Sblc Template Form

What is the SBLC Template

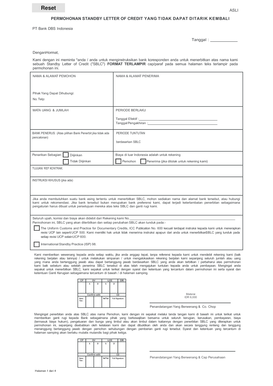

The SBLC template refers to a standardized document used to issue a Standby Letter of Credit. This financial instrument serves as a guarantee from a bank, ensuring that a beneficiary receives payment if the applicant fails to meet their contractual obligations. The SBLC template typically includes essential details such as the parties involved, the amount covered, and the conditions under which the payment will be made. Understanding the structure of the SBLC template is crucial for businesses and individuals who rely on this form of credit to secure transactions and manage risks effectively.

How to Use the SBLC Template

Using the SBLC template involves several steps to ensure that all necessary information is accurately captured. Begin by filling in the applicant's details, including their name and contact information. Next, specify the beneficiary's information, which identifies who will receive the funds. It is essential to detail the amount of the standby letter of credit and outline the conditions that trigger payment. Ensure that all parties sign the document, as this validates the agreement. Finally, submit the completed SBLC template to the issuing bank for processing.

Steps to Complete the SBLC Template

Completing the SBLC template requires careful attention to detail. Follow these steps for a successful submission:

- Gather all necessary information about the applicant and beneficiary.

- Clearly outline the terms and conditions of the standby letter of credit.

- Specify the amount and currency of the credit.

- Include any expiration dates or specific performance conditions.

- Review the document for accuracy and completeness.

- Obtain signatures from all relevant parties.

- Submit the completed template to the bank for issuance.

Legal Use of the SBLC Template

The legal use of the SBLC template is governed by various regulations and standards. In the United States, compliance with the Uniform Commercial Code (UCC) is essential, as it outlines the legal framework for letters of credit. Additionally, the SBLC must adhere to the stipulations of the issuing bank and any applicable international trade laws. Understanding these legal requirements helps ensure that the SBLC is enforceable and protects the interests of all parties involved.

Key Elements of the SBLC Template

Several key elements must be included in the SBLC template to ensure its effectiveness and legality. These elements typically consist of:

- The names and addresses of the applicant and beneficiary.

- The amount of credit being issued.

- The conditions under which the credit can be drawn.

- The expiration date of the letter of credit.

- Any specific requirements for documentation to trigger payment.

Examples of Using the SBLC Template

Examples of using the SBLC template can be found in various business scenarios. For instance, a construction company may use an SBLC to guarantee payment to subcontractors for completed work. Similarly, an importer might issue an SBLC to ensure payment to a foreign supplier upon delivery of goods. These examples illustrate how the SBLC template serves as a vital tool in facilitating secure transactions and managing financial risk across different industries.

Quick guide on how to complete sblc template

Effortlessly Prepare Sblc Template on Any Device

Digital document management has become increasingly favored by enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without any delays. Handle Sblc Template on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Sblc Template with Ease

- Find Sblc Template and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Sblc Template and ensure excellent communication throughout every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sblc template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SBLC template?

An SBLC template is a pre-designed document that outlines the terms and conditions of a Standby Letter of Credit. It simplifies the process for businesses needing to issue or request financial assurances. With an SBLC template, you can ensure that all necessary legal requirements are met efficiently.

-

How can I create an SBLC template using airSlate SignNow?

Creating an SBLC template with airSlate SignNow is straightforward. You can easily upload your document, customize it based on your requirements, and save it as a template for future use. This not only saves time but ensures consistency across all documents.

-

Is there a cost associated with using the SBLC template feature?

AirSlate SignNow offers competitive pricing plans that include access to the SBLC template feature. Depending on the plan you choose, you may also benefit from additional features and integrations, making it a cost-effective solution for your document management needs.

-

What are the benefits of using an SBLC template?

Using an SBLC template offers numerous benefits, including time savings, reduced errors, and enhanced compliance with legal standards. It helps streamline the process of setting up financial agreements, making it easier for businesses to manage their financial transactions. This ensures that your documents are both professional and legally sound.

-

Can I integrate the SBLC template with other software?

Yes, airSlate SignNow supports integrations with various software applications, enabling you to seamlessly use your SBLC template across different systems. Whether you use CRM, ERP, or project management tools, the integration ensures a smooth workflow. This enhances productivity and efficiency in managing your documentation.

-

Are there any security features with the SBLC template?

AirSlate SignNow places a high priority on document security, including for SBLC templates. Your documents are encrypted and stored securely to protect sensitive information. Additionally, you can set permissions and access controls to ensure that only authorized personnel can handle your financial agreements.

-

How do I customize an SBLC template in airSlate SignNow?

Customizing your SBLC template in airSlate SignNow is easy. You can modify text fields, add your company branding, and include specific clauses relevant to your contracts. Once customized, you can save the template for future use, speeding up your workflow tremendously.

Get more for Sblc Template

- Ct blue light permit 104747 form

- Direct credit authorisation form 82589676

- Eventuale logo provincia attestato di qualifica professionale berufsbezeichnungszeugnis attestation de qualification form

- Book report template 7th grade form

- Charity care application ny form

- Application for shop registration form form a

- Www irs govesforms pubsordene formularios y publicacionesinternal revenue service

- Iwcc forms

Find out other Sblc Template

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple