submission. These elements typically include:

- Business Information: Legal name, address, and contact details.

- Ownership Structure: Details about the owners or partners, including their personal information and ownership percentages.

- Financial Statements: Recent financial statements, including balance sheets and income statements.

- Credit History: Information regarding past credit relationships and payment history.

- Bank References: Contact information for banks or financial institutions that manage the business's accounts.

Steps to complete the Business Credit Application Wisconsin

Completing the Business Credit Application Wisconsin involves several important steps to ensure accuracy and completeness:

- Gather Required Information: Collect all necessary documents and details, including financial statements and ownership information.

- Fill Out the Application: Carefully complete each section of the application, ensuring all information is accurate and up-to-date.

- Review for Completeness: Double-check the application for any missing information or errors before submission.

- Submit the Application: Follow the specified submission method, whether online, by mail, or in person, based on the lender's requirements.

Legal use of the Business Credit Application Wisconsin

The Business Credit Application Wisconsin is legally binding once it is signed by the authorized representatives of the business. It is essential that the application is completed truthfully and accurately, as providing false information can lead to legal repercussions, including denial of credit or potential fraud charges. The application must also comply with relevant state and federal laws regarding credit and lending practices.

Eligibility Criteria

To qualify for credit through the Business Credit Application Wisconsin, businesses typically must meet certain eligibility criteria. These may include:

- Business Age: Many lenders require the business to be operational for a specific period, often at least one to two years.

- Creditworthiness: A satisfactory credit score and history are usually necessary to demonstrate the ability to repay borrowed funds.

- Financial Stability: Lenders often look for positive cash flow and stable financial statements to assess risk.

- Legal Compliance: The business must be in good standing with state regulations and have all necessary licenses and permits.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit the Business Credit Application Wisconsin through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer an online portal for submitting applications digitally, which can expedite the process.

- Mail: Businesses may choose to print the application and send it via postal service, ensuring it is sent to the correct address.

- In-Person Submission: Some businesses may prefer to deliver the application directly to a lender's office for immediate processing.

Quick guide on how to complete business credit application wisconsin

Complete Business Credit Application Wisconsin effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Business Credit Application Wisconsin on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Business Credit Application Wisconsin with ease

- Find Business Credit Application Wisconsin and then click Get Form to commence.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Business Credit Application Wisconsin to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application Wisconsin?

A Business Credit Application Wisconsin is a formal document that businesses use to apply for credit from financial institutions or suppliers in Wisconsin. It requests crucial information about the business, including financial history and ownership details. This application helps lenders assess the creditworthiness of the business.

-

How can airSlate SignNow assist with Business Credit Applications in Wisconsin?

airSlate SignNow streamlines the process of creating and sending Business Credit Applications Wisconsin by providing a user-friendly eSigning platform. With our solution, businesses can easily fill out their applications, obtain signatures, and send them securely. This enhances efficiency and reduces turnaround time for credit approvals.

-

What features does airSlate SignNow offer for Business Credit Applications Wisconsin?

airSlate SignNow includes features like customizable templates, secure cloud storage, and real-time document tracking for Business Credit Applications Wisconsin. The platform allows users to create applications that are tailored to their business needs. Additionally, the audit trail feature ensures that all actions taken on the application are recorded.

-

Is airSlate SignNow a cost-effective solution for Business Credit Applications Wisconsin?

Yes, airSlate SignNow is a cost-effective solution for managing Business Credit Applications Wisconsin. With various pricing plans, businesses can choose a plan that best fits their needs and budget. The savings on printing and mailing expenses, combined with improved efficiency, make it a smart investment for businesses of all sizes.

-

Can I integrate airSlate SignNow with other business tools for my Business Credit Applications Wisconsin?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing the process for Business Credit Applications Wisconsin. Popular integrations include CRM systems, cloud storage solutions, and accounting software, allowing businesses to manage their documents and data in one place.

-

What are the benefits of using airSlate SignNow for Business Credit Applications in Wisconsin?

Using airSlate SignNow for Business Credit Applications Wisconsin offers numerous benefits such as improved efficiency, reduced paperwork, and faster processing times. The secure eSigning process ensures that documents are signed legally and correctly, making it easier for businesses to access credit. Additionally, businesses can better track their applications' status in real-time.

-

How secure is the airSlate SignNow platform for Business Credit Applications Wisconsin?

The airSlate SignNow platform prioritizes security, especially for Business Credit Applications Wisconsin. It employs advanced encryption and secure data storage protocols to protect sensitive information. Compliance with various regulatory standards ensures that your business documents remain safe throughout the signing process.

Get more for Business Credit Application Wisconsin

- Control number ca p086 pkg form

- The essential checklist for international travel what to do form

- Control number ca p088 pkg form

- Control number ca p090 pkg form

- Control number ca p092 pkg form

- Control number ca p093 pkg form

- Power of attorney requirements in california legalzoom form

- Starting a business in californiachecklist and forms

Find out other Business Credit Application Wisconsin

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship