Wisconsin Assets Form

What is the Wisconsin Assets

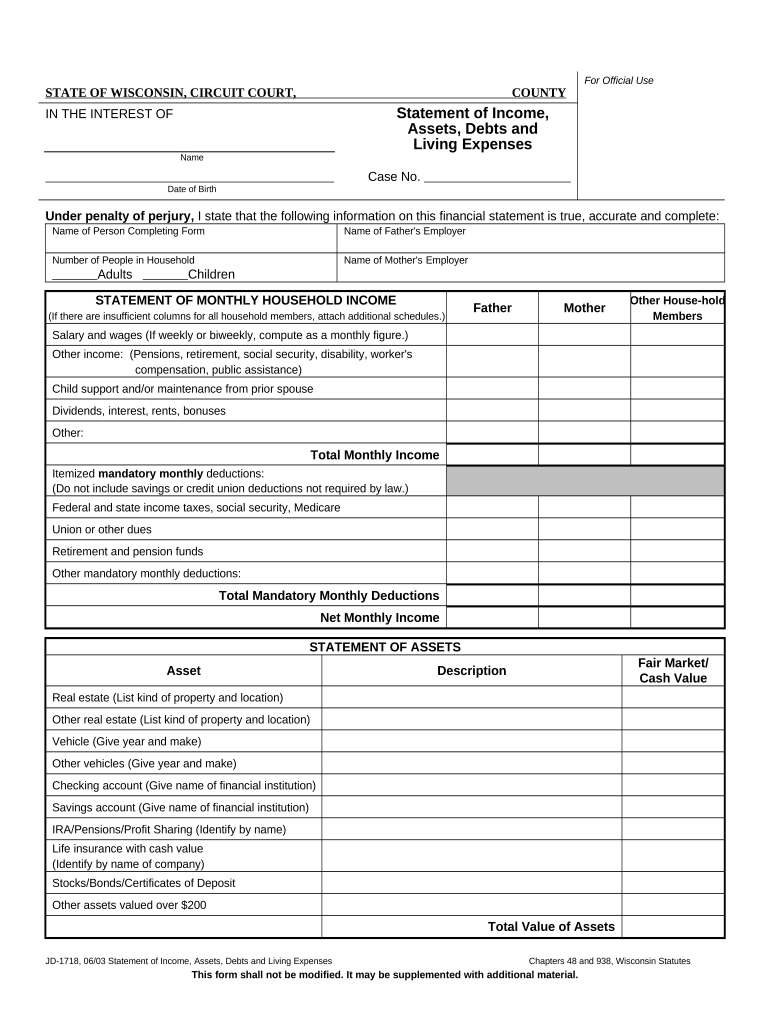

The Wisconsin assets form is a legal document used primarily to report and manage assets owned by individuals or entities within the state of Wisconsin. This form is essential for various purposes, including estate planning, tax reporting, and legal compliance. It provides a comprehensive overview of the assets held, ensuring that all relevant information is accurately documented. Understanding the specifics of this form is crucial for individuals and businesses looking to maintain compliance with state regulations.

Steps to complete the Wisconsin Assets

Completing the Wisconsin assets form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the assets, including property deeds, bank statements, and investment records. Next, accurately list each asset on the form, providing detailed descriptions and values. It is important to double-check all entries for accuracy to avoid potential issues. After completing the form, review it thoroughly and ensure that all required signatures are included before submission.

Legal use of the Wisconsin Assets

The legal use of the Wisconsin assets form is vital in various contexts, such as estate management and financial reporting. This form serves as a legally binding document that outlines the ownership and value of assets, which can be critical in legal disputes or estate settlements. Compliance with state laws regarding asset reporting is essential to avoid penalties or legal complications. Proper execution of this form ensures that all parties involved have a clear understanding of asset ownership and obligations.

State-specific rules for the Wisconsin Assets

Wisconsin has specific rules and regulations governing the use of the assets form. These rules dictate how assets should be reported, the types of assets that must be included, and the deadlines for submission. Familiarizing oneself with these state-specific guidelines is crucial for compliance. Additionally, certain exemptions or special considerations may apply depending on the type of asset or the status of the individual or entity submitting the form.

Required Documents

To complete the Wisconsin assets form accurately, several documents are typically required. These may include:

- Property deeds for real estate assets

- Bank statements for cash and savings accounts

- Investment account statements

- Personal property valuations

- Any relevant legal documents, such as wills or trusts

Having these documents readily available will streamline the process of completing the form and ensure that all necessary information is accurately reported.

Examples of using the Wisconsin Assets

There are various scenarios where the Wisconsin assets form is utilized. For instance, individuals may use it during estate planning to outline their assets for beneficiaries. Businesses may need to complete this form for tax reporting purposes or during mergers and acquisitions to disclose asset values. Additionally, financial institutions may require this form when assessing creditworthiness or loan applications, making it a versatile tool in both personal and professional contexts.

Quick guide on how to complete wisconsin assets

Prepare Wisconsin Assets effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Manage Wisconsin Assets on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Wisconsin Assets with minimal effort

- Find Wisconsin Assets and click Get Form to begin.

- Use the features we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and eSign Wisconsin Assets and ensure excellent communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow for managing Wisconsin assets?

airSlate SignNow provides a range of features designed to streamline the management of Wisconsin assets. These include customizable templates, secure eSigning options, and real-time document tracking. The platform helps ensure that all asset-related agreements are executed efficiently, reducing the time spent on paperwork.

-

How does airSlate SignNow enhance the security of Wisconsin asset transactions?

Security is a top priority for airSlate SignNow, especially when it comes to Wisconsin assets. The platform uses advanced encryption protocols and offers secure cloud storage for documents. Additionally, users can implement multi-factor authentication to further protect their asset transactions.

-

What is the pricing structure for using airSlate SignNow for Wisconsin assets?

airSlate SignNow offers flexible pricing plans that cater to businesses managing Wisconsin assets. There are different tiers based on the number of users and features needed. By selecting a plan that fits your business size, you can effectively manage your asset-related documents within budget.

-

Can I integrate airSlate SignNow with other software for Wisconsin asset management?

Yes, airSlate SignNow supports a variety of integrations with popular software applications to assist in managing Wisconsin assets. This includes CRM systems, cloud storage solutions, and project management tools. Integrating these systems enhances workflow and ensures all asset-related information is seamlessly connected.

-

What benefits does airSlate SignNow provide for businesses handling Wisconsin assets?

By using airSlate SignNow, businesses can signNowly reduce the time and effort spent on managing Wisconsin assets. The platform simplifies the eSigning process and allows for quick document turnaround. This efficiency can lead to increased compliance and improved customer satisfaction.

-

Is airSlate SignNow user-friendly for new users working with Wisconsin assets?

Absolutely! airSlate SignNow is designed with user experience in mind, making it highly accessible for those new to managing Wisconsin assets. The intuitive interface allows users to quickly get accustomed to the platform without extensive training, facilitating a seamless transition.

-

How can airSlate SignNow assist in compliance related to Wisconsin assets?

AirSlate SignNow helps businesses maintain compliance for Wisconsin assets by ensuring that all eSigned documents meet legal requirements. The platform provides audit trails and keeps records of all transactions, making it easy to demonstrate compliance in any future audits or legal matters.

Get more for Wisconsin Assets

- Failure to cure defaultforfeiture and acceleration of rent due form

- Exhibit a 1 form of stockholders agreement cases

- Stop work order form for construction on personal dwelling

- Employment contract with form

- Physicians agreement with non profit corporation to treat people who cannot afford healthcare form

- Social media questionnaire for new clients 42 questions to form

- Enclosed herewith please find copies of the relevant form

- Pay per click services agreementus legal forms

Find out other Wisconsin Assets

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF