Financial Account Transfer to Living Trust Wisconsin Form

What is the Financial Account Transfer To Living Trust Wisconsin

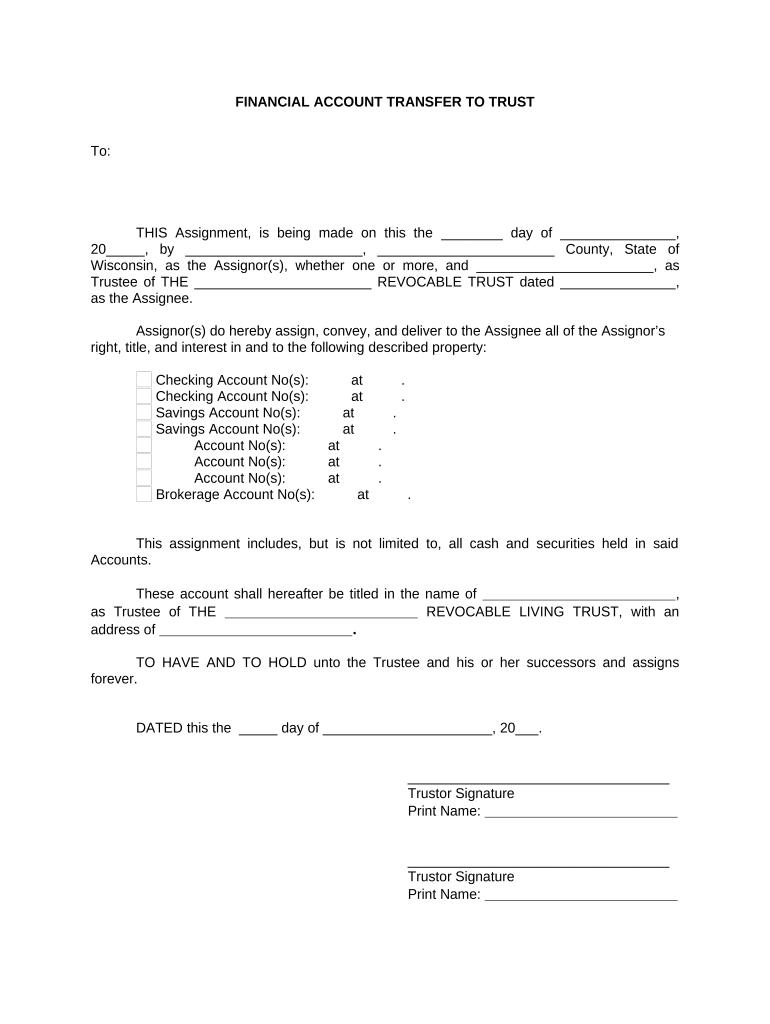

The Financial Account Transfer To Living Trust Wisconsin form is a legal document that facilitates the transfer of financial assets into a living trust. This process allows individuals to manage their assets during their lifetime and ensures a smooth transition of those assets to beneficiaries upon death. In Wisconsin, this form adheres to state-specific regulations that govern trusts and estate planning, making it essential for individuals looking to protect their financial interests and simplify estate management.

Steps to complete the Financial Account Transfer To Living Trust Wisconsin

Completing the Financial Account Transfer To Living Trust Wisconsin form involves several key steps:

- Gather necessary information: Collect details about the financial accounts you wish to transfer, including account numbers and the names of financial institutions.

- Review your living trust: Ensure that your living trust is properly established and that it includes the correct beneficiaries.

- Fill out the form: Accurately complete the Financial Account Transfer To Living Trust Wisconsin form, providing all required information.

- Sign the document: Ensure that you sign the form in accordance with Wisconsin state regulations, which may include notarization.

- Submit the form: Deliver the completed form to the financial institutions holding your accounts, following their specific submission guidelines.

Legal use of the Financial Account Transfer To Living Trust Wisconsin

The Financial Account Transfer To Living Trust Wisconsin form is legally binding when executed correctly. It must comply with Wisconsin laws regarding trusts and estate planning. This includes proper signatures, potential notarization, and adherence to the specific requirements set forth by financial institutions. By ensuring that the form is completed accurately, individuals can avoid legal disputes and ensure that their assets are managed according to their wishes.

State-specific rules for the Financial Account Transfer To Living Trust Wisconsin

Wisconsin has specific rules that govern the creation and management of living trusts. These rules dictate how assets can be transferred into a trust, the rights of beneficiaries, and the responsibilities of trustees. It is important to be aware of these regulations to ensure compliance. For example, Wisconsin law may require that certain types of assets, such as real estate, undergo additional steps for transfer into a living trust.

Required Documents

To successfully complete the Financial Account Transfer To Living Trust Wisconsin, several documents may be required:

- Living trust document: A copy of the established living trust that outlines the terms and conditions.

- Financial account statements: Recent statements from the financial institutions where the accounts are held.

- Identification: Valid identification to verify the identity of the individual completing the transfer.

Examples of using the Financial Account Transfer To Living Trust Wisconsin

Utilizing the Financial Account Transfer To Living Trust Wisconsin can be beneficial in various scenarios:

- Estate planning: Individuals looking to streamline their estate planning can transfer their bank accounts and investment accounts into a living trust.

- Asset protection: By placing assets in a living trust, individuals can protect their financial accounts from probate, ensuring quicker access for beneficiaries.

- Tax considerations: Transferring financial accounts into a living trust may have implications for tax planning, allowing for more strategic management of assets.

Quick guide on how to complete financial account transfer to living trust wisconsin

Effortlessly Prepare Financial Account Transfer To Living Trust Wisconsin on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the essentials to create, edit, and electronically sign your documents swiftly without delays. Manage Financial Account Transfer To Living Trust Wisconsin on any device with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The Easiest Way to Edit and Electronically Sign Financial Account Transfer To Living Trust Wisconsin with Ease

- Find Financial Account Transfer To Living Trust Wisconsin and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form: by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Financial Account Transfer To Living Trust Wisconsin and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is involved in a Financial Account Transfer To Living Trust in Wisconsin?

A Financial Account Transfer To Living Trust in Wisconsin involves transferring the ownership of financial assets like bank accounts, stocks, and bonds into a trust. This process helps streamline asset management and ensures that your funds are distributed according to your wishes upon your passing. Consulting an attorney can provide insights tailored to your specific situation.

-

How can airSlate SignNow assist with the Financial Account Transfer To Living Trust in Wisconsin?

airSlate SignNow offers a user-friendly platform for electronically signing the necessary documents for your Financial Account Transfer To Living Trust in Wisconsin. With our cost-effective solution, you can easily manage all your eSigning needs, ensuring a smooth transfer process without the hassle of paperwork.

-

What are the benefits of creating a Living Trust in Wisconsin?

Creating a Living Trust in Wisconsin provides several benefits, including avoiding probate, maintaining privacy, and ensuring your assets are managed during your lifetime. A Financial Account Transfer To Living Trust Wisconsin can streamline the handling of your finances and provide peace of mind for you and your beneficiaries.

-

Are there any costs associated with the Financial Account Transfer To Living Trust in Wisconsin?

The costs associated with a Financial Account Transfer To Living Trust in Wisconsin can vary. You may incur fees for legal assistance, document preparation, and possibly transfer fees from financial institutions. However, using airSlate SignNow can help minimize costs related to document management and signing.

-

What types of accounts can be transferred to a Living Trust in Wisconsin?

In Wisconsin, you can transfer various types of financial accounts to a Living Trust, including bank accounts, brokerage accounts, retirement accounts, and investment assets. A thorough Financial Account Transfer To Living Trust Wisconsin ensures that your financial resources align with your estate planning goals.

-

Can I make changes to my Living Trust after the Financial Account Transfer To Living Trust in Wisconsin?

Yes, you can make changes to your Living Trust even after the Financial Account Transfer To Living Trust in Wisconsin has been completed. It is advisable to review and update your trust periodically to reflect any changes in your financial situation or family dynamics.

-

Is legal assistance necessary for completing a Financial Account Transfer To Living Trust in Wisconsin?

While it is not strictly necessary to have legal assistance for a Financial Account Transfer To Living Trust in Wisconsin, it is highly recommended. An experienced attorney can guide you through the intricacies of the process and ensure that all documents comply with Wisconsin laws.

Get more for Financial Account Transfer To Living Trust Wisconsin

- Texas promulgated contract forms slideshare

- Notice not for use for condominium transactions or closings form

- Bill of sale form unimproved property contract templates

- Texas real estate commission residential sales contract form

- Trec no 28 2 environmental assessment addendum form

- Addendum for abstract of title form

- Notice not for use where seller owns fee simple title to land beneath unit form

- Fha or va financed residential condominium contract form

Find out other Financial Account Transfer To Living Trust Wisconsin

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract

- Can I Sign Montana Rental lease contract

- How To Sign Minnesota Residential lease agreement

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement