Garnishment Notice Form

What is the garnishment notice?

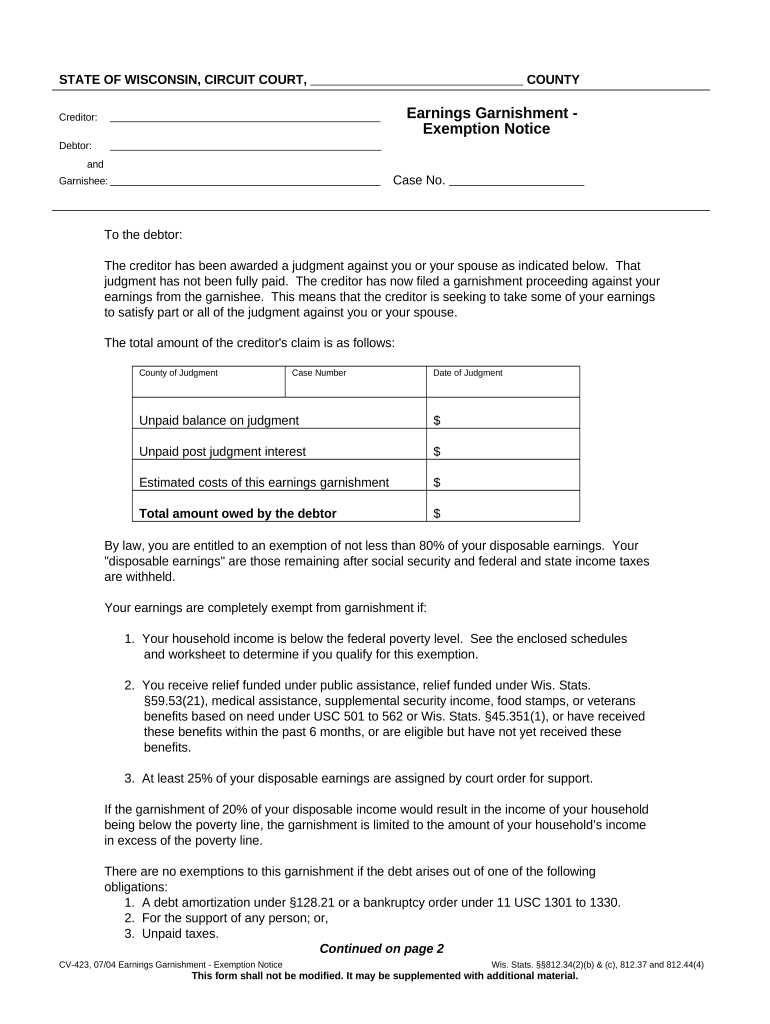

The garnishment notice is a legal document that informs an individual that their wages or bank accounts are subject to garnishment due to a debt owed. This notice is typically issued by a court or a creditor and outlines the amount to be garnished and the reason for the garnishment. Understanding this notice is crucial for individuals who may be facing financial difficulties, as it details their rights and obligations under the law.

How to use the garnishment notice

Using the garnishment notice involves several steps to ensure compliance with legal requirements. First, the recipient should review the notice carefully to understand the details, including the amount to be garnished and the creditor's information. Next, it is essential to determine if the garnishment is valid and whether any exemptions apply. If applicable, the individual may need to respond to the notice, potentially contesting the garnishment or claiming an exemption based on their financial situation.

Steps to complete the garnishment notice

Completing the garnishment notice requires careful attention to detail. Here are the general steps involved:

- Gather all necessary financial information, including income sources and expenses.

- Fill out the garnishment notice form accurately, ensuring that all required fields are completed.

- Attach any supporting documents that may be needed to substantiate claims for exemptions.

- Review the completed notice for accuracy before submission.

- Submit the notice to the appropriate court or creditor as specified in the instructions.

Key elements of the garnishment notice

Several key elements are essential in a garnishment notice. These include:

- The name and contact information of the creditor or court issuing the notice.

- The name of the individual subject to garnishment.

- The specific amount to be garnished from wages or bank accounts.

- Details regarding the debt that is being collected.

- Information on how to contest the garnishment or claim exemptions.

State-specific rules for the garnishment notice

Each state has its own rules and regulations regarding garnishment notices. In Wisconsin, for instance, certain exemptions may apply that protect a portion of an individual's earnings from garnishment. It is important for individuals to familiarize themselves with state-specific laws to ensure they understand their rights and the procedures that must be followed. Consulting with a legal professional can provide clarity on these rules and how they may affect an individual's situation.

Eligibility criteria for garnishment exemptions

Eligibility for garnishment exemptions in Wisconsin is determined by specific criteria. Generally, individuals may qualify for exemptions based on their income level, family size, and other financial circumstances. Common exemptions may include a portion of wages, social security benefits, or public assistance. Individuals should carefully assess their financial situation and consult relevant resources or legal counsel to determine their eligibility for exemptions.

Quick guide on how to complete garnishment notice

Accomplish Garnishment Notice effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers a seamless eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without hindrances. Manage Garnishment Notice on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Garnishment Notice with ease

- Locate Garnishment Notice and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or inaccessible files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Garnishment Notice and guarantee excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an exemption notice in the context of airSlate SignNow?

An exemption notice is a critical document that indicates certain transactions are exempt from regulatory requirements. Within airSlate SignNow, creating and managing exemption notices is streamlined, allowing businesses to easily customize and send these documents for eSignature.

-

How can airSlate SignNow help me manage exemption notices efficiently?

airSlate SignNow provides a user-friendly platform that simplifies the process of drafting and sending exemption notices. With its intuitive interface, users can easily access templates, edit details, and ensure that exemption notices are sent securely for eSignature.

-

What are the pricing options for airSlate SignNow when handling exemption notices?

airSlate SignNow offers flexible pricing plans tailored to suit various business needs, including options for high-volume users. Pricing is competitive, and features related to creating and managing exemption notices are included, ensuring a cost-effective solution for all businesses.

-

Are there any integrations available for managing exemption notices?

Yes, airSlate SignNow integrates seamlessly with numerous tools to enhance the management of exemption notices. Popular integrations with platforms like Google Drive and Salesforce allow for easy document storage and retrieval, improving workflow efficiency.

-

What features does airSlate SignNow offer for eSigning exemption notices?

airSlate SignNow includes comprehensive eSigning features specifically designed for exemption notices. Users can add signatures, initial fields, and dates, ensuring that all necessary information is captured and the document is legally binding.

-

Can I customize exemption notices within airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize exemption notices easily. You can modify templates, add your branding, and adjust specific clauses, ensuring that every exemption notice meets your business's requirements.

-

How secure is the transmission of exemption notices in airSlate SignNow?

Security is a top priority for airSlate SignNow when it comes to exemption notices. The platform uses advanced encryption and compliance with industry standards to protect all documents during transmission and storage.

Get more for Garnishment Notice

- Rhode island quit claim deeds us legal forms

- Start or qualify a business rhode island department of state form

- Public counter monday friday 830 am to 430 pm form

- Information requests

- Online filing 247 form

- Rhode islandnon profit legal center form

- Hours for filing form

- All forms in this package are provided without any warranty express or implied as to

Find out other Garnishment Notice

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement