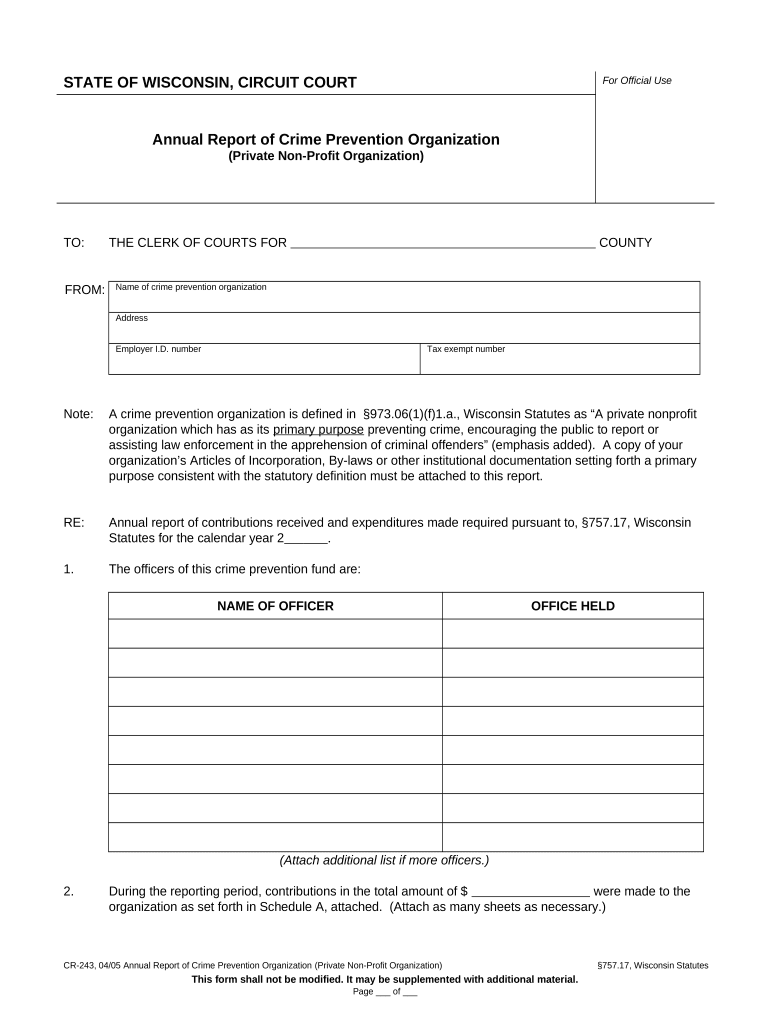

Wi Annual Report Form

What is the Wisconsin Annual Report?

The Wisconsin annual report is a mandatory document that businesses, including limited liability companies (LLCs), must file with the Wisconsin Department of Financial Institutions. This report provides essential information about the business, such as its current address, registered agent, and management structure. Filing the annual report ensures that the business remains in good standing and complies with state regulations.

Steps to Complete the Wisconsin Annual Report

Completing the Wisconsin annual report involves several clear steps:

- Gather necessary information, including the business name, address, and details about members or managers.

- Access the Wisconsin annual report form, which can be found on the Wisconsin Department of Financial Institutions website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy and completeness.

- Submit the form electronically or by mail, depending on your preference.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Wisconsin annual report. Generally, the report is due on the last day of the month in which the business was formed. For example, if your LLC was established in May, the report must be filed by May thirty-first each year. Late submissions may incur penalties, so timely filing is essential.

Required Documents

To complete the Wisconsin annual report, you will need specific documents and information, including:

- The business's legal name and any assumed names.

- The principal office address.

- Information about the registered agent.

- Details of the members or managers of the LLC.

Form Submission Methods

The Wisconsin annual report can be submitted using various methods, providing flexibility for business owners:

- Online: Filing electronically through the Wisconsin Department of Financial Institutions website is the most efficient method.

- By Mail: You can print the completed form and send it via postal service to the appropriate address.

- In-Person: Some businesses may prefer to submit the report in person at the Department of Financial Institutions office.

Penalties for Non-Compliance

Failing to file the Wisconsin annual report on time can lead to significant penalties. These may include:

- Late fees, which can accumulate over time.

- Potential loss of good standing status, affecting the ability to conduct business legally.

- In extreme cases, the state may initiate administrative dissolution of the business.

Quick guide on how to complete wi annual report

Complete Wi Annual Report effortlessly on any gadget

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the proper form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Wi Annual Report on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign Wi Annual Report with ease

- Find Wi Annual Report and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize vital sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Wi Annual Report and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the Wisconsin LLC annual report instructions?

The Wisconsin LLC annual report instructions guide you through the process of filing your business's annual report with the state. It is crucial to follow these guidelines to ensure compliance and avoid penalties. The report typically requires basic information about your LLC, including its registered agent and business activities.

-

How often do I need to file the Wisconsin LLC annual report?

Wisconsin LLCs are required to file an annual report every year, following the Wisconsin LLC annual report instructions. This must be completed by the end of the month in which your LLC was formed. Timely submission is essential to maintain good standing with the state.

-

What information do I need to prepare for my Wisconsin LLC annual report?

To complete your Wisconsin LLC annual report, you will need to provide information such as the LLC's name, the registered agent's details, principal business address, and any changes since the last report. Following the Wisconsin LLC annual report instructions carefully will ensure that you gather all necessary information.

-

What are the filing fees for the Wisconsin LLC annual report?

The filing fee for the Wisconsin LLC annual report is typically around $25 if filed online and $30 for a paper submission. It's important to check for any updates on these fees as they may change. Ensuring timely payment alongside your report is vital to avoid late penalties.

-

Can I submit my Wisconsin LLC annual report online?

Yes, you can submit your Wisconsin LLC annual report online through the Wisconsin Department of Financial Institutions website. This option is not only convenient but also expedites processing. It’s essential to follow the specific Wisconsin LLC annual report instructions when filing online to ensure all information is accurate.

-

What happens if I miss the Wisconsin LLC annual report deadline?

If you miss the deadline for filing your Wisconsin LLC annual report, your LLC may face penalties or even dissolution. The state allows a grace period, but it’s critical to act quickly. Complying with Wisconsin LLC annual report instructions is key to preventing any negative consequences.

-

Do I need to hire a professional to help with my Wisconsin LLC annual report?

While it is possible to file your Wisconsin LLC annual report on your own by following the instructions provided, some business owners prefer hiring professionals for peace of mind. A professional can ensure that you correctly complete the forms and comply with all requirements. This choice may save time and reduce the risk of errors.

Get more for Wi Annual Report

- Control number pa p051 pkg form

- Control number pa p054 pkg form

- Control number pa p055 pkg form

- Control number pa p056 pkg form

- Control number pa p058 pkg form

- Control number pa p064 pkg form

- Legal forms thanks you for your purchase of an amendment to lease package

- Telecommunication online forms pa puc

Find out other Wi Annual Report

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online