Wisconsin Transfer Property Form

What is the Wisconsin Transfer Property

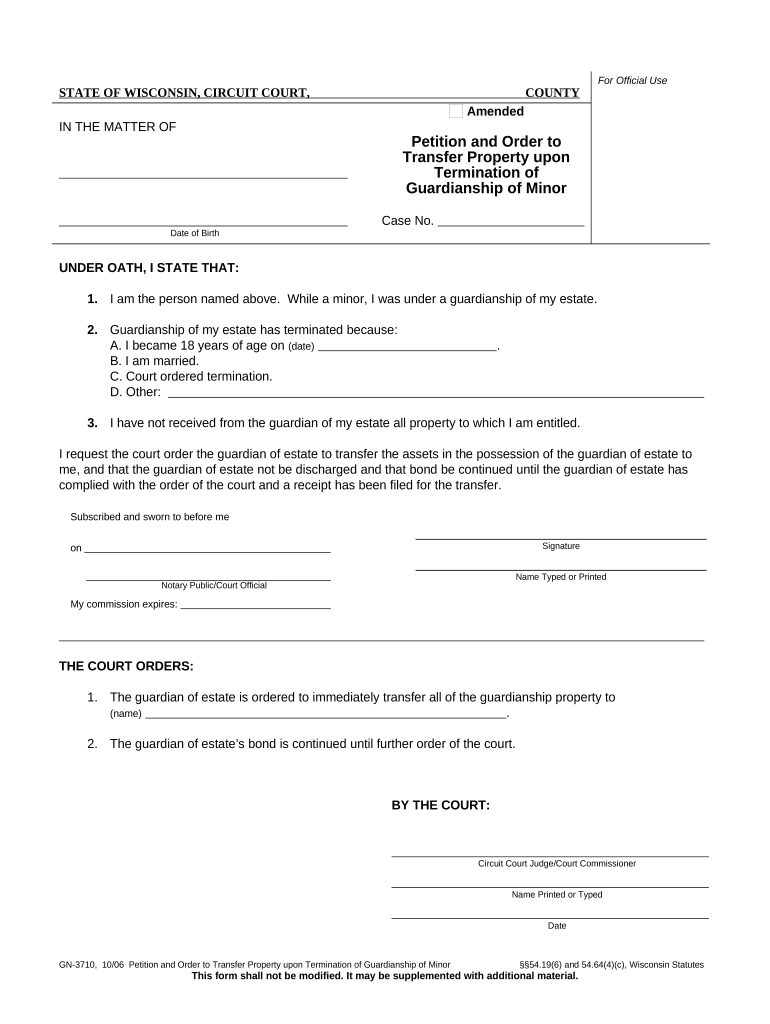

The Wisconsin Transfer Property form is a legal document used to transfer ownership of real estate or property in the state of Wisconsin. This form is essential for ensuring that the transfer is recognized by local authorities and is compliant with state laws. It outlines the details of the property being transferred, including its legal description, the names of the parties involved, and any conditions related to the transfer. Understanding this form is crucial for both buyers and sellers to ensure a smooth transaction.

How to use the Wisconsin Transfer Property

To effectively use the Wisconsin Transfer Property form, parties involved must first gather all necessary information regarding the property and the individuals involved in the transaction. This includes the property's legal description, tax identification number, and the full names of the grantor (seller) and grantee (buyer). Once the form is filled out accurately, it should be signed by all parties in the presence of a notary public to ensure its legal validity. After notarization, the form must be filed with the appropriate county register of deeds office to complete the transfer process.

Steps to complete the Wisconsin Transfer Property

Completing the Wisconsin Transfer Property form involves several key steps:

- Gather necessary information about the property and parties involved.

- Fill out the form accurately, ensuring all details are correct.

- Have the form signed by the grantor and grantee in front of a notary public.

- File the completed form with the county register of deeds office.

Following these steps carefully helps ensure that the transfer is legally binding and recognized by local authorities.

Key elements of the Wisconsin Transfer Property

The Wisconsin Transfer Property form includes several key elements that are crucial for its validity:

- Legal Description: A precise description of the property being transferred.

- Grantor and Grantee Information: Full names and addresses of both the seller and buyer.

- Consideration: The amount of money or value exchanged for the property.

- Signatures: Required signatures of both parties, along with a notary acknowledgment.

These elements work together to ensure the document is legally sound and enforceable.

Legal use of the Wisconsin Transfer Property

The Wisconsin Transfer Property form is legally binding when completed according to state laws. It must be signed by both parties and notarized to be valid. Once filed with the county register of deeds, it serves as public notice of the property transfer, protecting the rights of the new owner. Failure to properly execute and file this form may lead to disputes over property ownership and could complicate future transactions.

State-specific rules for the Wisconsin Transfer Property

Wisconsin has specific rules governing the use of the Transfer Property form. These include requirements for notarization, the need for accurate legal descriptions, and adherence to local filing procedures. Additionally, certain exemptions may apply, such as transfers between family members or in cases of foreclosure. Familiarity with these state-specific rules is essential for ensuring compliance and avoiding potential legal issues during the transfer process.

Quick guide on how to complete wisconsin transfer property

Effortlessly Prepare Wisconsin Transfer Property on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage Wisconsin Transfer Property on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to Edit and eSign Wisconsin Transfer Property with Ease

- Find Wisconsin Transfer Property and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your updates.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Edit and eSign Wisconsin Transfer Property to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for a Wisconsin transfer property using airSlate SignNow?

To complete a Wisconsin transfer property, simply upload your documents to airSlate SignNow. The platform allows you to invite all relevant parties to eSign, ensuring a smooth and efficient transfer process. Additionally, all documents are securely stored and easily accessible.

-

How much does it cost to use airSlate SignNow for Wisconsin transfer property?

airSlate SignNow offers affordable pricing plans tailored for businesses. The costs depend on the features you need, but you can begin with a free trial to see how our eSigning capabilities can enhance your Wisconsin transfer property process without breaking the bank.

-

What features does airSlate SignNow offer for Wisconsin transfer property?

airSlate SignNow provides a range of features for Wisconsin transfer property, including customizable templates, bulk sending, and real-time tracking of document status. These tools streamline the eSigning process, making it quick and efficient for all parties involved.

-

Are there any integrations available with airSlate SignNow for Wisconsin transfer property?

Yes, airSlate SignNow integrates with various platforms like Google Drive, Dropbox, and Microsoft Office, streamlining your workflow for Wisconsin transfer property. These integrations help you seamlessly manage your documents and eSignatures in one centralized location.

-

What are the benefits of using airSlate SignNow for Wisconsin transfer property?

Using airSlate SignNow for Wisconsin transfer property offers improved efficiency, reduced paper usage, and enhanced security. The platform allows you to finalize transactions quickly while keeping legal compliance in check, making your operations more sustainable and effective.

-

Is airSlate SignNow legally binding for Wisconsin transfer property documents?

Yes, eSignatures created using airSlate SignNow are legally binding as per Wisconsin law. This ensures that all your Wisconsin transfer property transactions are recognized and upheld in court, providing peace of mind when signing important documents.

-

Can I access my documents for Wisconsin transfer property on mobile devices?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage your Wisconsin transfer property documents on the go. Whether you’re using a smartphone or tablet, you can easily upload, send, and eSign documents from anywhere.

Get more for Wisconsin Transfer Property

Find out other Wisconsin Transfer Property

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form