Non Foreign Affidavit under IRC 1445 Wisconsin Form

What is the Non Foreign Affidavit Under IRC 1445 Wisconsin

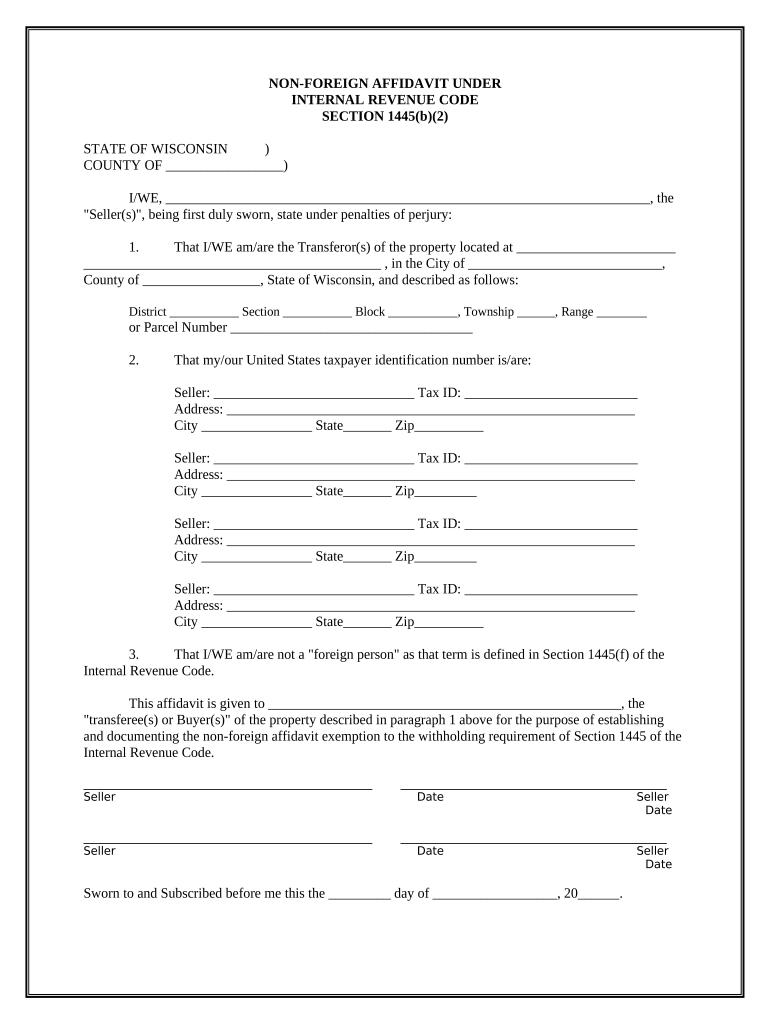

The Non Foreign Affidavit Under IRC 1445 in Wisconsin is a legal document required for transactions involving the sale of real property by foreign persons. This affidavit serves to certify that the seller is not a foreign person, which helps buyers avoid withholding taxes that would apply if the seller were foreign. The form is essential for compliance with the Internal Revenue Code, specifically Section 1445, which mandates that buyers withhold a percentage of the sales price when the seller is a foreign entity. Proper completion of this affidavit is crucial to ensure that the transaction is processed without unnecessary tax implications.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 Wisconsin

Completing the Non Foreign Affidavit Under IRC 1445 involves several key steps to ensure accuracy and compliance. First, gather the necessary information about the seller, including their legal name, address, and taxpayer identification number. Next, accurately fill out the form, confirming that the seller is not a foreign person as defined by the IRS. After completing the form, ensure that it is signed and dated by the seller. It is advisable to have the affidavit notarized to enhance its credibility. Finally, provide a copy of the completed affidavit to the buyer, who will retain it for their records.

Legal Use of the Non Foreign Affidavit Under IRC 1445 Wisconsin

The legal use of the Non Foreign Affidavit Under IRC 1445 is primarily to confirm the seller's status as a non-foreign person, thereby exempting the buyer from withholding taxes on the sale of real estate. This affidavit must be executed correctly to be valid in the eyes of the IRS and state authorities. Failure to provide a properly completed affidavit may result in withholding obligations for the buyer, leading to potential financial penalties. Therefore, it is essential for both parties involved in the transaction to understand the implications of this document and ensure it is filled out accurately.

How to Obtain the Non Foreign Affidavit Under IRC 1445 Wisconsin

The Non Foreign Affidavit Under IRC 1445 can typically be obtained through various means. Many real estate professionals, including attorneys and title companies, have access to the form and can provide it to their clients. Additionally, the form may be available through state or local government websites that deal with property transactions. It is important to ensure that the version of the affidavit is up-to-date and compliant with current IRS regulations. If needed, consulting with a tax professional can also provide guidance on obtaining and completing the form correctly.

Key Elements of the Non Foreign Affidavit Under IRC 1445 Wisconsin

Several key elements must be included in the Non Foreign Affidavit Under IRC 1445 to ensure its validity. These elements include the seller's name and address, their taxpayer identification number, and a declaration confirming that the seller is not a foreign person. The affidavit should also include a statement regarding the seller's residency status and a signature line for the seller to sign and date the document. Additionally, including a notary acknowledgment can enhance the affidavit's legal standing, providing further assurance of its authenticity.

Filing Deadlines / Important Dates

When dealing with the Non Foreign Affidavit Under IRC 1445, it is crucial to be aware of relevant filing deadlines and important dates. Generally, the affidavit should be completed and submitted at the time of closing the real estate transaction. Buyers must ensure they have the affidavit on file to avoid potential withholding tax obligations. It is advisable to check for any specific deadlines set by local authorities or the IRS to ensure compliance and avoid penalties associated with late submissions.

Quick guide on how to complete non foreign affidavit under irc 1445 wisconsin

Complete Non Foreign Affidavit Under IRC 1445 Wisconsin seamlessly on any gadget

Web-based document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can acquire the correct form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your files quickly without holdups. Handle Non Foreign Affidavit Under IRC 1445 Wisconsin on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Non Foreign Affidavit Under IRC 1445 Wisconsin effortlessly

- Locate Non Foreign Affidavit Under IRC 1445 Wisconsin and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your needs in document management within a few clicks from any device of your choosing. Edit and eSign Non Foreign Affidavit Under IRC 1445 Wisconsin and ensure outstanding communication during any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 in Wisconsin?

A Non Foreign Affidavit Under IRC 1445 in Wisconsin is a document that certifies that a seller of real estate is not a foreign person, ensuring that proper withholdings are maintained during transactions. This affidavit protects buyers and sellers by clarifying tax responsibilities. Understanding this is crucial for smooth real estate transactions in Wisconsin.

-

Why do I need a Non Foreign Affidavit Under IRC 1445 in Wisconsin?

You need a Non Foreign Affidavit Under IRC 1445 in Wisconsin to confirm that the seller is not a foreign entity, which can affect tax withholding during the sale of real estate. This affidavit is essential for compliance with federal tax laws and helps to avoid unexpected tax liabilities. It ensures transparency in property transactions, which benefits all parties involved.

-

How can airSlate SignNow help with the Non Foreign Affidavit Under IRC 1445 process?

airSlate SignNow streamlines the process of creating and signing a Non Foreign Affidavit Under IRC 1445 in Wisconsin by offering templates and eSignature capabilities that save time. Our platform allows you to manage documents electronically, making it simpler to ensure compliance with IRS regulations. This cost-effective solution enhances your document management efficiency.

-

Is there a cost associated with using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445?

Yes, there is a minimal cost associated with using airSlate SignNow, but it is designed to be affordable and provides signNow savings compared to traditional methods. The pricing structure varies based on the plan you choose, offering flexibility for businesses of all sizes. Investing in our services improves your workflow for managing the Non Foreign Affidavit Under IRC 1445 in Wisconsin.

-

What features does airSlate SignNow offer for managing the Non Foreign Affidavit Under IRC 1445?

airSlate SignNow offers a variety of features including customizable templates for the Non Foreign Affidavit Under IRC 1445, secure eSigning, and document storage. Users can collaborate easily by inviting others to sign or review documents and can track the status of signatures in real time. These features enhance compliance and streamline your documentation process.

-

Can I integrate airSlate SignNow with other applications for managing the Non Foreign Affidavit Under IRC 1445?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to connect it with your existing tools to manage the Non Foreign Affidavit Under IRC 1445 efficiently. Whether it's CRM systems, cloud storage, or email platforms, our integrations help facilitate better workflow and improve overall productivity. This flexibility makes it easier to handle legal documents and stay organized.

-

How secure is the information when using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your sensitive information related to the Non Foreign Affidavit Under IRC 1445 in Wisconsin. Additionally, our compliance with industry standards ensures that all documents and signatures are handled securely, giving you peace of mind.

Get more for Non Foreign Affidavit Under IRC 1445 Wisconsin

- A guide to small claims court legal aid of north carolina form

- Jdf 250 notice claims and summons for trial r01 17pdf form

- Forms small claims colorado judicial branch home

- Small claims petition tom green county form

- The judgment creditor requests this court to issue an order requiring the judgment form

- Self help small claims cases colorado judicial branch form

- Justice court civil case information sheet nacogdoches county

- Justice court civil case information sheet 413

Find out other Non Foreign Affidavit Under IRC 1445 Wisconsin

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now